The Finance Minister of India Nirmala Sitharaman announced a new provision in the Union budget of 2020. This provision states that applicants can now get a PAN card instantly through Aadhaar details, without filling out a lengthy application form. This provision was announced with the aim of making the process of allotting PAN details to the applicant quicker.

The instant PAN card can be obtained for free as a digital copy in under 10 minutes. The digital PAN card is just as useful as the physical version of the card. In this blog, we will take a look at how to obtain an instant PAN card, basic requirements, and how to check the status of your instant PAN card.

Table of contents

How to apply for an instant Pan Card?

The latest provision states that applicants who have an already existing Aadhaar card can obtain a PAN card instantly. This means that the applicant is not required to fill out a detailed form. The PAN card is provided in the form of a PDF file, without any extra cost.

The file will however bear a QR code which links the details like holder’s name, DOB, and photograph. A printout of the e-PAN card can be obtained from the online income tax portal using your application acknowledgement number. Further, a digital copy of the card will be dispatched to the applicant’s email address.

Applications for an e-PAN card on the UTIITSL or NSDL websites, both of these methods have a small fee applicable. The applicants can also apply for an e-PAN card free of cost on the online returns filing portal of the Income Tax Department. Using the e-filing portal will also automatically link your PAN card to your Aadhaar Card.

Who Can Get PAN Instantly Through Aadhaar?

Applicants who have an Aadhaar number that is already linked with a registered Mobile number can apply for an Instant PAN Card.

Since the process for getting an e-PAN card is relatively quicker and less tedious than filling up the detailed forms, you must be wondering if you can do it too. In this section, we will talk about who can use their Aadhaar card to get a PAN card instantly. Given below are the prerequisites for getting an instant PAN card:

- The applicant should have valid Aadhaar card details which were never previously linked to any PAN.

- There should be a registered mobile number linked with the applicant’s Aadhaar card.

- Since the whole e-PAN process is paperless, there is no need to upload any identity proof documents.

- The applicant should not already have a valid PAN. Any individual who is found to be having multiple PAN cards is liable to be fined under the laws of the Income Tax Act.

Instant PAN Card Application Process

Now that we’ve seen who all can use their Aadhaar to apply for an instant PAN card. Let’s take a look at how you can apply for an instant PAN card with Aadhaar details on the e-filing website:

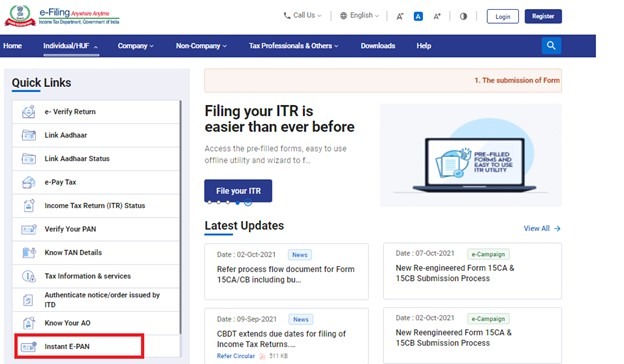

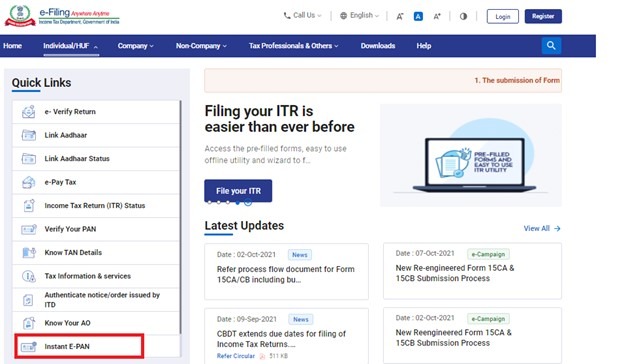

Step 1: Go to the official income tax e-filing page.

Step 2: Under ‘Quick Links’ select ‘Instant e-PAN’ on the homepage. You will be redirected to another page for PAN Allotment.

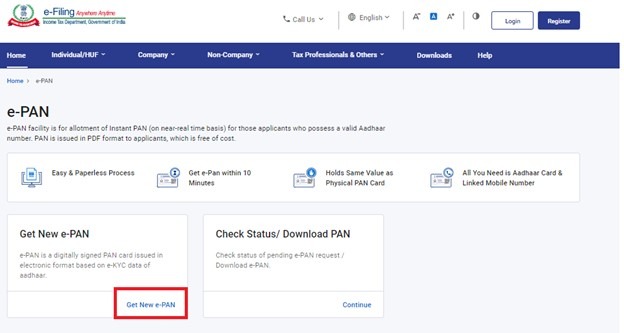

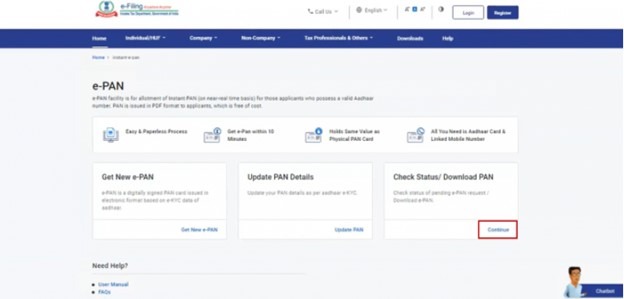

Step 3: Clicking on ‘Get New e-PAN’ will take you to another page to file your instant PAN application.

