‘Tax refund status’ is one of the terms that we come across in our daily professional life. Let’s understand what it means. A tax refund is an amount paid to a taxpayer with regards to any extra tax paid for the financial year. These refunds are usually paid out during the end of the financial year. But unfortunately, there might be various reasons for a delay in your refund processing. The status and reason for the same can be checked in a number of ways. In this blog, we will take a look at how you can check the income tax refund status and much more. Let’s begin!

What is an Income Tax Refund?

An income tax refund is the reversal of the excess tax payment made by the taxpayer to the income tax authorities. In simple words, it can be referred to as a reimbursement of any extra tax paid. The best way to describe this for a taxpayer is that it is an interest-free loan that you have provided to the government.

When is an Income Tax Refund Applicable?

Given below are some of the circumstances in which a taxpayer may be eligible for an Income Tax Refund:

- Excess Deduction of Tax Deduction at Source (TDS)

-

-

- Tax deduction is done by employers after based on various documentary proof provided by employees with regards to any tax saving investments. However, there may be certain situations where the employee is not able to furnish the proof for such investments. This leads to the employer generally deducting an extra amount with regards to TDS. Thankfully, the same amount can be claimed by the taxpayer as an income tax refund, while filing returns for the assessment year.

- Certain individuals do not fall under any tax-bracket, which means that they do not have to make any tax payments. Yet, taxes might have been deducted on their income. They can claim a tax refund for the same for the excess amount collected.

-

- Extra TDS Deducted on Interest: Sometimes tax is deducted on the tax saving investments that you have made for the financial year. This could be investments like bonds or fixed deposits. An income tax refund can be claimed for any such amount deducted.

- Excess Advance Tax Payment: There are instances where the taxpayer has paid an extra amount in terms of self-assessment tax for the financial year. This extra amount paid for advance tax can be claimed as an ITR.

- In Case of Double Taxation: This is most likely when the individual is a citizen of a certain country while receiving income from another country. For this very purpose, the income tax authorities have entered into a Double Taxation Avoidance Agreement (DTAA). This allows the taxpayer to claim a refund if he/she is a non-resident with taxable income in another country.

How to Claim Income Tax Refund?

In order to claim an income tax refund, the applicant needs to have filed the ITR for the relevant assessment year. It is important to know that the income tax authorities only process refunds for only verified ITR. Further, the refund is subject to scrutiny and approval from the income tax department.

Checking Income Tax Refund Status

Once the authorities determine that the refund is valid, the same will be processed. The ITR status can be checked in the following ways:

- Income tax e-filing portal

- NSDL website

Now let’s take a look at the way you can check the income tax refund status using both of these methods:

Checking ITR Status on E-Filing Portal

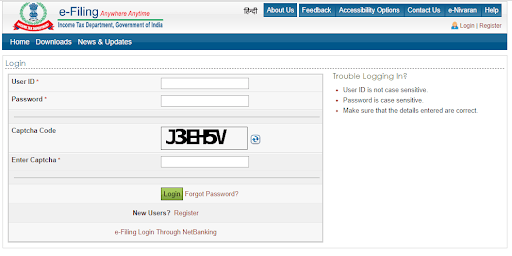

Given below are the steps you need to follow to check the refund status on the income tax portal:

Step 1: Visit the income tax e-filing portal.

Step 2: Log in to your account by using your credentials. Verify the captcha and click on ‘Login’ to proceed.

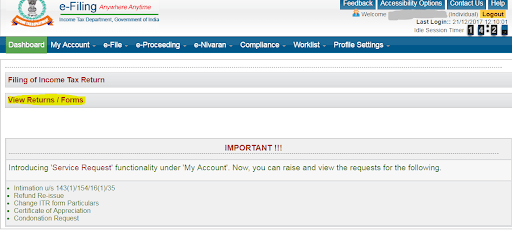

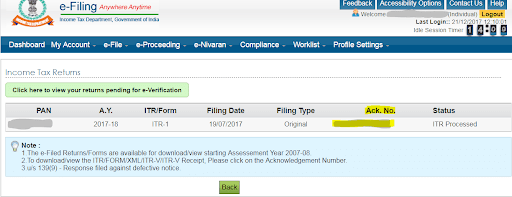

Step 3: Click on the ‘View Returns/Forms’ option present on the dashboard.

