PAN cards are essential for everyone, but did you know PAN cards for Employer certificates are mandatory?

PAN cards assist the government in keeping track of every banking transaction in the company under the PAN number. However, PAN is also beneficial to Employer Certificates. An Employer certificate will assist you in showing address proof for the office while applying for a PAN card.

In this article, we’ll provide a few things you must know about the importance of an Employer Certificate, Annexure-B and more.

Table of contents

- Employer Certificate to Apply for PAN Card As Address Proof

- Annexure B: PAN Application for Employer Certificate

- How to Download Annexure-B PAN Form?

- When to Use Annexure-B as an Address Proof?

- Information Needed to Fill the Annexure-B PAN Form

- Alternative Address Proof to Apply for PAN Card

- Frequently Asked Questions (FAQs)

Employer Certificate to Apply for PAN Card As Address Proof

Employer certificate is granted by the head to authenticate that the applicant is working for his or her company. This also serves as Address Proof which confirms that their staff reside at that address provided in the PAN card with an identical level of certainty.

This certificate will be office address proof while applying for a PAN card. People applying for a PAN card can have the option of having their PAN card delivered to their office address.

However, Employer certificates, bank statements, and credit card statements are the three types of file proofs acknowledged for office proof of address. But, an employer certificate is commonly used by applicants as a document for office address proof.

Annexure B: PAN Application for Employer Certificate

Numerous people are unaware that an employer certificate for applying for a PAN card has a specific format known as Annexure – B PAN. Any other format granted by the employer will not be accepted as proof of document for office address proof, among the most common errors made by PAN card applicants.

How to Download Annexure-B PAN Form?

Some of the steps are mentioned below to download the Annexure-B PAN Card form:

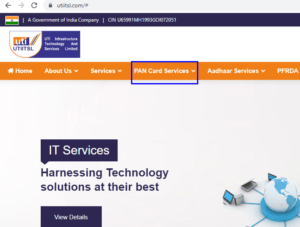

Step 1: Go to the official website of UTIITSL.

Step 2: Under the ‘PAN Card Services’ category, select the ‘Apply PAN Card’ option.

Step 3: After selecting the PAN card option, you will be redirected to a new page.

Step 4: Select the required Annexure-B option. Fill out the form and submit it.

When to Use Annexure-B as an Address Proof?

Under rule 114 (4) of Income Tax Rules, 1962, getting immediate residence proof is impossible if you have resided in a new city. So, in that case, you can use Annexure-B PAN Form.

Or you can show an Employer certificate.

Information Needed to Fill the Annexure-B PAN Form

Some of the primary information required to fill the Annexure- B PAN form are as follows:

- The employer must provide the authorisation certificate on company letterhead.

- The applicant must attach a passport-sized photograph similar to that submitted on the PAN application.

- The employer must affirm the photo, should sign and stamp it.

- Fill out all the details to be filled in, including the user name, father’s name, experience years with the firm, office and house address, company registration and PAN.

- Issuing Person details like full name, designation, Individual PAN number, office address, telephone and phone number.

- It should include the responsible person’s signature and the official seal at the bottom.

- Attached the form with duly with your PAN application form

Alternative Address Proof to Apply for PAN Card

The listing of documents are mentioned below, applying for a PAN card as an alternative address proof.

- Aadhaar card/ Driving license/ Passport

- Elector’s photo identity card

- Electricity bill/ Water bill/Gas connection (not older than three months)

- Landline phone bill or a broadband connection (not older than three months)

- Bank accounts statement (not older than three months)

- Depository Account statement

- Debit/ Credit card Statement use

- Domicile Certificate/ Spouse Passport/ Post Office Passbook

- If any, recent Property Tax Assessment or Asset Registration Document

Frequently Asked Questions (FAQs)

What is Annexure-b?

Annexure B gives the format to be used by the employer on the letterhead of the firm.

What is the use of Annexure B?

The usage of Annexure B are:

Highlight certain general requirements for government bids, agreements, and orders.

To ensure customers understand the rights and responsibilities of all parties associated with conducting business with the authorities.

What is the difference between Annexure A and Annexure B?

The difference between Annexure A and Annexure B are as follows:

- Annexure A: Under rule 114, sub-rule (4) of the Income-tax Rules, this certificate can be utilised by a Member of Parliament/Member of the Legislative Assembly/Municipal Councillor.

- Annexure B: Certificate to be utilised on the cover letter of the organization/institution by the Employer under sub-rule (4).

Why need of Employer Certificate to be an Address Proof?

Employer Certificate to be an Address Proof approves that their staff member resides at the address provided in the PAN card.

What credentials are required to apply Employer Certificate for a PAN card?

Numerous credentials are required to apply Employer Certificate for a PAN card like an Aadhaar card, PAN card, electricity bill, water bill, Domicile Certificate and more.