Confused if you need to pay advance tax or not?

Advance tax is a tax you pay according to the amount you earn apart from your salary. It was introduced by former Finance Minister, Mr. Arun Jaitley, after demonetization came into effect in 2016.

In this article, let’s dive deep to know more about advance tax, its eligibility, calculation and application process, advantages, etc.

What is Advance Tax Payment?

The tax you pay in advance for earning income from different sources (rent, capital gains, shares, FD, lottery) apart from your salary is known as advance tax. You can pay the advance income tax either online or through some banks.

Some of the banks you can pay your advance tax through are: SBI, HDFC, ICICI, Reserve Bank of India, Syndicate Bank, and Allahabad Bank, among others.

What is the Eligibility Criteria to Pay Advance Tax?

You have to be eligible for the following points to pay advance tax:

- Your tax liability is above Rs. 10,000.

- Are self-employed or a salaried individual.

- Earn through winning lotteries.

- Receive rent received from any house property.

- Have earnings from fixed deposit interests.

- Have earnings from shares or capital gains.

Monthly Installment to Pay Advance Tax Payment: FY 2021-22

Here is the advance tax schedule for salaried and self-employed individuals under section 44AD.

- 15th March of 2022 is the last date to submit advance tax. You have to pay 100% tax liability.

- As a taxpayer under Section 44AD, you have to pay 15% tax liability on or before 15th June of every year.

Check the table below to better understand the dates and taxable amounts.

| Installment Date | Payable Advance Tax Amount |

| On or prior to 15th September | 45% |

| On or prior to 15th December | 75% |

| On or prior to 15th March | 100% |

Note: If there is a holiday or Sunday on the last submission day of tax, then you can pay it the next working day.

What is Advance Tax Challan 280?

Challan 280 is a form required to pay taxes online. You can pay advance tax, assessment tax, self-assessment tax, extra charges, etc., with Challan 280. To pay online from the website, you have to select the challan and fill the form.

However, you can pay the taxes offline as well. To do so, download the Challan 280 form and submit it to the bank along with the payable amount.

What are the Required Steps to Pay Advance Tax Online?

Step 1: Visit the official website to pay advance tax online.

