Courtesy of the Digital India campaign, opening an SBI FD online has become really easy. All you need is a smart device and follow a few steps.

The State Bank of India (SBI) allows its savings bank account holders to open fixed or term deposits via online banking. You can open an FD and even an RD (Recurring Deposit) from the convenience of your home, saving a lot of time and effort.

In this article, let’s see how to open FD in SBI online, its benefits, and requirements.

Table of Contents

How to Open FD in SBI Online

Using the online banking platform of SBI, you can create an e-fixed deposit with just a few clicks. SBI offers a variety of FD options to their customers and allows them to choose the one that suits their interests the most. So, let’s see here how you can open an SBI FD online.

Step-by-Step Procedure of Opening an SBI FD Online

Here are the quick steps on how to open FD in SBI online.

- Step 1: Visit the official State Bank of India (SBI) website.

- Step 2: In the Personal Banking section, sign in using your Login ID and Password.

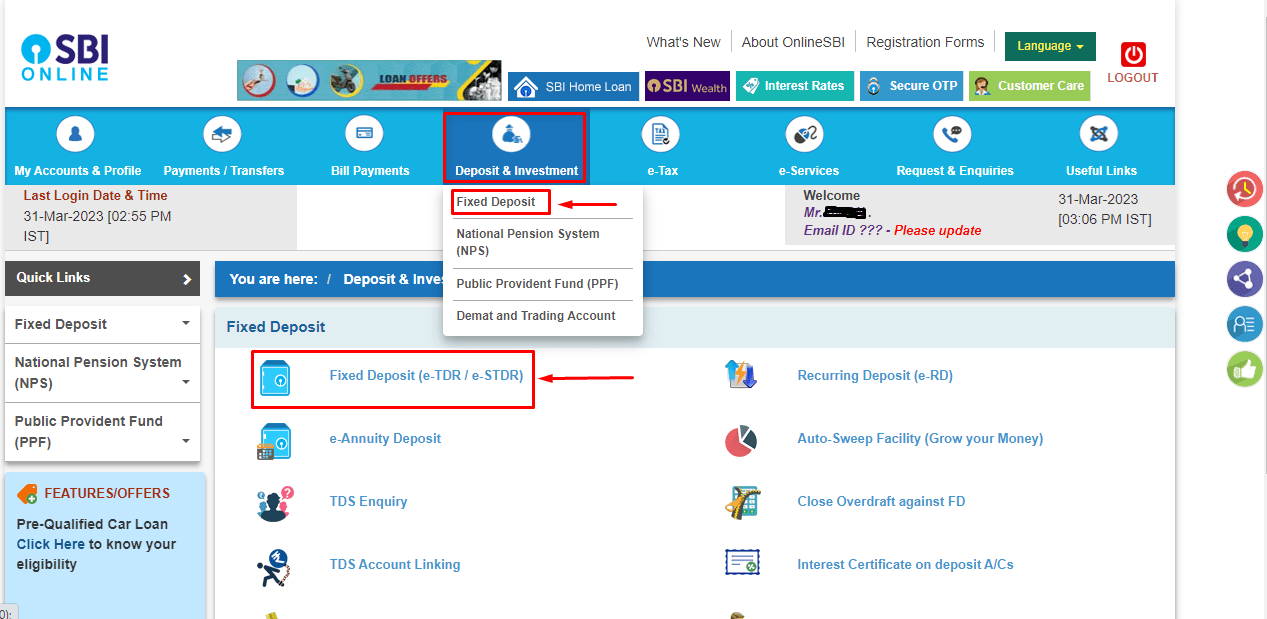

- Step 3: Click on the e-Fixed Deposit (eFD) tab from the top menu. A dropdown of multiple options will appear, including:

- Fixed deposits

- Fixed deposits under income tax savings scheme

- Multiple option deposits

NOTE: If you simply wish to open a normal FD, the first option is the perfect choice for you. Click on it and then click on Proceed to view the next level of instructions.