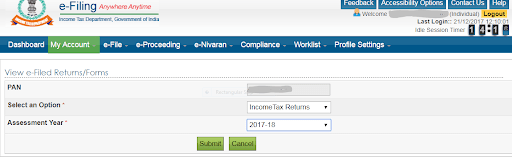

Step 4: Select the ‘Income Tax Returns’ option from the ‘Select an Option’ drop-down menu. Select the relevant financial year from the ‘Assessment Year’ drop-down, and click on the ‘Submit’ button.

Step 5: Click on the acknowledgement number that appears on the screen.

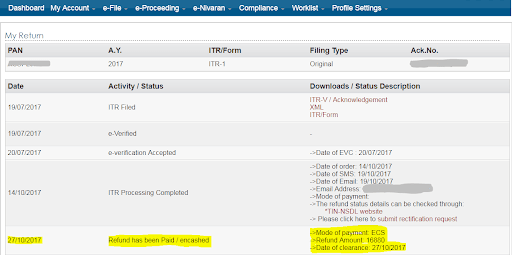

The income tax refund status will then be displayed as shown in the image below.

Checking ITR Status on the NSDL Portal

Taxpayers can also view their ITR status on the NSDL portal by following the tapes given below:

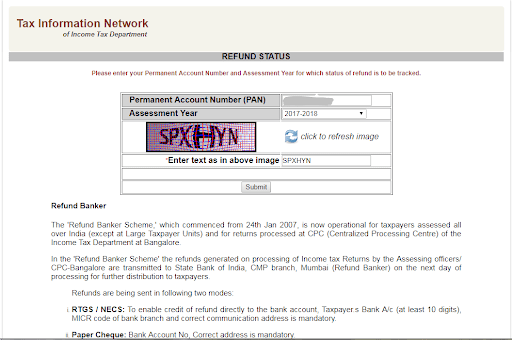

Step 1: Visit the income tax refund status page of the NSDL portal.

Step 2: A page as shown below will appear on the screen. Here, enter your PAN details and assessment year. Verify the captcha and click ‘Submit’.

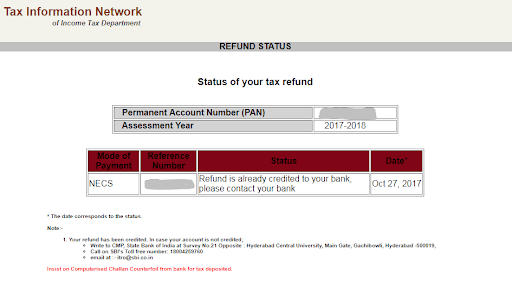

Once you have submitted the details, a screen like the one given below will reflect the status of your income tax refund.

What are the Different Income Tax Refund Status Messages?

The table given below shows the meaning of the different status messages that you might come across while checking your ITR status:

| Status Message | What it Means | Required Action |

| Refund Paid | The request for income tax refund has been processed and credited to the bank account. | Coordinate with the bank to check the details of the refund received. If refund is not received, then contact your bank’s customer care for further assistance. |

| No Demand No Refund | The request has been processed and it has been determined that the taxpayer is not eligible for a refund or liable to be taxed. | Verify the details received from the income tax authorities and file corrected returns if applicable. |

| Refund Unpaid | The request for refund has been approved by the authorities but was not paid out due to discrepancy in address or bank details. | Log in to the income tax portal and correct the relevant details. Apply for a refund request again. |

| Refund Status not Determined | The request for income tax refund has not been processed yet. | Check the income tax refund status again after a few days. |

| Refund Determined and Sent Out to Refund Banker | The refund request has been approved by the authorities and the same has been forwarded to the refund banker. | Wait for the income tax refund to be credited to your bank account. You can contact the banker to know about the income tax refund status. |

| Demand Determined | The tax calculation provided you does not match with the income tax authority’s calculations and an additional amount has to be paid for tax. | Cross-check the calculation mentioned in 143(1) to determine the discrepancy. In case of any error, make the additional payment to the authorities within the determined timeline. In case of no error, file a correction along with the documents to support your refund claim. |

