GST e-way Bill came into effect from 1st April 2018. Before its existence the movement of goods was unbridled. To pull things together and offer seamless transportation of goods, the GST e-way Bill was anticipated. It worked as expected and offered an uninterrupted supply of goods from origin to destination. It applies to inter-state as well as intra-state transactions. Regardless of the mode of transport, it is vital to carry a GST e-Way Bill to avoid in-transit hurdles. When moving goods from one place to another don’t forget to carry an e-Way bill. This mechanism makes sure that goods transported comply with the GST Law. This whole E-way bill system monitors the movement of goods and scrutinizes tax evasion. As a newbie you might feel confused. Fret Not!! As Square Yards got you covered. Keep scrolling through this brief guide to know vital information about GST E-way Bill.

What is a GST e-Way Bill?

GST e-Way Bill also known as the Electronic Way bill is the foremost way to record authentic transportation of goods. A GST e-Way bill can be considered as a receipt /document that the carrier issues after providing an array of details. Additionally, the bill comprises shipment related instructions including consignor’s name, consignee, place of origin, destination place of the consignment as well as the route.

You can easily generate such a bill by visiting the official e-Way Bill Portal. There are certain restrictions on goods transportation such as a registered GST individual is bound to transport goods that do not exceed the value of 50,000 in Indian Rupee. This is applicable on Single Invoices in addition to transportation bills, and delivery challans. In simple words, if you don’t generate an e-Way bill for transportation purposes then you cannot transport goods worth more than INR 50,000.

Alternatively, to offer the utmost convenience to you, the facility of generating bills through SMS is also available. Moreover, count on Android App to generate e-Way bill through easy navigation. With the generation of the bill, you will be allotted a unique EBN ( E-way Bill Number). This number is available to all involved parties including the supplier, recipient as well as transporter.

When a GST e-Way Bill is Issued?

The GST E-way bill is generated only in the event of the movement of goods through a vehicle or conveyance. Additionally for the issuance of such bills the value of goods must be more than INR 50,000. In other words, the e-Way bill is issued

- If there is a supply of goods

- Other reasons such as return

- In case of a supply of goods initiated from an unregistered individual

For the purpose of bill issuance either of the following condition must be satisfied:

- Supply made with the purpose of payment certainly in business

- Supply of goods that doesn’t falls in the course of business with payment purpose

- A supply is carried out without any payment consideration.

In simpler terms, ‘supply’ represents the:

- Sale: sale of products or goods for which a payment is made

- Transfer: In case of branch transfers

- Barter or Exchange: In the case where payment is made through goods rather than money

That is why you must generate your e-Way Bills prior to making any sort of aforementioned movements. There are certain products for which the issuance of an e-Way bill is a must even if the consignment value is below INR 50,000. As a supplier. Buyer or transporter be familiar with such products or goods to avoid from later stage hassles. Such goods include:

- Inter-State Transport of goods from the Principal towards the Job-worker. If the registered Principal sends the goods to a registered Job-worker then he must avail an e-Way bill to avoid libel penalties.

Inter-State movement of Handicraft items. When the movement of handicrafts is carried out by a dealer and the task is exempted from registration under GST.

What is the Format of the GST E-way Bill?

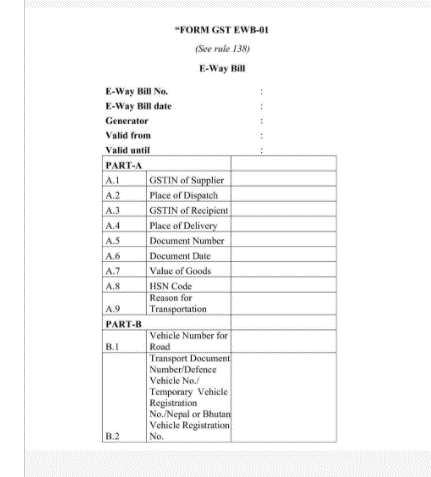

If you are in the domain of import-export of goods and transportation, then being familiar with the authentic GST Bill format becomes essential. In general, the E-way bill is categorized into two parts i.e. Part A and Part B. Part A enlists vital details of the consignment, including details of the invoice. Although, you need to submit the following details to get your transport bill:

- The recipient’s GSTIN is mandatory.