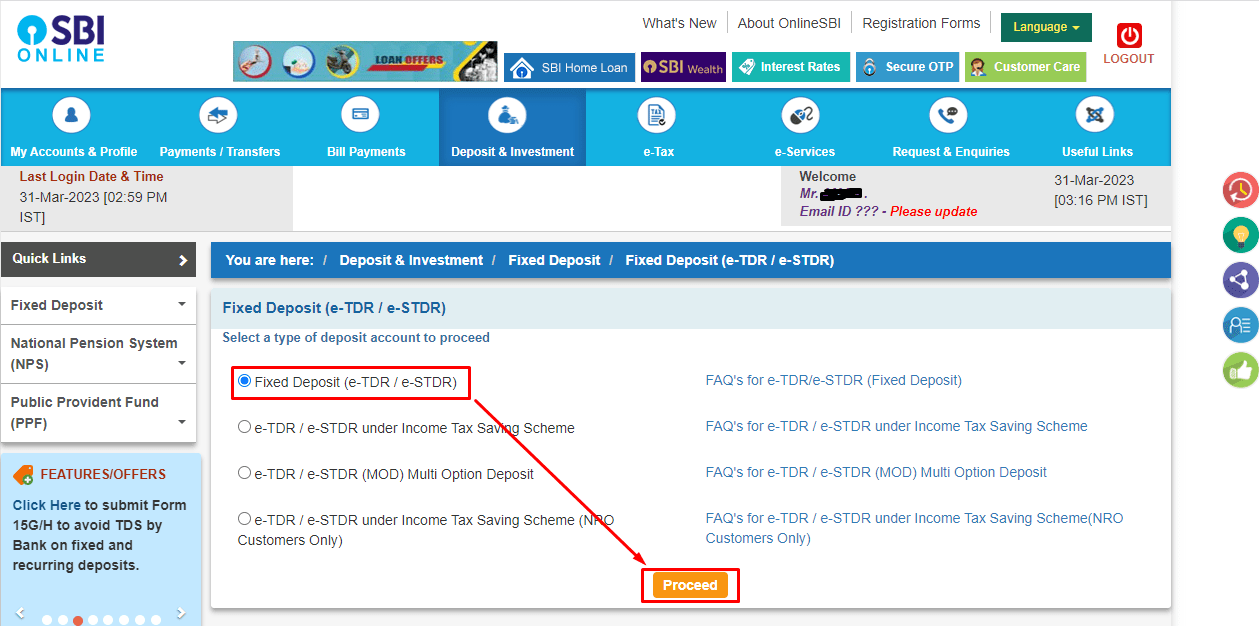

- Step 5: Once you are on the Fixed Deposit page, choose e-TDR/e-STDR (FD) and click on ‘Proceed’.

- Step 6: Select the FD type you wish to create: Term Deposit (TDR) or Special Term Deposit (STDR). Again, click on ‘Proceed’.

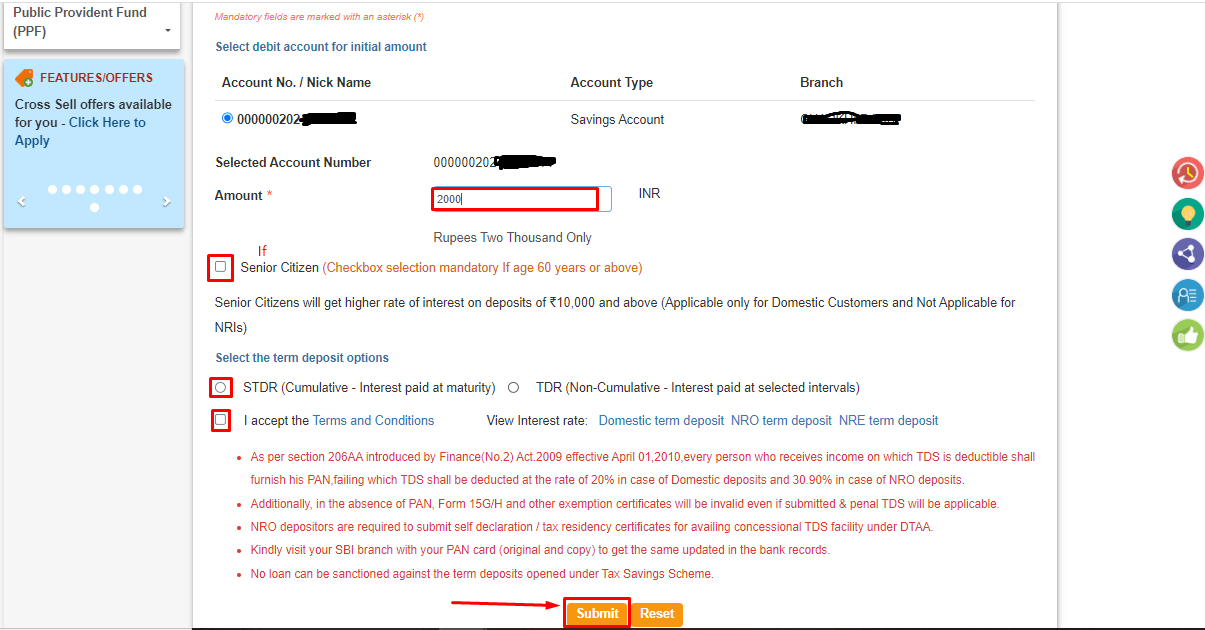

- Step 7: In case you have more than one bank account linked to online banking, choose the account from which you wish the FD amount to be deducted.

- Step 8: Fill out the principal FD amount for which you wish to open an FD in the ‘Amount’ section of the website.

- Step 9: If you are a senior citizen (60 years or above), tick the check box that says ‘Senior Citizen’. SBI offers special plans for Senior Citizens who wish to open an FD. They can get higher interest on maturity compared to normal FDs.

- Step 10: Now, choose the deposit tenure or maturity date. After that, follow the maturity instructions that display on your screen.

- Step 11: Read the Terms and Conditions carefully and accept them by ticking the checkbox.

- Step 12: Click on Submit and a summary of the details of your FD will appear on the screen. Go through the details and click ‘OK’.

