Whenever someone applies for a new PAN card, they must enter the AO code. AO code is an identity that defines your tax jurisdiction and the category of taxpayers you come under.

AO code for PAN cards helps determine the jurisdiction directly connected to the taxation. Further, these codes tell the authorities what tax laws will apply to that individual.

For example, if a person is a resident of India, they have to pay taxes as per the rules, but the tax rules might differ if there is a company.

These differences can occur between the citizens as well; thus, the AO code for citizens serving in the Air Force or Indian Military is different.

Thus, the right AO is important to tax the company and individuals taxed accordingly.

Table of contents

How to Find Your AO Code for PAN Online?

You can easily find your AO codes on the government authorised PAN website. Here are the steps you must follow:-

Step 1: First, you must identify whether you fall under the individual salaried category or non-salaried individual.

Step 2: You have to select now your resident or office address depending upon the criteria you selected above.

Step 3: The AO Code lists are available on – Protean eGov Technologies Limited website and the UTIITSL website.

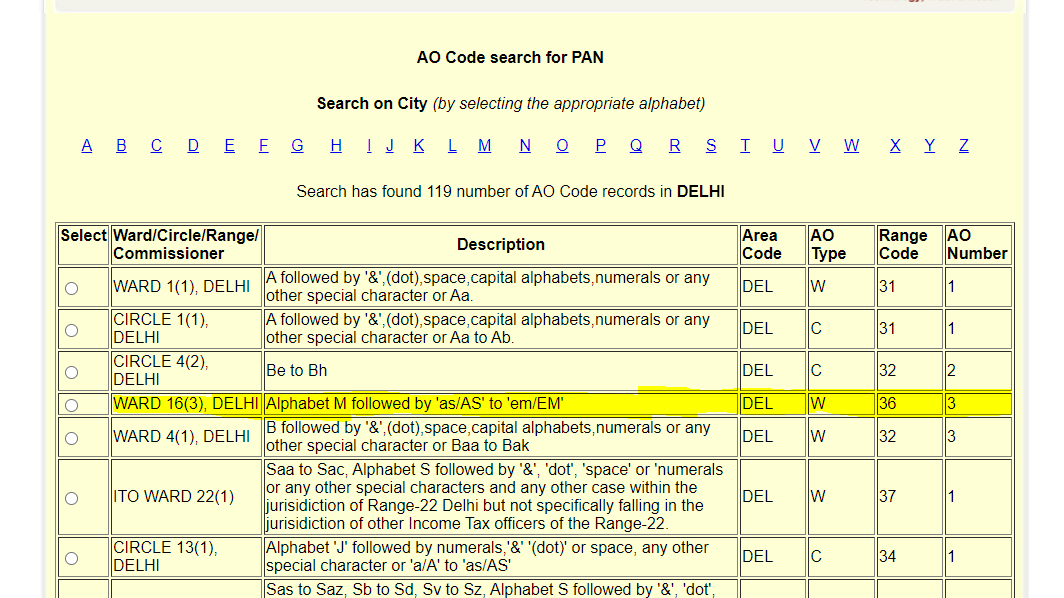

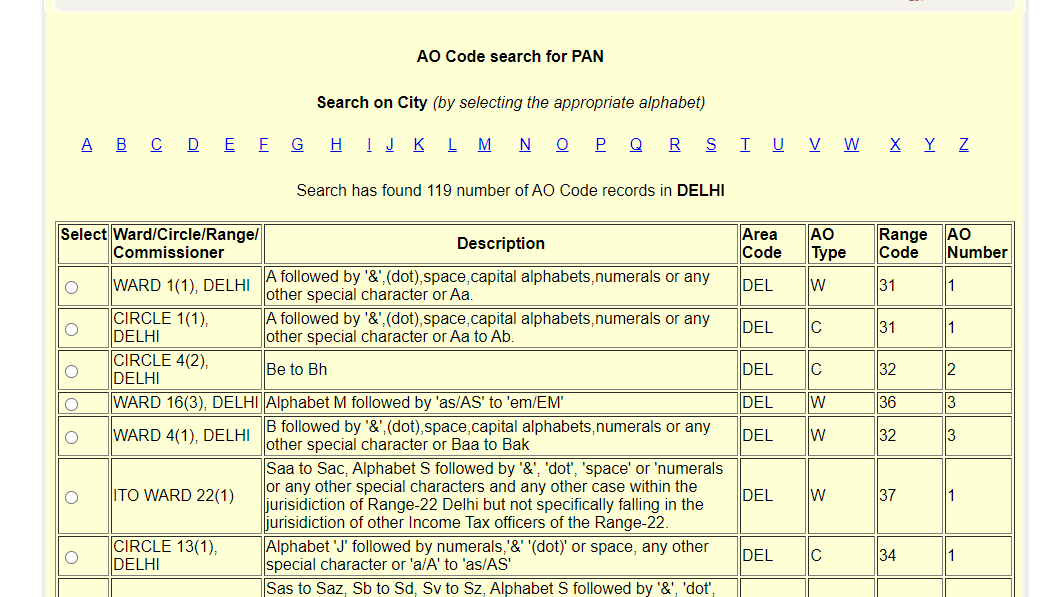

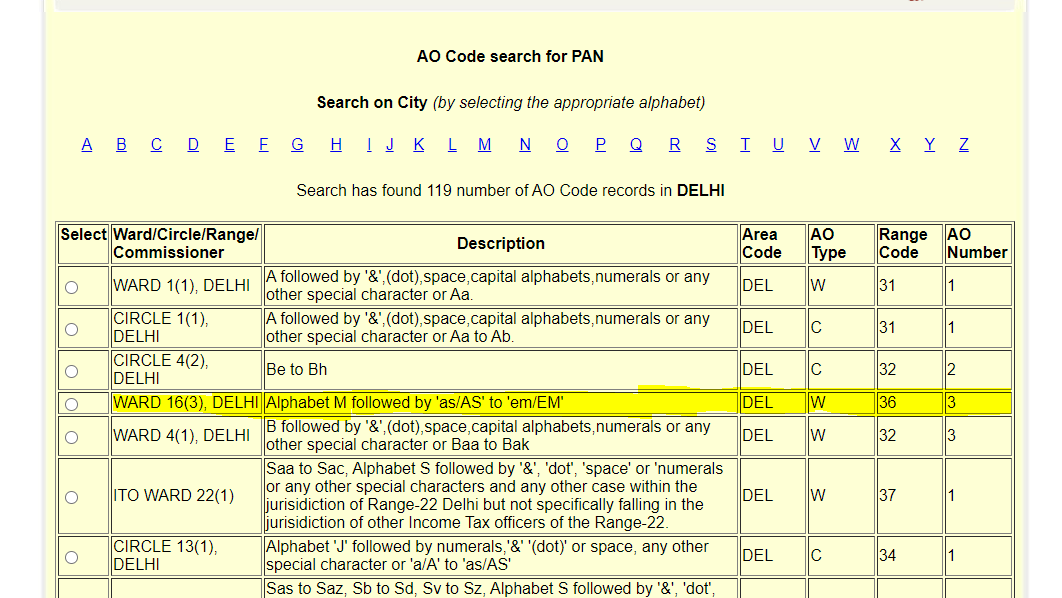

Step 4: Further, you have to search your city by its initial alphabet on the website. Now, select the city and read the description. Finally, you can select the area where your office or company falls.

Note: For future reference, you can note down Area Code, AO Type, Range Type and the AO Number and you shall have your AO Code.

For example, in the above image, the area highlighted displays the AO Code will be DEL W 36 3.

Know Your PAN Card AO Codes and Jurisdictional AO for Top Cities

Your PAN card AO codes for top cities are given below. Open the link in a new tab and search for your area code, range code, AO code.

For Example, if you click to open the link in front of the AO Code for Delhi, you will see the following image.