- The Pin code of the destination address where the goods will be delivered.

- The invoice number or the challan number associated with the transportation of goods has to be submitted.

- The value of goods transported through the consignment is a must as it determines the need for issuance of the transportation bill.

- The HSN code of the product that will be transported needs to be mentioned on the bill. If the overall turnover is equal to or below INR 5 crores, then only the initial two digits of the HSN code will be mentioned. In case the turnover is above INR 5 crores, then you will have to mention four-digit of the HSN code.

- Submit the actual reason behind the transportation or movement of goods. From the multiple available options choose the most appropriate one related to your genuine reason for transport.

- Mention the number of transport documents I/n general this number covers goods receipt number, in addition to the railway receipt number and airway bill number. It will depend upon the mode of transport.

You have to generate the EWB through an e-way bill portal. The applicable form comprises a 12-digit number also termed as an e-way bill number along with other mandatory details such as generation date and the generator’s name and validity of the e-way bill ( Days or months).

Parts Of GST E-way Bill

The overall content of the EWB is divided into two parts as mentioned earlier. Refer to the information that is embraced in both the parts of this E-way bill:

| PART A of EWB | PART B of EWB |

| • GSTIN of the party that initiated the transport i.e. Supplier or the Recipient • Site of Dispatch along with the appropriate PIN Code • Site of Delivery in addition to the PIN Code • Invoice Number or Challan Number together with the Date of transport and overall value of the consignment • HSN Code: either 2 digit or 4 digit based upon the turnover • Purpose of Transport: Supply of goods, Import-Export, Trading, Job Work, Return of sale, Exhibition, Personal Use and much more. |

• Document number of the Transporter/ Defence Vehicle No./ Vehicle Registration Number (temporary)/ Document number ( mentioned by the transporter)/ Vehicle Registration number for movement of goods between Nepal/ Bhutan and India • Vehicle Number in which the transport of goods will tackle place. |

Format of GST E-Way Bill

With the categorization of the bill, you might have an imaginary picture of the same. Refer to the depicted image to have a clear image of this must-have bill for the movement of goods.

Step-By-Step Procedure for Generating a GST E-Way Bill

By now you are well known for the fact that you can apply for the EWB through the official portal. As the name itself depicts that this is an electronic bill, thus, it can be easily availed by submitting essential details on the portal through an online medium. If you are transporting goods worth more than 50K then, the designated vehicle must carry EWB or E Way Bill. This is made mandatory by the GST Council regulations. Additionally, you need to be a GST registered supplier to avail of a GST E-Way bill. Although, this bill came into existence on 1st April 2018.

The supplier/ transporter can count on any of the mentioned ways to create an E-way bill:

- E-Way Bill Portal

- Through SMS

- Via navigating Android App

- Through Site-to-Site Integration ( API)

Procedure to Generate E-Way Bill through Official Portal

To carry out the online procedure initially, you need to have GST registration as well as transporter registration.

- Access the E-Way Bill portal and enter your login credentials to avail of the offered services.

- From the main menu section click on the “Generate New” tab to generate a new bill.

- Next to this, the applicable generation form will appear on your screen. Enter the requisite details to move further with the registration procedure.

Note: Choose outward in case of supplier & inward in case of the recipient. Enter the asked details about the buyer and seller together with the GSTIN. When you enter GSTIN in your Form the related details automatically get filled from the GST database.

- Next to this, you will move to the next half of the Form, which usually seeks the mentioned information:

- Product Name, its Description should be similar to the one mentioned in the tax invoice.

- Product’s HSN Code.

- Quantity of the transported goods along with the unit.

- Value of the goods in addition to the applicable tax rate.

- Applicable IGST / CGST rates ( IGST in case of inter-state transport & SGST / CGST in case of intra-state transport).

- Distance between the starting point and destination point along with the name of the transporter and authentic transporter ID. It helps to determine the E-Way bill’s validity.

- When you are done with the filling of information, click on the “SUBMIT” button. It will generate your final EWB. Next to this, the E-Way bill will appear on the screen enlisting the E-Way Bill number along with the QR Code. It comprises the bill details in digital format.

Note: Providing a printed copy of the bill to the transporter is vital. He needs to carry the same throughout the transportation.

