In India, the progress in technology and resources has helped the Income Tax Department to develop and improve. The government has embraced this progress by integrating modern technology into its duties. One key development supported by the Government of India is the National Securities Depository (NSDL).

In this blog, we will explore what NSDL is, its structure, and the services it provides to people who pay taxes. Moreover, find out more about the NSDL PAN card, the composition of the tax information network and the process of the NSDL PAN application.

What is NSDL?

Established in 1996, the NSDL has created a top-notch system for managing most securities owned and traded in India. Even though India’s capital market has been booming for over a hundred years, dealing with securities on paper was a big challenge for the officials. The problem was solved with the launch of the Depositories Act in 1996.

Using modern and extensive technology systems, NSDL works with government agencies to support brokers and investors in the country’s securities market. NSDL has brought stability and safety to the capital market by providing settlement solutions to minimise risk, save costs, and increase efficiency. Among its various services, NSDL also facilitates the NSDL PAN card application process, allowing individuals to search and apply for a PAN card directly through the NSDL PAN card website, making it easier for users to manage their financial transactions and comply with tax regulations.

Tax Information Network Composition

The Tax Information Network (TIN) was set up by the Income Tax Department of India, as a collection of information related to tax. The TIN receives the TDS related information and other digital information and uploads them to the central database. Given below are the 3 major components of the Tax Information Network:

- Electronic Return Acceptance and Consolidation System (ERACS): This is a comprehensive system meant to interface with the taxpayers. This interface is composed of a vast network of TIN-facilitation centres all over the country. This also includes a web-based provision on uploading e-returns of TDS, TCS, and AIR to the central database.

- Online Tax Accounting System (OLTAS): This system is meant for the daily upload of data to the main database. This system also collects the details of all taxes deposited in the tax collection centres in the country.

Online NSDL PAN Application Process

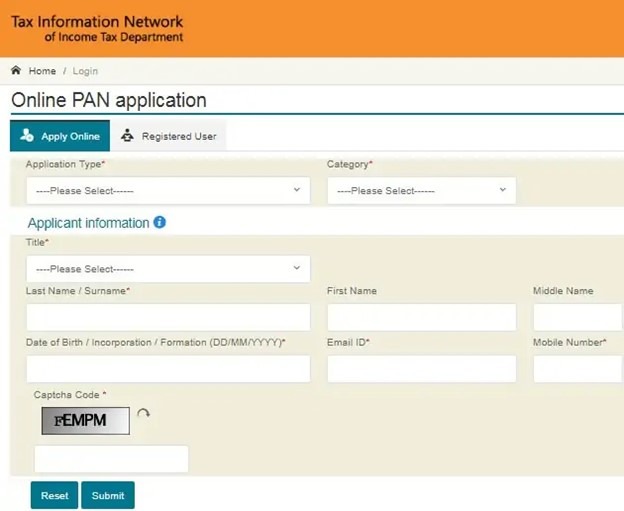

Given below is the process to apply for a PAN card through the official NSDL website:

Step 1: Go to the official NSDL portal.

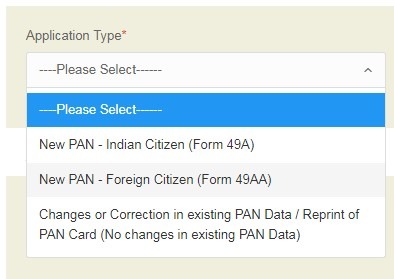

Step 2: Click on the ‘New PAN for Indian citizens (Form 49A) or New PAN-Foreign Citizen (Form 49AA)’ under the ‘Application Type’ drop-down menu.

Step 3: Select the appropriate ‘Category’ from the drop-down menu.

Step 4: Enter all the required information like name, date of birth, address and contact details in the form.

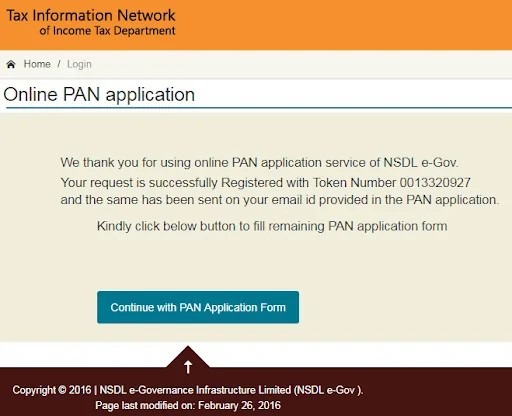

Step 5: Once you’ve submitted the form, a token number will be generated. Click on the ‘Continue with the PAN Application Form’ button.