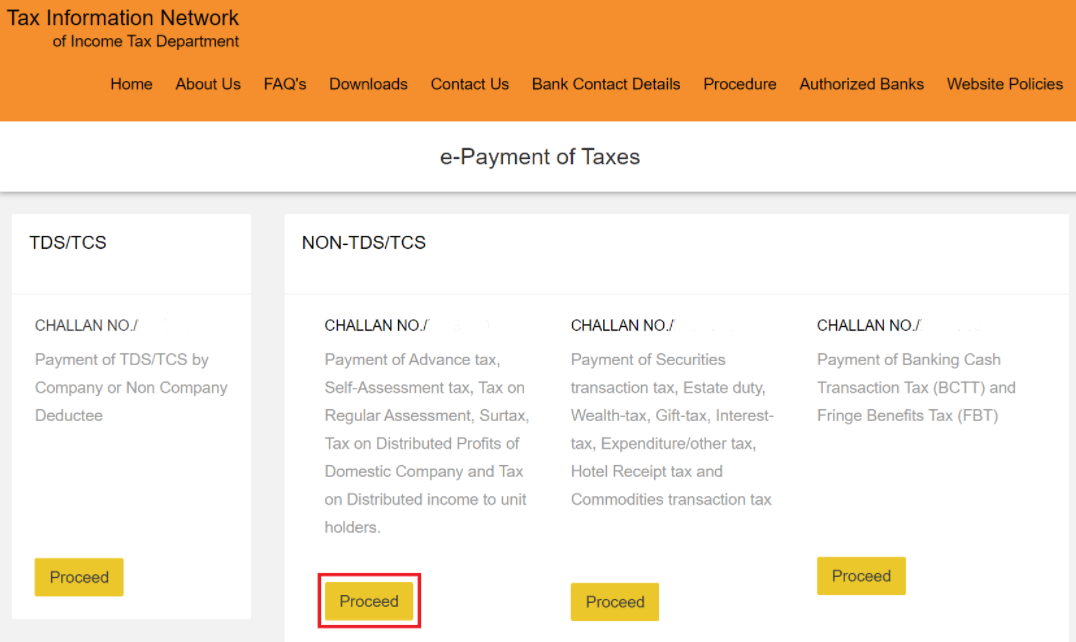

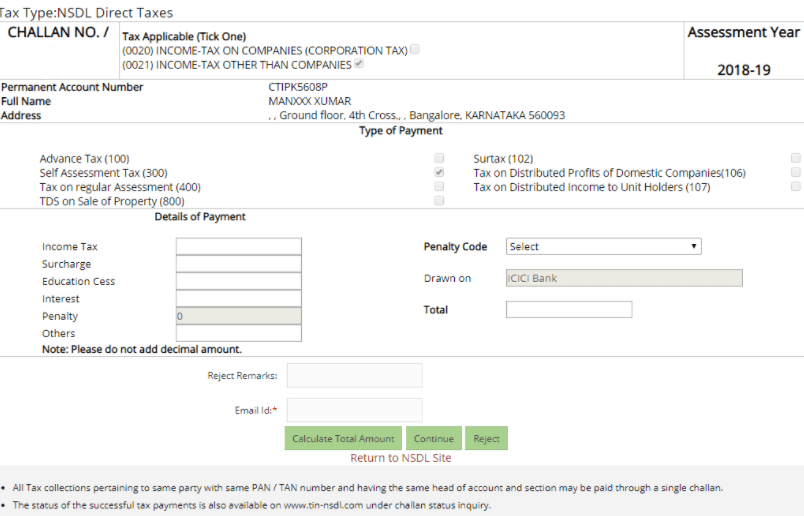

Step 2: Select Challan 280 from the options as shown in the image below.

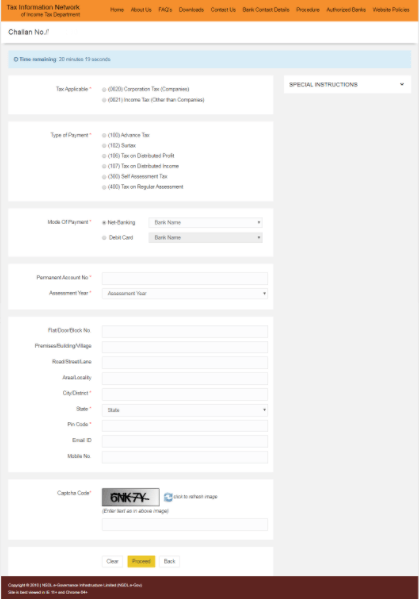

Step 3: Select the Applicable (0021) Income Tax (No Companies) and follow the below instructions:

- Select Self Assessment Tax as a kind of payment.

- Choose the mode of payment and your bank.

- Enter your Pan number.

- Select the Assessment Year (Re-confirm your choice).

- Fill in the contact details.

- Enter the captcha code and hit on Proceed.

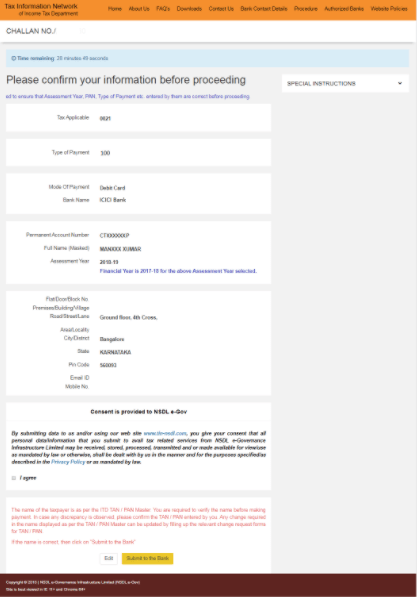

Step 4: Once you enter all the details, re-check all the information and press Submit to the Bank option.