- Moreover, you can create a consolidated EWB. It contains every essential detail about the transaction and is easy to create by entering an availed ‘E-Way bill number’.

An E-Way bill can be easily updated after generation. If required, both parties are permitted to update the same. It is applicable only if the bill is not due.

Who Can Generate an e-Way Bill?

Only specific involved parties are applicable to generate an e-Way Bill including registered person, unregistered person, and transporter. Here is what you need to know about the generation of e-Way bill and who is applicable for the generation:

- Registered Person: EWB is a must to be generated bills in case of movements of goods. Additionally, it is mandatory when you are transporting goods worth more than 50,000 INR. If you are a registered person then no matter what the value of transported goods is, you must get an e-Way Bill.

- Unregistered Persons: To transport goods from one place to another the unregistered traders also need to avail GST e-Way bill. If your seller is an unregistered person, make sure he copes with all essential compliances to avoid later-stage hurdles.

- Transporter: Transporters also need to carry the e-Way Bill regardless of their mode of transport i.e. road, air, water, rail, etc.

Well, note that an unregistered transporter gets a Transporter ID when they apply for EWB through the official portal. Refer to the below-depicted table to know in brief about who can apply for the EWB, when and by filling which part of the Form.

| Who | When | Part | Form |

| Every GST Registered person | Prior to the transportation of goods | Need to Fill Part A of the EWB Form | Form GST EWB-01 is applicable |

| When the Registered person is the consignor / consignee ( the transport mode can be self owned or can be hired) OR if the registered person is the recipient of goods | Prior to the transportation of goods | Need to Fill Part B of the EWB Form | Form GST EWB-01 is applicable |

| Registered person is the consignor/ consignee of the movement and have to hand over the goods to the transporter | Prior to the transportation of goods | Need to Fill Part B of the EWB Form | The registered person needs to fill the requisite information. It will be filled in the Part B of the FORM GST EWB-01 |

| Transporter of the goods | Prior to the transportation of goods | The applicant will have to generate the e-way bill by entering the information provided by the registered person. It will be filled in the Part A of the FORM GST EWB-01 | |

| An unregistered person is initiating the movement of goods towards a registered person | Subservience must be carried by the Recipient considering himself at the place of the Supplier. | 1. If the movement of goods is about to take place within an area of 50 km or less (inter-state or Union territory), then the supplier/ the transporter doesn’t need to enter the details within Part B of FORM GST EWB-01.

2. If the movement of goods will take place through the airway, waterway or railway, then the consignor/recipient needs to fill the information asked in Part A of the FORM GST EWB-01 mandatorily. |

Cases in Which the e-Way bill is Not Mandatory

There are certain cases in which the generation of e-Way bill is not mandatory. Here is a rundown of such cases, for which you won’t have to avail the EWB for the movement of goods:

- If the opted transport mode is a non-motor vehicle.

- When the goods are transported from the Customs port, or airport, or air cargo complex or from the land customs station towards the Inland Container Depot (ICD) or from the Container Freight Station to carry out the clearance procedure by the Customs officers.

- Good transport that takes place under the supervision of customs officials or falls under the customs seal.

- Movement of goods under the Customs Bond ( From ICD towards the Customs port/ one custom station to the other).

- Transit cargo that transports goods from Nepal or Bhutan to India or vice-versa.

- Movement of goods initiated by the defense formation and falls within the Ministry of defence ( the consignor/ consignees are the defence officials).

- In the transportation of empty cargo containers.

- The consignor is responsible for transporting goods when the distance between the initial and final destination is 20 Kms and is accompanied through a Delivery challan.

- When the transportation of goods takes place through railways and the Central Government and State Governments and local authorities are the consignors of the same.

- Goods that fall within the exempted category of the E-Way bill requirements as per the GST Rules.

Note: The involved parties don’t need to fill Part B of the e-Way Bill when the distance ( between the consignor and transporter) is below 50 Kms. The same applies to the transport of goods that take place within the state.

Status of GST e-Way Bill Implementation across India

The overall impact of the implementation of the e-Way Bill is commendable. It boosted and promoted the movement of Inter-State goods. There is a huge rise in the generation of EWB. Traders count on the e-Way Bill for seamless transportation of goods without any interference of the officials and verification checks as it helps to authenticate the movement. It came into existence on 1st April 2018, and since then people have positively adopted it for their convenience.

