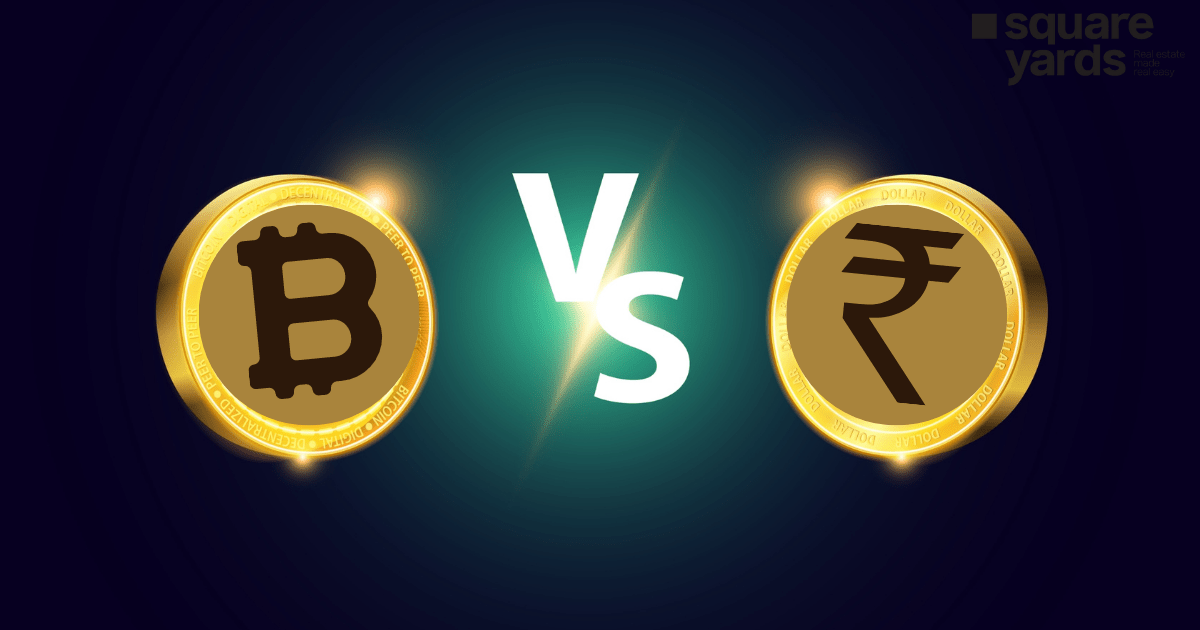

It’s time to bid goodbye to fraudulent activities and identity theft to better access and a lesser fee. The world is now seeing a steady expansion in the growth of cryptocurrency. This creates a sense of scepticism among banks and other financial institutions to utilise these digital assets. The banking institutions believe that the risks related to crypto have higher chances of contaminating their potential advantages.

On the other hand, OCC (Office of the Comptroller of the Currency) believes differently that crypto potentially drives banks to a whole new phase of revolution and competence.

Table of contents

What are the Benefits of Cryptocurrency in India?

Crypto Contracts

Cryptocurrencies have a crypto contract that runs in the network of their blockchains. This network’s structure helps in giving instructions to the system that involve minimum human interactions. This, in turn, helps them rectify the fraudulent activities & any kind of corruption involved. This platform also helps encourage the investors to make positive steps towards building & ensuring good growth of the coins.

Ease of Access

The system of cryptocurrency, unlike banks, has an automatic system involved. This system requires minimum human interactions and is always easily available, including weekdays and weekends. Thus, the seamless incorporation into their financial system makes them a better corporation system.

Modification

Cryptocurrencies have many variant features to offer, unlike the uniform services that are provided by the banking system. The diversity provided by cryptocurrency gives it an upper hand over traditional banking services as it can grow in numerous ways.

Quick Payments

The cryptocurrency system carries a rapid speed of transactions that is difficult for an individual to find in their regular banking system, as the banking system has a lot of protocols and guidelines to follow. Therefore, the cryptocurrency system offers quick transactions in a single day compared to the banking system. This function of cryptocurrency is analysed to provide better and quicker economic opportunities.

Spread – Out Nature

The Cryptocurrency system is entirely free from any control of the third party. Such a method of decentralisation allows them to be completely unbiased. This system is also known to be more reliable & secured as it is impossible for anyone to trespass the system. Also, the numbers mentioned in the transactions are made with anonymous IDs.

Inclusive Finance

The system of cryptocurrency carries minimum entry barriers with them. This is why the system is easily accessible to all individuals, irrespective of their position. This advantage of cryptocurrency is quite encouraging as it helps improve the economy completely for all the individuals who get an equal opportunity.

Proper Security

The most recurring issue that surrounds any type of financial system is security. Therefore, cryptocurrency blockchain technology is concerned with being free from such security threats as hacking.

As the system automatically leads all the transactions with minimum human interactions. Therefore, it also has fewer chances to attract any kind of false activities. So, if the system decides to bring in more such proper security measures, it can easily lead and remain a better option for making all the financial transactions.

Drawbacks of Cryptocurrency

Regulations

If you plan to invest in a cryptocurrency system, there is always risk involved. Until and unless the federal government adopts the technology, the risk always tends to be high. The other concern attached to this system is its logistical nature. This includes the changes made in the protocols, which is important for tech to improve. But sometimes, the process of changing may take longer than expected, and therefore, it becomes a difficulty in the flow of the transactions.