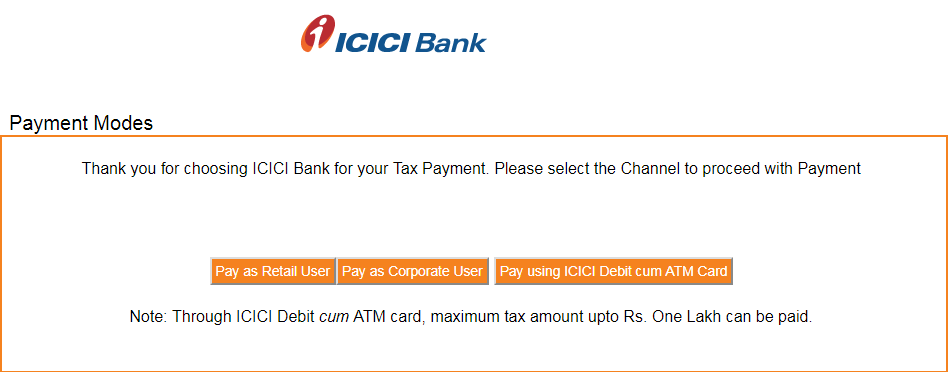

Step 5: Use your credentials to make your net-banking payment.

Step 6: Enter the entire tax amount and press Submit.

Step 7: After a few seconds, you will receive the challan along with bank details such as the BSR code, Challan number and date, and amount paid.

Once received, you will automatically know that you have paid your advance tax online successfully. However, you can download the receipt for any future reference.

How to Calculate Advance Tax Payment?

Follow the steps below to calculate your payable advance tax.

Step 1: Calculate how much you are earning in that particular financial year and consider the following types of income.

- Interest earned from FDs, savings accounts, etc.

- Earnings from Capital Gains.

- Your annual professional income.

- Income received through rent.

- Income from minors account (if added as a tax-paying person).

- Other sources of earning.

Step 2: Now, in the above-estimated amount, add your salary. It is how you will calculate the gross taxable income. Although the advance tax does not apply to your salary, the total amount will change your tax liability.

Step 3: To determine the payable amount, add the latest income tax slab relevant to you.

Step 4: According to the TDS slab, the deduction will take place or might have already happened.

Note: If the tax liability after deduction exceeds Rs.10,000, you will have to pay advance tax.

Advance Tax Calculation with an Example

Here is a general example of how to calculate advance tax.

Arushi is a freelance writer. And, for the financial year 2019-2020, she calculates her annual income at Rs. 20,00,000. Her total annual expenses are Rs. 12,00,000.

Further, she deposited Rs. 40,000 in her Public Provident Fund (PPF). She also pays Rs. 25,000 for her LIC Premium and Rs. 12,000 for medical insurance premium. Therefore, the professional receipts of Arushi are constrained to TDS.

Moreover, Arushi calculates Rs. 30,000 as TDS according to her professional receipts for the financial year 2019 to 2020. Apart from the professional slips, she calculates the interest of Rs. 10,000 on FD held by her. So, here is the advance tax liability of Arushi:

| INCOME ESTIMATION FOR ADVANCE TAX | Amount (Rupees) | Amount (Rupees) |

| Professional Income: | ||

| Gross receipts | 20,00,000 | |

| Less: Expenses | 12,00,000 | 8,00,000 |

| Income From Other Sources: | ||

| Interest from fixed deposit | 10,000 | |

| GROSS TOTAL INCOME | 8,10,000 | |

| Less: Deduction under section 80C | ||

| Contribution to PPF | 30,000 | |

| LIC premium | 20,000 | |

| 65,000 | ||

| Deduction under section 80D | 12,000 | 77,000 |

| Total Income: | 7,33,000 | |

| TAX PAYABLE | 59,100 | |

| Add: Education cess @ 4% | 2,364 | |

| 61,464 | ||

| Less: TDS | 30,000 | |

| Payable Advance Tax | 31,464 |

Monthly Slots Available to Pay Advance Tax

After the start of the financial year, you can pay your advance tax in the following time periods:

- Start of Financial Year to 15th June.