It was implemented state-wise in addition to Union Territories and showed unbelievable response from the individuals and ventures. Although, the authorities have offered reliefs to few states based on certain parameters including threshold amount and exempted items. For example, Tamil Nadu officials have exempted the consignor or consignee from the generation of e-Way Bill if the consignment is worth less than INR 1 lakh.

Validity of GST e-Way Bill

Everything comes with validity and the same is applicable for GST e-Way Bill. The validity may differ from one case to another based upon the conveyance, and the distance. Here is the list of EWB validity as per the distance covered for the movement of goods. In general, the validity is determined from the date and time on which the GST bill is generated.

| Conveyance Type | Overall Distance | Validity of the EWB |

| Other conveyance apart from the Over-Dimensional Cargo | Below 100 Kms | One Day |

| For each additional 100 Kms | Validity is increased by One Day | |

| In case of Over-Dimensional Cargo | Distance is below 20 Kms | One Day |

| For each additional 20 Kms | Validity is increased by One Day |

You can also extend the validity of the E-way bill. Although, the generator will take certain parameters into consideration for the validity extension. Moreover, this extension can take place either 4 hours prior to the valid time/ within 4 hours of the completion of the valid time.

Essential Documents To Generate GST e-Way Bill

It is quite obvious that you can’t generate a GST e-Way bill without having certain mandatory documents. You need to be ready with these beforehand to apply for EWB. Here is the list of essential documents you will require to generate an eWay bill.

- Invoice; Bill of Supply; Challan associated with the consignment of goods

- If the movement of goods takes place through road then you must have the Transporter ID and the Vehicle number

If the movement of goods takes place through railway, airway or waterway then you need to have a Transporter ID in addition to Transport document number

In a Nutshell

After going through the aforementioned things it is crystal clear that for seamless movement of goods you must generate an e-Way bill prior to the transportation. For your convenience, GST authorities have a separate portal for the generation of the GST e-Way Bill. All you need to do is follow the easy peasy steps and generate the requisite bill from home comfort. Know which part of the bill you need to fill and what requirements you need to consider.

YOU MAY ALSO LIKE

Frequently Asked Questions (FAQs)

Is it necessary for the transporter to generate an E-Way bill?

Transporters are responsible for the actual movements of goods from one place to another through, roadways, airways, railways, or waterways. The fact is no matter which medium you opt you need to go through the clearance phase and for seamless clearance, having an eWay bill is liable. You can easily generate an eWay bill based upon the information shared by the supplier or consignor through the invoice and challan. In case the transporter fails to generate the bill, he will be liable to pay a penalty of INR 10,000. Based upon the seriousness of the matter the vehicle can also be seized.

How many GST e-way bills will be required for shipping a consignment which involves multiple transporters?

Only one e-Way bill will be issued against the generated invoice. A situation in which multiple transporters are involved is termed as “Transshipment”. Additionally, the transporter has the authority to re-assign the shipment to another transporter. This can be done by editing the transporter ID in the issued e-Way bill by visiting the e-Way portal. Although, the seller isn’t permitted to make any changes once the transporter reassigns the shipment to other transporters.

Who generates an e-way bill?

The consignor or the consignee is responsible for generating an e-way bill if the transport takes place through railway or waterways. Additionally, if the transport takes place through the road then the same needs to be handed to the transporter.

Is e-Way Bill Mandatory?

Yes, an e-way bill is mandatory especially if you are transporting goods worth more than 50 thousand and you are registered under GST. Only the ones who are exempted as per the updated GST rules don’t need to generate an e-Way bill for the movement of goods.

What is the purpose of generating an E-way Bill?

The sole purpose of generating an E-way bill is to make sure that the movement of goods takes place in compliance with the GST Law. It is a foremost tool for tracking the transportation of goods from point of origin to the destination point.

What does URP in the e-way bill stand for?

URP refers to an Unregistered Person. When an individual generates an E-way bill and any of the involved parties is not registered with GST, then you will have to mention URP on the e-way bill.

Can invoice date and e-way date be different?

Yes, an invoice date can be different from the e-way date. E-Way bill date is the one on which the bill is generated, thus, in maximum cases, it is different from the invoice date.