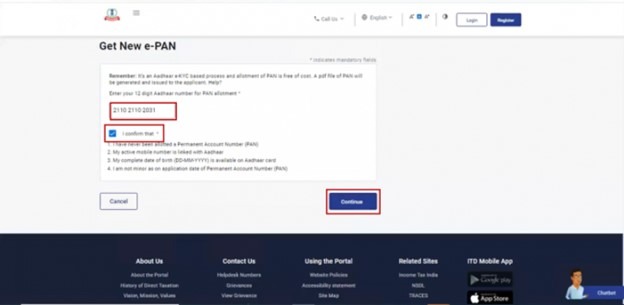

Step 4: Key in the Aadhaar number. Click on ‘I confirm that’ and proceed by clicking on the ‘Continue’ button. This will trigger an OTP is sent to your registered phone number.

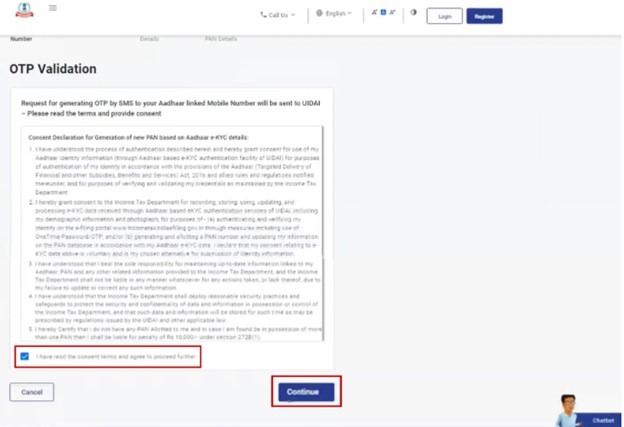

Step 5: Verify the OTP you received on the registered email address and click on the ‘Validate Aadhaar OTP and Continue’ button after you agree to have your Aadhaar be verified by UIDAI.

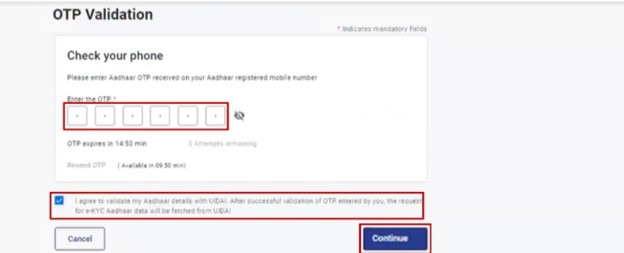

Step 6: This will redirect you to an OTP verification page. Agree to the terms and conditions and click ‘Continue’.

Step 7: Key in the OTP, select the check box, and then click on ‘Continue’.

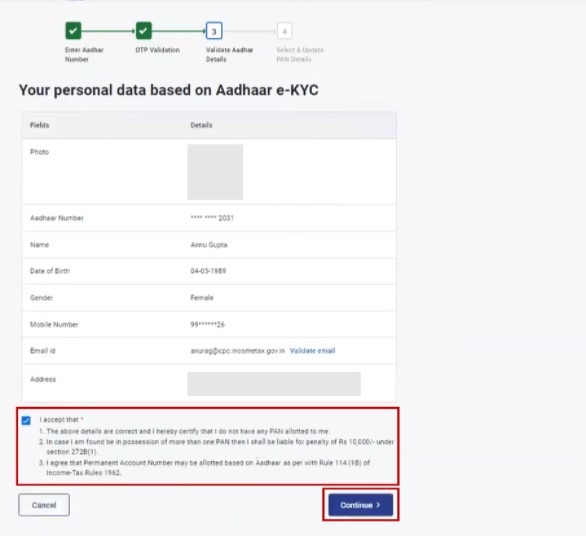

Step 8: In this step, you will have to validate your email address if not done so previously. Click the checkbox and click on ‘Continue’.

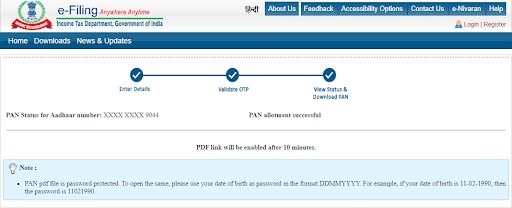

After you submit the Aadhaar details for verification, an acknowledgement number will be generated. The PAN allotment status can be checked using your Aadhaar card number or acknowledgement number.