- Between 16th June and 15th Sept.

- Between 16th Sept and 15th Dec.

- Between 16th Dec and 15th March.

What are Some Advance Tax Late Payments and Interest?

If the advance tax paid by you is less than 90% of the entire assessed tax, you will have to pay an interest of 1% every month according to Section 234B of the Income Tax Act, 1961.

However, the tax estimate as one percent interest on the amount defaulted for a month is paid entirely. If you do not pay the penalty, the same will be applicable to your taxes as well.

Further, under Section 234C of the Income Tax Act, if somehow you are unable to pay the advance tax installment on time, you still be charged as per the interest rate of 1%.

Who is Eligible for Advance Tax Payment Exemptions?

Advance tax does not apply to all Indian citizens. Here are the ones who are exempted from advance tax payment.

- Any senior citizen above 60 years of age.

- Indian citizens who are not earning as per the TDS slab. However, if they have income from other sources, like interest, capital gains, rent, or any other non-salary income, then they might have to pay advance taxes.

- If the TDS is more than the annual payable tax, you will not have to pay any advance tax.

Benefits of Paying Advance Tax

The perks of paying the taxes in advance are as follows:

- Timely payments of advance tax reduce your burden of last-moment hassle.

- Taxes paid in advance help the tax-paying person to be free from any pressure for the entire financial year.

- Advance tax helps people avoid becoming defaulters.

- Advance tax helps the Indian government in raising funds. These funds are further used to aid the needy in India.

- It increases the speed of tax collection.

Refund in Advance Tax Payment

To file your return in advance of tax, you have to fill Form 16. It is one of the easiest ways to claim a refund. Declare all your investments and earnings in Form 16 and mention your life insurances, house rent you receive, FD, tuition fees, mutual funds, NSC, etc. Make sure that you attest all the necessary proofs.

However, if you have failed to file Form 16, you should fill Form 30. Form 30 helps you in avoiding all the extra taxes you have been paying. Form 30 will look like a request case from your side. It will be resolved first. At the end of the financial year, money will be transferred to your bank account.

Frequently Asked Questions (FAQ’s)

Does an NRI have to pay advance tax?

If an NRI is earning more than Rs.10,000, they have to pay advance tax.

What should I do if I forget to pay my 4th installment on 15th March?

There is nothing to worry about because you can still pay the fourth installment on 31st March.

What if someone accidentally pays more advance tax than the total tax liability?

The amount will be refunded back in the account if someone has paid more advance tax. However, if the advance amount is higher than 10% of total tax liability, then the interest of 6% annually is also payable to the income tax department.

Which mode of payment to use for making payment of advance tax?

You can use internet banking or use the challan process to make the advance tax payment.

Is any tax paid till 31st March considered as advance tax?

Yes, any tax that you pay till 31st March will be considered an Advance Tax payment.

Can I claim a deduction under 80C while preparing my advance tax?

Yes, you can consider all these deductions while calculating your income for the current year and figuring out your advance tax liability.

How can I check the status of the advance tax payment?

You have to visit the official website. Select your Challan Identification Number (CIN). You have to fill in all the details as asked. Now, you can see your advance tax payment status. Another way to check is to use your credentials to log in. Once you log in, go to the My Account option and select the Viewing option to check Form 26AS. Make sure to enter the financial year as well. Further, if you want, you can download the receipt.

How can I download the advance income tax payment receipt?

To download the advance income tax payment receipt, you have to visit the advance tax payment challan. Enter your Challan Identification Number and fill in the other required details. Select the View option. Now, the receipt is visible on your screen. However, you can either download it or take a printout as per your choice.

I am a senior citizen with a pension and interest income. Do I have to pay advance tax?

All the residential senior citizens who are not earning anything from the business income or any job are not eligible to pay advance tax.

What documents or information will I need to generate Challan 280?

To generate Challan 280 form, all you need is your PAN card details. Additionally, when generating Challan 280 online, make sure to select the right financial year and payment mode.