You can scroll down and see your AO code for your PAN card easily. We have highlighted the area just for your better understanding.

| AO Codes for Top Cities | Links to Government Website |

| AO Code for Delhi | https://tin.tin.nsdl.com/pan/servlet/AOSearch?city=DELHI |

| AO Code for Chennai | https://tin.tin.nsdl.com/pan/servlet/AOSearch?city=CHENNAI |

| AO Code for Bangalore | https://tin.tin.nsdl.com/pan/servlet/AOSearch?city=BANGALORE |

| AO Code for Hyderabad | https://tin.tin.nsdl.com/pan/servlet/AOSearch?city=HYDERABAD |

| AO Code for Mumbai | https://tin.tin.nsdl.com/pan/servlet/AOSearch?city=MUMBAI |

| AO Code for Kolkata | https://tin.tin.nsdl.com/pan/servlet/AOSearch?city=KOLKATA |

| AO Code for PATNA | https://tin.tin.nsdl.com/pan/servlet/AOSearch?city=PATNA |

| AO Code for Gurgaon | https://tin.tin.nsdl.com/pan/servlet/AOSearch?city=GURGAON |

| AO Code for Ahmedabad | https://tin.tin.nsdl.com/pan/servlet/AOSearch?city=AHMEDABAD |

How to Know your Jurisdictional AO Officer

Here are the steps you can follow to know your Jurisdictional AO officer:-

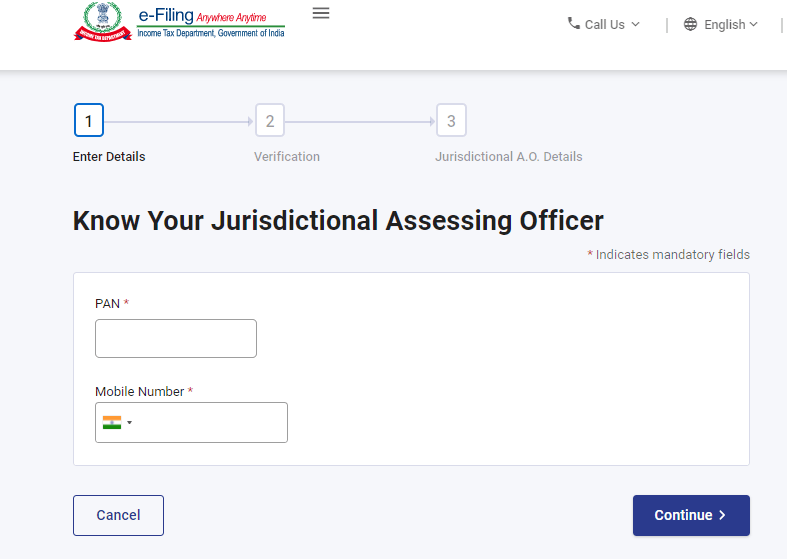

Step 1: You have to visit the official website of the Income Tax Department PAN portal – www_incometax_gov_in/iec/foportal.

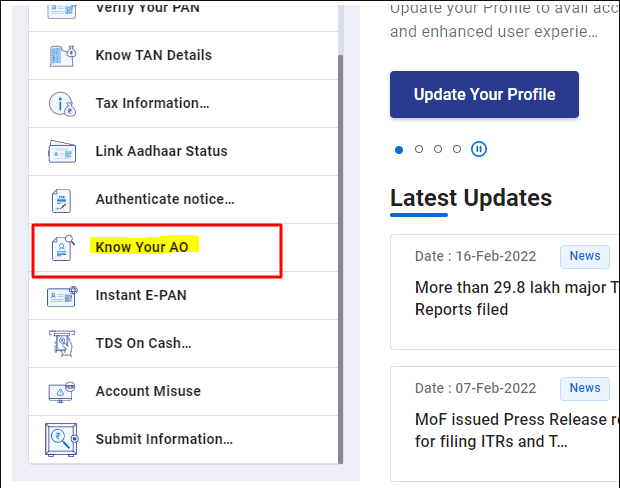

Step 2: Select the option Know your AO. You will further be directed to a new page.