How to Track Instant PAN Allotment Status?

Once the applicant has submitted the Aadhaar details for validation, they can track the allotment status of the PAN card. The applicant will need a valid Aadhaar number to track the status on the income tax e-filing website.

Given below are the steps to track the instant PAN allotment status:

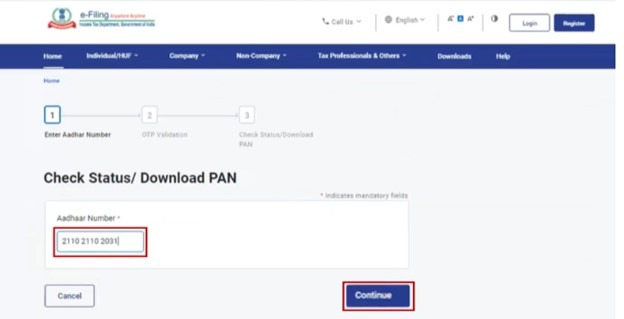

Step 1: Go to the income tax e-filing portal homepage.

Step 2: On the homepage, click on ‘Instant e-PAN’ under ‘Quick Links’.

Step 3: Select ‘Check Status/Download PAN’ option.

Step 4: Provide the Aadhaar number associated with the application and verify the captcha code, and click ‘Submit’.

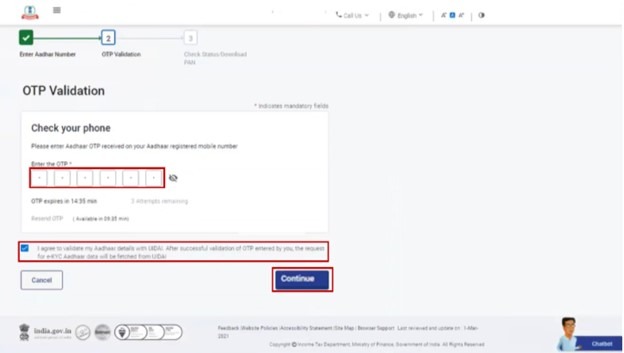

Step 5: This will trigger an OTP being sent to the registered phone number. Be sure to keep the number in handy as the OTP comes with a 5 minute expiry period. Click the checkbox and click on ‘Continue’ to proceed.

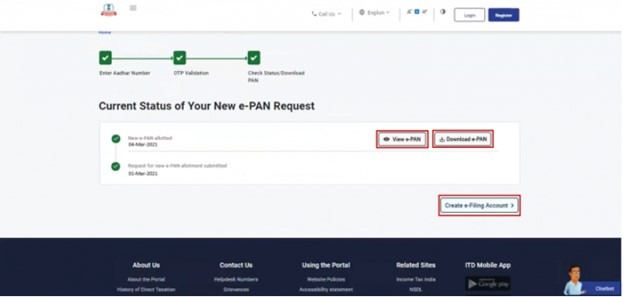

Step 6: This will redirect you to a new page where you can check the PAN allotment status.

Step 7: If the PAN has been successfully allotted, a PDF doc file will be available for download in under 10 minutes.

Note: The file generated will be password protected. The password to access the file is the Date of Birth of the applicant in ‘DDMMYYY’ format. For example, if the applicant’s date of birth is 27/05/1992, then the password to access the file will be 27051992.

Don’t Miss Out!

Frequently Asked Questions (FAQs)

Can I apply for an instant PAN even if I have misplaced my Aadhaar card?

No, you can apply for an instant PAN card only if this is the first time you are applying for a PAN card. You will also require a valid Aadhaar card with latest KYC details.

What should I do if I cannot update my date of birth on e-PAN?

If you wish to change your date of birth in e-PAN card, you will need to change the date of birth details in your Aadhaar card.

Is it mandatory to set up an account with the Income Tax Department website to link PAN and Aadhaar?

No, it is not compulsory to register to the Income Tax Department’s website. There is also a direct link available which you can use to link your Aadhaar card to PAN.

What details do I require to know my PAN card details on the NSDL or UTIITSL website?

If you wish to find your PAN details on the UTIITSL or NSDL websites, you will need certain details like name, date of birth, father’s name, etc.

How to apply for instant e pan card

You can apply for an instant E-PAN card on the e-filing website of the Income Tax Department.

- Click on ‘Instant PAN through Aadhaar’

- Then, click on ‘Get new PAN’

- Fill in your Aadhaar details followed by captcha.

Please remember that you must have a registered Aadhaar Card to apply for an Instant E-PAN card.

What is the difference between ePAN and physical PAN?

E-Pan and PAN are primarily the same in nature. The only difference between the two is that E-PAN is the electronic version of the PAN card issued by the Income Tax Department. E-PAN is a soft copy while the physical PAN is the hard copy.