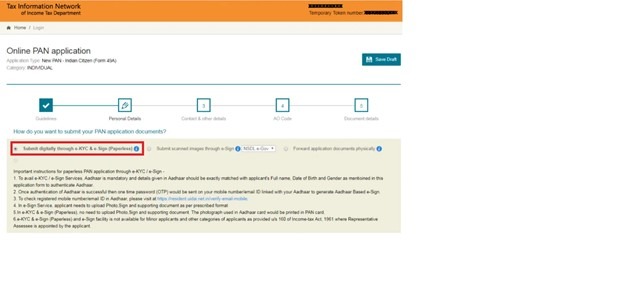

Step 6: On the resulting page, you need to submit your PAN application. Click on ‘Submit digitally through e-KYC & e-Sign (paperless)’.

Step 7: Enter details such as name, and contact information.

Step 8: Enter your AO Type, Area code, and other details to continue.

Step 9: There is no need to submit any documents. All the required documents will be automatically picked from your Aadhaar card. Agree to the declaration to continue.

Step 10: If there are any mistakes in the form, they will appear on the screen. If there ar e no changes, click on ‘Proceed’.

Step 11: This will redirect you to the payment section, make payment using your preferred mode.

Step 12: After successful payment, you will receive an acknowledgement form along with an acknowledgement slip.

Step 13: Take a printout of the acknowledgement form, attach 2 passport size photographs and sign on the space provided.

Step 14: Enclose all the self-attested copies of the documents along with the acknowledgement form. You will also need to attach the Demand Draft if the payment was done by this mode.

Step 15: Send it via post or courier along with all the documents to the NSDL address mentioned below.

Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune – 411016

How to Track your NSDL PAN Status?

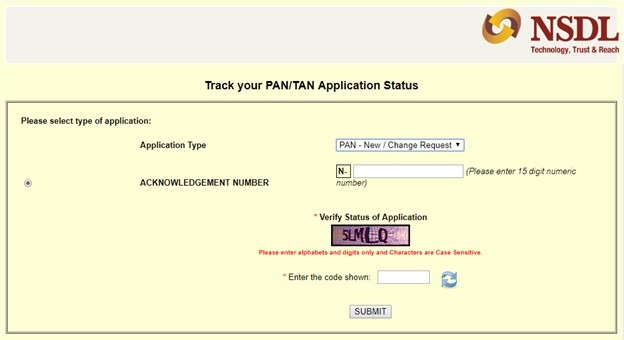

You can also use the NSDL website to track the status of your PAN card application. Given below are the steps you need to follow to track the status of PAN card on the NSDL portal:

Step 1: Visit the official NSDL website.

Step 2: Click on the ‘Track your PAN/TAN Application Status’ tab.

Step 3: Select ‘new/change request’ from the ‘Application Type’ drop-down menu.

Step 4: Enter your 15-digit acknowledgement number.

Step 5: Verify the captcha.

Step 6: Click on ‘Submit’ and view the application status.

Online NSDL PAN Card Process for NRIs

The NSDL portal has made the PAN card application process for foreigners very easy. The innovative portal ensures that not a lot of time is wasted in the application process can be completed on the innovative in minimal time. Given below are the steps for NSDL PAN application for foreigners:

Step 1: Visit the NSDL website and click on the ‘Online PAN Application’ tab on the main page.

Step 2: On the resulting page, click on Form 49A. This is the form required for Indian citizens.

Step 3: A page displaying all the guidelines and instructions for filling the form will appear. Go through the instructions very carefully.

Step 4: Select the application type from the drop-down menu at the bottom of the page.

Step 5: A new tab with an online form will appear. Enter all the relevant details in the form.

Step 6: Upon filling the form, you will be provided with an option to review the information entered by you.

Step 7: Upload all the required documents.

Step 8: Review the information and click on ‘Submit’.

Step 9: This will redirect you to the payment gateway. You can make payments via debit card/credit/card/net banking. You can also choose to make payments in the form of a cheque or Demand Draft.

Step 10: An acknowledgement form will be generated post payment. Take a printout of the form and paste 2 recent passport size photographs on the space provided.

Step 11: Sign the form in the designated places and attach the documents if you have not already uploaded the same. Send the completed form to the address mentioned on the acknowledgement form.

Step 12: The PAN card will be sent to the registered address within 21 days of receipt of the application by authorities.

Payment Procedure

If the correspondence address you have mentioned in the form is in India, then you will have to pay an amount of INR 110 as registration fees. You can make this payment via debit card/credit card/net banking/demand draft.

If you have provided an overseas address, then you are liable to pay an amount of INR 1020 as registration fees. This amount can be paid through debit card/credit card/demand draft. If you are making payment using DD, it should be drawn in the favor of ‘NSDL-PAN’ payable at Mumbai.

Note: Payments via foreign credit cards are currently not being accepted by the authorities.