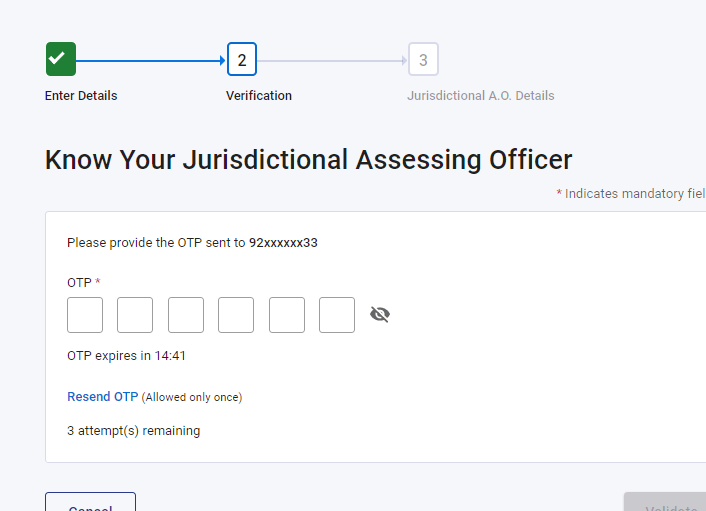

Step 3: You have to enter your PAN number and registered mobile number. You will receive an OTP which you have to enter and submit to know AO under whose jurisdiction you fall.

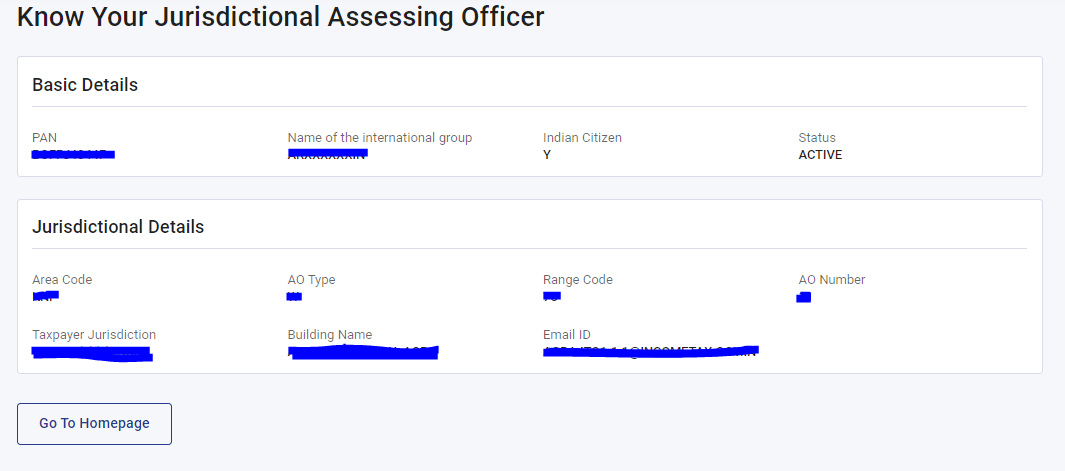

Your Jurisdictional AO details will display on the screen as shown below:-

How is AO Code Determined?

AO code is determined by two prominent factors: your address or the category of taxpayer you fall in. Based on these criteria, AO codes are divided into two domains: Individual and Non-individuals.

- Individual: As an individual taxpayer, you are receiving your income from tax or business earnings, your AO code will be dependent on the registered area and address you are residing on. However, if you are earning aside from your salary, your AO code will be dependent on your home address.

- Non-individuals: If you belong to the Hindu Undivided Family, any organisation, partnership firm, LLP, association, or body of individuals, then your office address will be your AO code.

For Army Personnel, the AO code will be:-

| Description | ITO WARD 4(3), GHQ, PNE |

| Area Code | PNE |

| AO Type | W |

| Range Code | 55 |

| AO No. | 3 |

For Air Force Personnel, the AO code will be:–

| Description | ITO WARD 42(2) |

| Area Code | DEL |

| AO Type | W |

| Range Code | 72 |

| AO No. | 2 |

Elements of an AO Code

AO code for PAN has four primary elements.

