The PAN or Permanent Account Number is a 10-digit unique alpha-numeric number which is allotted to every eligible individual/entity in the country. This unique number is used to record all the taxation related information of a person. Having a PAN allows the holder to carry out a number of financial transactions. One can apply for a PAN card online, as well as offline.

Online PAN card application can be made on the NSDL and UTIITSL websites. In this blog, we will take a look at how you can submit a PAN application online. We will also take a look at the documents that you will need to complete the application. Let’s begin!

Table of contents

- Online PAN Application on NSDL Website

- Online PAN Application on UTIITSL Website

- How to Apply for Reprint or Change Details on Your PAN Card Online

- Online PAN Application Fees

- Date of Birth Documents for Online PAN Application

- Address Proof Documents for Online PAN Application

- Identity Proof Documents for Online PAN Application

- Frequently Asked Questions (FAQs)

Online PAN Application on NSDL Website

Form 49A and Form 49AA are the two forms to be used for applying for a PAN card. Having said that, this is only applicable for people who do not have already existing PAN details, and have never applied for one. Given below are the steps for online PAN Card application on the NSDL portal:

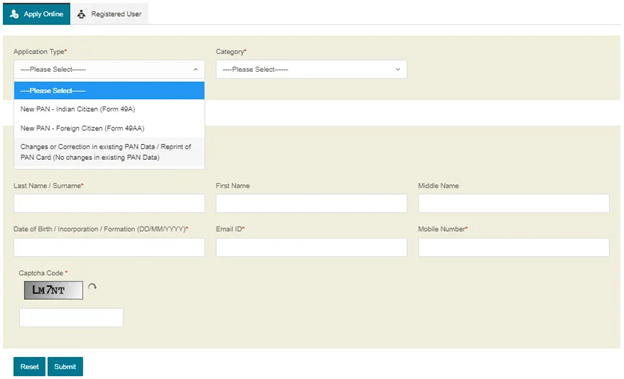

Step 1: Visit the online PAN application section of the NSDL website.

Step 2: Select the appropriate form type. 49A for Indian citizens, and Form 49AA for foreigners.

Step 3: Select what category you fall under. The options available to you will be Individuals, Body of Individuals, Limited Liability Partnerships, Local Authority, Hindu Undivided Family, Firm, Government, Trust, and Artificial Judicial Person.

Step 4: Enter details like Title, First name, middle name, surname, date of birth in DD/MM/YYYY format, phone number, and email address. Verify the captcha and submit the form.

Step 5: You will be redirected to a new page with an acknowledgement and token number. Click on ‘Continue with PAN Application Form’.

Step 6: This will redirect you to a new page where you have to enter details similar to the one entered in the application form.

Step 7: Choose how you would like to submit the supporting documents. You can choose to submit documents physically, submit through digital signature, or submit through e-sign.

Step 8: Mark the documents that you will be submitting as identity proof, address proof, and DOB proof. Confirm the application date, place, and declaration. Review all the details to avoid any errors and submit the form.

Step 9: Click on the ‘Proceed’ button. This will take you to the payment gateway page. You can make payment through Demand Draft or Online Payment through Bill Desk.

Step 10: It is important to note that, if you wish to make payment via demand draft, you will need to make the same before beginning the application process. This is because you will have to provide the DD number, issued date, name of bank, amount, etc during the application process.

Step 11: If you proceed with Bill Desk, you can make payment via credit card/debit card/netbanking.

Step 12: Agree to the terms of service and proceed to make payment. The fees for the application will differ according to how you are forwarding the supporting documents.

Step 13: If you make payment through Bill Desk, you will get an acknowledgement receipt and receipt of payment. Take a print out of the acknowledgement receipt.

Step 14: Attach 2 recent passport size photographs with the acknowledgement receipt.

Step 15: After the payment has been completed, send the supporting documents to NSDL via post or courier.

Online PAN Application on UTIITSL Website

Given below are the steps to apply for a PAN card on the UTIITSL portal:

Step 1: Visit the online PAN Card application Section of the UTIITSL website.

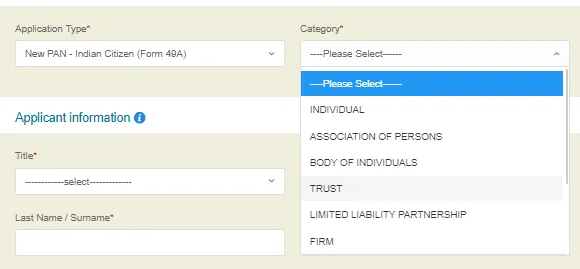

Step 2: On this page, you need to select the application type. Indian citizens need to use Form 49A, while Form 49AA is to be used by foreigners.

Step 3: Next, you need to select what category you fall under. You will need to choose from Individual, Local Authority, Association of Persons, Artificial Judicial Person, Body of Individuals, Hindu Undivided Family, Trust, Firm, Government, and Limited Liability Partnership.

Step 4: After selecting the category, you need to fill in some details. Enter details like Title, First Name, Middle Name, Last Name, Date of Birth, Mobile Number, and Email Address. Verify the captcha and submit the form.

Step 5: On submitting the form, you will see an acknowledgement with a token number on the next page. Click on ‘Continue with PAN Application Form’.

Step 6: This will redirect you to another page where you will be required to enter information similar to the one on Form 49A or Form 49AA.

