In the recent times, there is continuous rise in investment in alternative real estate asset classes along with conventional ones such as residential, office & retail space. These new asset classes are catching the fancies of the international investor fraternity, who are investing into such assets, not just as a part of their value maximization strategy but also to expand their portfolio & reduce risk.

One such asset classes, that has seen a windfall of Investment has been Student Accommodation or Purpose Built Student Accommodation (PBSA), as it is commonly called. These are dedicated space catering to the accommodation need of the international & domestic student class. These spaces are generally built in the vicinity of International universities & college campuses & could involve individual suites & customized students pods. The latter has individual rooms with common kitchen & living space.

The exponential growth in the PBSA is emanating not just from the individual HNIs but also from various institutional investors, that are actively scouting for such lucrative investment opportunities.

Factors Driving the PBSA Investment

There are multiple factors, that have been driving the investment flow in the PBSA asset class. One significant factor is high demand for such accommodation driven by rise in student populace. This has led to significant rise in the demand for quality student accommodation, coming from both domestic as well as international students.

However, in comparison to high demand, there is dearth of good quality PBSA resources. This further adds to the demand dynamics of the PBSA.

Another benefit of the PBSA is the high occupancy that generally such asset classes enjoy. On an average due to high demand, PBSA has an average occupancy, up to 99% in major educational hubs of the world. The higher occupancy adds to financial attractiveness in the form of higher rental yields & mitigation of any possible risk.

Another unique feature of PBSA is its non-reliance on the global economic dynamics. No matter, whether there is an economic meltdown or a bullish run, education as a sector generally remains strong without witnessing any change in demand. This makes PBSA a great investment opportunity, not to be missed out.

Major PBSA Destinations

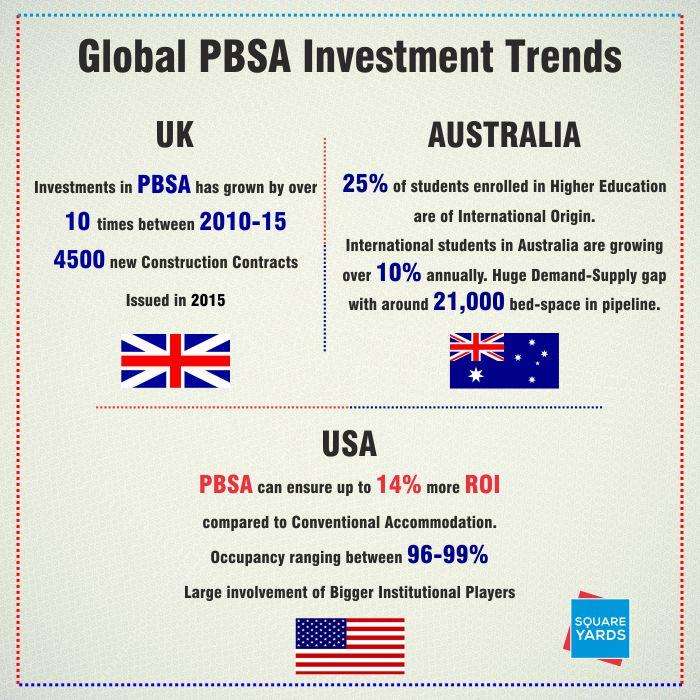

Amongst the major PBSA destinations, that account for a market of around USD 260 billion globally, UK leads the chart with a total investment of USD 6.62 billion in 2015, over 100% increase when compared a year before. International students bring in a revenue of over USD 14 billion in UK & the subsequent expansion of the sector in the years to come will make PBSA an attractive class to look into.

Research conducted shows that, investment in the PBSA have multiplied by over 10 times in the last 5 years. With surge in intake in universities, the market in UK is still very under supplied in terms of PBSA. In 2015, work has commenced on over 4500 PBSA projects, all over UK.

USA &Australia are other major markets. Latter, wherein educational export is presently third largest item in the national economy with an estimated value of USD 13.5 billion in exports, PBSA as an asset class is emerging very fast on the investment landscape. However, compared to UK, Australia is considered an immature market with the present bed space estimated at slightly over 80,000. 21,000 new units are anticipated to enter into the country in near future.

The present higher education students in Australia is estimated at around a million, that comprises of around 25% international students. In times to come, both domestic & international students are anticipated to multiply at an aggressive pace that will fuel the PBSA sector.

There are not just HNIs who are investing into the PBSA, but various institutional investors are also investing into the PBSA sector. In fact, in comparison to the investment appetite pertaining to the PBSA sector, there are not enough quality PBSA assets available in the market to feed the demand.

In Q1 2016, Mappletree Investment, arm of Singapore based Temasek, made an investment of USD 541 million in a portfolio of student bed spaces in UK. In 2015, CPPIB, Goldman Sachs & Greystar has also made big ticket size deals in UK PBSA sector. Goldman Sachs has also forged joint venture to invest into the burgeoning Australian PBSA sector.

So far considered to be one of the peripheral investment option for institutional investors, PBSA is now high up on the agenda of various institutional investors across the globe.

Such investment options are not completely devoid of pitfalls as it is believed that PBSA, especially student pods might have some difficulty in resale when compared to conventional homes. Compared to conventional homes, the management & maintenance of PBSA generally requires more expense.

However, given its relatively risk free nature & higher yields, PBSA are going to be one of the most sought after investment engine in the times to come. The market has still not matured in most of the major markets, however with exponential increase in investment, market dynamics are expected to change in the times to come.