- Area Code

- AO Type

- Range Code

- AO Number

Area Code: The region where the Assessing Officer has his jurisdiction.

AO Type: The type of Assessing Officer assigned to every individual. The AO type is Ward, Circle, Range or Commissioner.

Range Code: It is the code of the range where the Assessing Officer operates functionally.

AO Number: It is a specific number assigned to the Assessing Officer of your area.

AO Code Types

AO code is of four types. These types depend upon the area type in which you’re residing. Also, the tax implication for the AO code differs from each other. Therefore, AOs are given the task of ITR assessment as per the applicant. The AO code types are as follows:

- International Taxation – Any individual applying for a PAN card (a foreigner, company outside India) will fall in this category.

- Non-International Taxation – This AO code is applicable to all the entities registered in India except Mumbai.

- Non-International Taxation – This is a type of AO Code for Mumbai only. Therefore, all the individuals and companies living or registered in Mumbai fall under this type of AO code.

- Defence Personnel – This AO code for PAN applies to all the members of the Indian Army or the Indian AirForce.

How to Migrate PAN Card AO Code?

Migrating your PAN card AO code involves updating your PAN card with the jurisdiction of your new Income Tax Officer (ITO). Here is how you can navigate the process:

Understanding AO Code Migration

- Your PAN card is associated with an AO code based on your initial tax jurisdiction.

- If you relocate to a new city or state, your AO code might need to be updated to reflect your current tax jurisdiction.

- This ensures proper administration of your taxes to avoid any future discrepancies.

Initiating the Migration Process

1. Identifying your new AO jurisdiction: Determine the tax jurisdiction of your new location. This information can be obtained from the Income Tax Department website or by contacting your local tax office.

2. Documents Required:

- Valid PAN card

- Proof of new address (Aadhaar card, voter ID, utility bill)

- Proof of income source change (salary slip, business registration, etc.)

3. Choose your preferred method: You can migrate your AO code online through the e-filing portal of the Income Tax Department or offline by submitting a physical form (Form 49A)

4. Online Method:

- Visit the e-filing portal of the Income Tax Department (https://www.incometax.gov.in/iec/foportal/) and log in using your PAN and password.

- Navigate to the “My Account” section and select “Update PAN Card Details.”

- Provide your new address and choose the “Change of AO” option.

- Select your new AO jurisdiction from the drop-down menu.

- Submit the form electronically with a digital signature.

5. Offline Method:

- Obtain Form 49A from the Income Tax Department website or your local tax office.

- Fill out the form with your PAN details, old and new addresses, and reason for migration.

- Submit the completed form along with the required documents (proof of address and new jurisdiction) to your nearest PAN Service Centre or Income Tax office.

Frequently Asked Questions (FAQs)

A combination of your Area code, AO type, Range code and AO number is known as AO code. The PAN card applicants have to provide their AO details while filing the form. You can have the AO code from the nearest Income Tax office. The MUMBAI AO code is- MUM – W – 222 – 91. AO code is the Assessing Officer’s code. The jurisdiction of the applicant’s ITR will fall under the assigned Assessing Officer. This code must be mentioned in the PAN card application form. You can contact the e-filing and Centralised Processing Centre on the following toll-free numbers.

AO Type C means you fall under a Circle. Also, AO Type W means Ward. If your income is equal to or more than Rs. 10 lakhs, you will fall under Circle. No, there is no AO code for students. Well, for an unemployed person, there is no specific AO code. However, the applicant can choose a salary of a certain amount. To find the area code, you must contact the Income Tax department. They will guide you to visit the Protean eGov Technologies Limited portal. There you will find the details of your area. No, none can change their AO code until they have changed their residential address. What is the AO code in a PAN card?

What is the AO Code of Mumbai?

How do I contact AO for a refund?

What is AO Type C?

Is there any AO Code for students?

How to find an AO code for an unemployed person?

How to find an AO code for PAN?

Can an individual change the AO code anytime?