| Rectification Processed, Refund Determined and Details sent to Refund Banker | The rectified return filing has been approved. The actual income tax refund amount has been determined and sent to the refund banker for processing. | Check your bank account to verify the refund receipt. |

| Rectification Processed and Demand Determined | The corrected refund amount has been approved. However, an extra amount has to be paid within the stipulated time period. | Make all the extra tax payment before the deadline. |

| Rectification Processed, No demand and No Refund | The rectified return filing has been accepted. It has been determined that there is no eligible tax refund or deficit. |

How is Income Tax Refund Paid Out?

The authorities make the income tax refund payments in one of the following ways:

- Direct Credit: The authorities can pay out your income tax refunds via NECS/RTGS. Make sure that you provide all the correct account details so as to avoid any delay or problem in crediting the amount. Some of the details to be mentioned are the branch’s IFSC code, account number, and correspondence address. This will ensure that your refund amount will be credited efficiently.

- Cheque: In case the bank details provided by you are incorrect or unclear, the amount will be paid out in the form of a cheque.

How to Apply for a Refund Reissue?

You can apply for a refund reissue by following the steps given below:

Step 1: Visit the income tax e-filing portal and enter your credentials. Verify the captcha and click on ‘Login’.

Step 2: Click on the ‘Service Request’ option under the ‘My Account’ tab.

Step 3: Select the ‘New Request’ option from the ‘Request Type’ category. Select ‘Refund Reissue’ from the ‘Request category’.

Step 4: A new page will appear reflecting the acknowledgement number from each financial year . Click on the ‘Submit’ button under the relevant assessment year.

Step 5: Enter certain details like bank account number, type of account, IFSC code, and bank name and click on ‘Submit’.

Step 6: The refund amount will be credited to your bank account within a few days.

Reasons for Delay in Income Tax Refunds

There could be a number of different reasons for a delay in income tax refunds. You can always check the income tax refund status on the government portal. Some of the reasons there might be a delay are as follows:

- Your ITR return filing has not been verified. You need to make sure that the filings are verified within 120 days of filing the ITR. The more you delay the verification, the more your refund will be delayed.

- The income tax authorities do not have your updated bank details.

- The refund process takes a little longer in the case of manual ITR filing. So if you have physically filed the returns, your refund could be delayed.

- Lastly, your refund might be delayed because the authorities feel that there is an under-reporting of income. The delay could be because the authorities are scrutinizing the returns.

Things to Remember About Income Tax Refund

Given below are some of the things about income tax refunds that you should keep in mind:

- Verify the bank account details with the details on your passbook at least twice. Make sure that there are no errors while entering the bank details.

- Make sure the income tax authorities have the updated address details in case of refund by cheque.

- Complete your income tax return filing before the due date for efficient processing of income tax refunds.

- Generate and view your Form 26AS, and make sure that the excess tax paid is reflected in the form.

Frequently Asked Questions (FAQs)

Will I be compensated for a delay in my refund payment?

Yes, you will be compensated for a delay in your income tax refund payment. The refund amount will be subject to an interest of 0.5% per month. This amount will be calculated from 1st April to the date your refund was paid out.

Is the tax refund amount taxable?

The amount of income tax refund will be equal to the amount of extra tax paid. This amount is not taxable as it is not a form of income. Having said that, the interest amount on your refund will be subject to taxation.

Do I have to file ITR to get a refund?

Yes. You can only apply for an income tax refund for any extra tax paid for the assessment year. This means that you will have to file an ITR to claim a refund.

What is the time limit for claiming an income tax refund?

The income tax refund can only be claimed only after you have filed the returns for the relevant financial year. As both these processes are dependent on each other, the deadline for claiming a refund is the same. The last day for filing returns and claiming refunds is the last day of the tax year.

Is there a limit to revised returns filing?

No, there is no limit. Returns can be filed multiple times within the 1 year expiry period.

What are the prerequisites for checking the ITR status online?

In order to check your income tax refund status online, you will require your PAN details and the correct assessment year.