- Step 13: Take note of the transaction number of your FD for future reference. Your online SBI FD has been successfully opened.

SBI Fixed Deposit Calculation

SBI FD interest rates are variable and are directly proportional to the deposit tenure. The longer the lock-in period, the better the interest rates. SBI interest rates for amounts below Rs. 2 crores (effective since December 27, 2023) range between 3.50% to 6.50% for normal FDs and 4.00% to 7.50% for senior citizen FDs.

To ensure higher rates of interest for your deposit and determine the maturity amount, calculating the SBI FD is inevitable. You can do this both manually as well as by using online FD calculators available online. However, for both forms of calculation, the below formula is applied.

A = P(1 + r/n) ^ n*t

Here, the maturity amount (A) is calculated by considering the invested amount (P), the annual interest rate (r), the number of times the interest is compounded (n), and the investment tenure (t).

Checklist and Requirements for Opening SBI FD Online

An SBI savings account and a mobile banking account are all you need to open SBI FD online. Apart from a safe banking experience and quick process, this is another convenience that makes SBI online banking flawless and easy.

8 Benefits of Opening SBI Fixed Deposit Online

Here are 8 best advantages of opening a fixed deposit in SBI online.

- Create Your FD Account Anytime – Since the process is online, you don’t have to worry about taking a day off from work and visiting the bank for it. You can open an FD from the convenience of your home, or for that matter, anytime, anywhere, given you have an internet connection. Some banks have a mobile, some have a website, others have both to ensure customer’s comfort.

- Super Quick – When opening an SBI FD online, all you need to do is log into your online banking account and enter the required information. Upon maturity, the FD amount is directly transferred to your linked savings account. And, if you choose the automatic-renew option while opening the FD online, the account will be automatically renewed at the end of the tenure.

- No Paperwork – The best part about online banking is that it’s a paper-free process. You don’t require filling out long forms since all the KYC information is already available with the bank. They have verified these details, so you don’t have to go through the hassle of paperwork.

- Extra Facilities – The State Bank of India offers additional benefits and discounts to those opening a term deposit online. These perks may be in the form of vouchers, coupons, or extra points that you can redeem later. A lot of banks also give insurance-based offers to their customers. Other than that, opening an FD online offers advantages like overdraft and nomination facilities.

- Easy Renewal – It takes only a click to renew your FD online. It is an exceptional benefit as it reduces the need to fill out forms, something you would have to do if you chose the offline method.

- Claim it Online – A lot of people forget to claim their deposit upon maturity. By the time they realize it, the fixed deposit gets renewed again. But when you open an SBI FD online, you can avoid all this. You get instant notification on your registered email and mobile number once the FD matures. You can also view the deposit status every time you log in to your online banking account.

- Hassle-Free Premature Withdrawals – With SBI online banking, premature withdrawal is remarkably easy. Only a click of a button and the amount will be credited to your savings account instantly. The offline method, however, requires you to fill lengthy forms or write an application to the bank manager.

- Simple Payment Option – The online method directly debits the amount from your account, making it an easy payment option. With this, you no longer have to worry about carrying a large sum of money to the bank or even visiting the bank at all.

You May Also Read

Frequently Asked Questions (FAQs)

Have more questions and concerns on how to open fixed deposit in SBI online? We have answered some of the most commonly asked questions to clear all your doubts. Check them out below.

What is the difference between TDR and STDR?

TDR (Term Deposit) is a cumulative FD with tenures ranging between 7 days and 10 years. Under term deposit, the interest component is sent to your savings account linked to your FD at regular intervals on an annually, monthly, quarterly or half-yearly basis depending upon your choice.

STDR (Special Term Deposit) is a non-cumulative FD with tenures of 6 months to 10 years. Under STDR, the interest is paid along with the principal amount upon maturity. An STDR helps enjoy the benefits of compounding and proves to be a better investment mention as they provide higher returns.

Is there any tenure range for online Fixed Deposits in SBI?

Yes. Like every other bank, SBI also offers a tenure range for online FDs, the minimum tenure for Term Deposits is seven days, and for Special Term Deposits, it is 180 days.

What is the minimum amount needed to create an online FD?

In the case of SBI, you can open an FD with a minimal amount of ₹1,000. There is no limit on the maximum principal amount as of now.

Can a new customer open an online FD with SBI?

No. You need to be an SBI account holder to open a fixed deposit online. So, if you are new, make sure you open a savings account with the bank first. Once you complete the procedure and finally have an account, you can open an FD through online banking.

Can I choose the tenure range for my fixed deposit with SBI?

Yes, you have the option to choose your preferred tenure range and deposit type (TDR or STDR).

Does SBI charge a penalty on premature withdrawal?

Yes, if you choose to prematurely withdraw your FD amount with the State Bank of India, you will have to pay a penalty amount. The penalty charge depends on your principal amount. An FD worth Rs. 5 lakhs is charged a penalty of 0.50%. If it is more than Rs. 5 lakhs, the penalty is 1%.