Primary Online Services Offered by NSDL

Some of the online services that the citizens can use on the NSDL portal are as follows:

Tax Deduction and Collection Account Number (TAN)

TAN is a prerequisite for many dealers, traders, or manufacturers who are involved in TDS and TCS related transactions. Some of the TAN related services on the website are TAN Application, TAN status, Reprint of TAN, and Duplicate PAN.

Permanent Account Number (PAN)

Some of the services users can avail the following PAN-related services on the NSDL website are:

- PAN card status tracking

- Online PAN card application

- Reprinting PAN card with updated information.

Annual Information Return (AIR)

According to the Income Tax Act of 1961, all high-value transactions are required to be covered under AIR. Taxpayers can use this portal for registering, tracking, changing, and renewing AIR.

Account Office Identification Number (AIN)

Accounting offices and firms can use the NSDL website to download/view the Book Identification Number, update information and upload 24G.

E-TDS/E-TCS

Any payments that an organisation or individual makes to third parties are liable to TDS taxation, and is required to be submitted with the tax authorities. Such entities can save the time and effort required for this process by uploading their returns online on NSDL. Entities also have the option of uploading TCS returns online.

Secondary Online Services Offered by NSDL

Given below are some of the secondary services that citizens can avail on the NSDL website:

- E-Payment of Taxes: The NSDL website provides taxpayers with an online platform for direct tax payments. People can pay income tax, corporate tax, wealth tax, etc.

- Online PAN Card Verification: Financial institutions like banks, insurance providers, NBFCs, etc need to verify the PAN details of the applicants. This is why the NSDL offers these institutions the option of easily registering and verifying PAN details in a few steps.

- E-Return Intermediary: With the help of the new feature, intermediaries who file taxes on behalf of individuals can now do so completely online. This makes things very easy for the intermediaries.

- Form 24G: Account officers can easily provide Form 24G statements and upload them to the TIN central database.

Offline Services of TIN Facilitation Centres

Apart from hosting a number of online services. The NSDL website also allows users to search for TIN Facilitation Centre in their locality. This can be done by entering the state and city on the website. Given below are some of the offline services offered by the TIN Facilitation Centres:

- The centre enables taxpayers to file TDS and TCS returns.

- Processing of TAN and NSDL PAN card applications.

- Accepting Annual Information Returns.

- Submission of Form 24G.

NSDL e-Governance

The advent of the Internet has helped in providing a solid platform for government authorities to simplify the existing structure. NSDL e-Governance Infrastructure Limited is responsible for regulating and managing the Income Tax Department’s Tax Information Network. This is done to increase productivity while utilising the available resources.

Established in 1995, it has succeeded in displaying its capability over the years, while establishing trust-based relations with various entities in the economy. Working in coordination with various government organisations, NSDL helps in designing, managing and implementing e-governance projects. This helps the agencies in overcoming any troubles and making the process easier for the general public.

Services of NSDL e-Governance

NSDL offers a plethora of services to its clients. This includes solutions that are drafted specifically to improve transparency and increase efficiency. Some of the other services offered by NSDL are:

- Information technology consulting.

- System integration solutions.

- Business process re-engineering.

- Architecture solutions.

- Datacenter colocation.

Major Projects of NSDL e-Governance

Since its inception, NSDL has been involved in the implementation of a number of major projects in the country. Some of these projects are as follows:

- Tax Information Network (TIN)

- Aadhaar Registration

- Aadhaar Authentication

- GST

- Central Recordkeeping Agency

- National Judicial Reference System (NJRS)

- Electronic Accounting System for Excise and Service Tax

Frequently Asked Questions (FAQs)

Is a notary affidavit valid date of birth proof for the NSDL PAN card application?

Yes, an affidavit issued by a Public Notary is a valid DOB proof for a PAN card application. Some of the other accepted documents are an Aadhaar card, driving license, passport, matriculation certificate, etc.

Is it possible to have more than 1 NSDL PAN?

No, it is not possible for one taxpayer to have more than one PAN card. If anyone is found to have more than one PAN, they may be fined up to INR 10,000.

Is it compulsory to provide an email address to receive PAN?

Yes, it is mandatory to provide an email address to receive an NSDL PAN card.

Can I get a PAN card even if I don't have taxable income?

Yes, any citizen of India can apply for a PAN card even without any taxable income.

Are there any charges for obtaining an NSDL PAN card application?

No, there are no charges. You can download the application for free on the NSDL website.

Can I get a PAN for a minor?

Yes, a minor can be issued a PAN card. This is if the application has been made on behalf of the applicant by a Representative Assessee.

Will the PAN card number be changed if I change my name on the PAN card?

No, the PAN will not change even if you change any of the other details on your PAN card.