Step 7: Next, choose how you want to submit the supporting documents. You can either forward the documents physically, submit digitally through e-sign, or online through digital signature.

Step 8: On this page, you need to select the documents that you want to submit. Click to agree to the declaration, enter place and date of application. Review all the details and submit the form. Make sure there are no mistakes.

Step 9: Click on ‘Proceed’. This will redirect you to the payment portal. You need to choose between Demand Draft or Online Payment through Bill Desk.

Step 10: If you wish to continue with Demand Draft, you need to have it made before you begin the application process. This is so because you will need to mention the Demand Draft number, amount, bank of issue, and date of issuance while making the payment.

Step 11: If you wish to continue with the Bill Desk option, you can make payment via credit card, debit card, or netbanking.

Step 12: Agree to the terms of service and proceed to complete the payment. The fees for the online PAN application will differ according to how you choose to send the supporting documents.

Step 13: If you choose to make payment via credit/debit card, you will receive a payment and acknowledgement receipt. Take a print out of the acknowledgement receipt.

Step 14: Attach two latest passport size photos to the acknowledgement receipt.

Step 15: Once the payment is completed, send the acknowledgement slip and supporting documents to the UTIITSL office via courier or post.

PAN Card More Information

How to Apply for Reprint or Change Details on Your PAN Card Online

You can apply for changing your PAN card details online on both the UTIITSL and NSDL website. The circumstances under which you can apply for a reprint are as follows:

- In case of a damaged PAN card

- You have lost/misplaced your PAN card

- You wish to make changes to your already existing PAN card details

Process for Correction of PAN Details on NSDL

Given below are the steps to make changes or corrections of PAN card details on the NSDL website:

Step 1: Visit the official NSDL portal.

Step 2: Select the relevant option from the 4 available while requesting for change in PAN details.

Step 3: Enter all the required details.

Step 4: Make the payment.

Step 5: Take a print out of the acknowledgement slip and attach supporting documents. Send the slip and documents to the NSDL office via courier or post.

Step 6: You may also be required to submit a copy of an existing PAN card as proof.

Process for Correction of PAN Details on UTIITSL

Given below are the steps you need to follow to apply for a reprint of your PAN card on the UTIITSL website:

Step 1: Visit the online PAN application section of the UTIITSL website.

Step 2: Choose if you want to get both a physical PAN card and e-PAN card or just the e-PAN card.

Step 3: Enter your PAN.

Step 4: Enter all the required details.

Step 5: Verify the captcha and continue to submit the form.

Step 6: Pay the application fees via credit/debit card/netbanking. You will receive an acknowledgment slip after completing the payment process.

Step 7: Take a printout of the acknowledgement slip and attach it with copies of all the supporting documents. You also need to enclose a copy of your Aadhaar card and a copy of your existing PAN card.

Online PAN Application Fees

The application fees for applying for a PAN card varies according to whether the address is India or overseas. Given below are the fees for each of these situations:

Online PAN Application Fees for Indian Citizens

For applicants with a registered address in India, the PAN application fee is 110 INR. This includes a processing fee of 93 INR with a GST charge of 18%. The government authorities have implemented a uniform PAN application fee in order to avoid any discrepancy in application processing.

Any individual or entity having a taxable income is always high on the priority list for issuing PAN cards. Having a valid PAN card allows the individual/entity to carry out a number of financial transactions with ease. It also allows them to take advantage of the various subsidies offered by the government.

Online PAN Application Fees for Foreigners

The Indian industrial sector and economy is expanding at a rapid pace. Naturally, this encourages a lot of foreign investors to carry out business operations in the country. A PAN card is one of the most important documents that they need to do so. Further, individuals also require a PAN card to carry out a number of transactions in the country.

The process for foreign individuals/entities to apply for a PAN card is the same as resident taxpayers. The fee for PAN card application for foreigners is 864 INR (not including GST).

Date of Birth Documents for Online PAN Application

Given below are some of the documents that you can submit in lieu of date of birth proof while applying for a PAN card:

- An affidavit stating the DOB, as attested before a magistrate.

- Marriage certificate issued by the Registrar of Marriages.

- Central Government Health Scheme photo identity card issued by the Central Government.

- Government issued domicile certificate.

- Any valid photo identity card issued by the State or Central Government.

- Birth certificate issued by a municipal authority.

- Mark sheet or passing certificate from a recognized board.

- Passport.

- Voter ID card.

- Aadhaar card.

Address Proof Documents for Online PAN Application

Given below are some of the address proof documents that can be used for an online PAN card application:

| Photocopies of Documents not Older than 3 months |

|

| Photocopy of any of these documents |

|

| Originals of these documents |

|

Identity Proof Documents for Online PAN Application

Given below are the set of identity proof documents that you will have to submit to complete your PAN card application:

| Photocopy of any of these documents |

|

| Originals of these documents |

|

Don’t Miss Out!

Frequently Asked Questions (FAQs)

How will my PAN card be delivered to me?

The PAN card will be delivered by post to the applicant’s communication address. If the applicant opts for an e-PAN card, then it will be sent to the registered email address.

Is a minor eligible for a PAN card?

Section 160 of The Income Tax Act states that a minor is eligible to apply for a PAN card. However, the application will only be processed if it is made by a representative assessee on behalf of the applicant.

Can I have more than one PAN card?

No, it is against the law to have more than one PAN card. In case you have more than one PAN card, you should get in touch with the authorities and get one of the accounts closed.