Does not Ensure Legal Security

Most people do not believe in investing in cryptocurrency. The reason behind this thought is that it does not have any kind of underlying value attached to itself. For instance, in the back days, gold & silver were a high investment as they were considered precious metals & did turn out to be a great currency in every part. Whereas flat money is considered to deliver its value from government legalisation. But a cryptocurrency is said not to have any such legal authorisation attached to itself, so it is not accepted as a currency in all parts of the country.

Stability

It is usual for a currency to fluctuate. This is because of the increase or decrease in amount compared to the economic assets. The US loses 2% of the value due to inflation every year. But when it comes to cryptocurrencies, the instability faced here is on another level. The value of crypto can even be a loss as low as 30% that an individual can witness yearly. This instability can tend to trigger the individuals because of different events.

Unpredictable

Cryptocurrency is unpredictable and thus does not follow a fixed pattern. Like stocks, it is directly related to GDP growth, whereas a cryptocurrency, on the other hand, is unpredictable and random. Therefore, it is difficult to establish any relationship, so it becomes stressful for investors to indulge in cryptocurrency to track their records. But, if you still wish to invest, it is recommended that investors invest in small percentages.

Cash Flow

The only way an individual can make money in the cryptocurrency system is by finding a buyer willing to buy it at a higher price than others. This is why the typical investors are unwilling to invest in the same. As per the investors, a good investment is when there is a continuous cash flow without selling anything. For example, rent is generated monthly from your tenant or shares that come in dividends. But in the case of cryptocurrency, the user is supposed to convince others to buy your currency at a much higher price.

Prone to Hoarding

The real job of a currency is to always stay in regular circulation. A work of a currency is to enable the transaction of goods and services. But as far as cryptocurrencies are concerned, they are only the mode of exchange that does not back any value. Although, many users hoard the currencies believing that the currency’s value will eventually increase soon. Also, if a user believes that the currency they currently hold will make them profit in about four years, the user tends to keep the currency with themselves and wait for the price to increase. This is why many investors do not consider cryptocurrency as the currency that can be used in the future.

Risks of Banking

Security Concerns

We often hear that people lose large sums of money due to fraudulent activities performed by skilled technicians, which includes hacking mobile banking applications. Such systems are also found vulnerable to money speculation. Such events have a very high chance of causing a loss of money.

Excess Fee & Lengthy Transactions

To perform international transactions, individuals have to face a prolonged period due to the time-taking protocols of banks, especially for larger amounts of money. Also, banks are infamous for charging extra transaction fees & taxes, which is a major drawback for the masses.

Convenience

Another major issue faced by people related to banks is accessibility. A significant portion of banks remains shut during weekends, which leads to people not completing mandatory transactions on holidays and weekends. The physical appearance is a must, and it gets too long for a person to process transactions.

Biasness

As the bank completely depends upon account numbers and names for rendering their services and transactions, chances are open for biasness. In a way, it can be said that in case of a conflict with bank officials, the manager might intentionally cause obstructions in rendering the financial services to the individual.

Advantages of Banking System

Safe Storage

The bank is the perfect system for individuals to store their wealth. By doing this, your money gets stored in a safe place and keeps you away from any kind of theft or danger.

Affordable Loan Options

Bank allows you to secure affordable loan amounts basis on your credit score. The procedure takes less time in case you already have a bank account.

Helps in Taking the economy forward

Another advantage of the banking system is that they help take the economy forward. In most cases, banks act as a lender, and they provide loans not only to the users of their banks but also to the individuals working in the agriculture sector or persons running businesses on a small scale. On the other hand, the government expects the banks to offer such loan opportunities to these individuals to increase job opportunities. Thus, helping in making the overall economy rise.

Provides Transparency

The banking system is the most authentic source as far as transparency is concerned. This is because banks allow you to keep track of all your transactions. It also helps keep users informed about their cash flow while maintaining the transaction history.

Easy Payment of Expenses

Another great feature of the baking system is its ease of paying off expenses. Banks allow you to make a direct setting in your bank accounts for specific expenses, including water bills, electricity bills, payment of EMI’s and loans. This feature helps the lender deduct the amount from your account on the day of the payment and also helps in saving the users time and effort.

Source of Identity

Having a bank account is how an individual gets an identity in the eyes of various other government institutions.

Comparing Banking System and Cryptocurrency

| Basis | Banking System | Cryptocurrency |

| Mode of Exchange | Physical Mode of Exchange | Digital Mode of Exchange |

| Representation | By Bills and Coins | By one private & public protocol. |

| Supply | Can be supplied as per need by the government. | Each crypto has a maximum limit. |

| Authorization | It is issued by the government. | It is issued by computer. |

| Control | It is controlled & issued by the government and the banks. Therefore, this is centralised. | It is not controlled or issued by any government or bank. Therefore, practice is decentralisation |

| Value | Value is set by regulations & the market. | Value is set by the demand & supply. |

Conclusion

The Acting Comptroller of Currency, Brian P. Brooks, once stated, “Like other technology developments in the past, there was the potential for criminal activity”. He further went on to state, “There’s also an enormous potential for economic growth. So, we don’t want to throw out those advantages because there’s a chance for criminal activity. Instead, we want to give compliance guidance to help banks innovate.”

Therefore, banks and other financial institutions must stop thinking of crypto as their rival. Instead, banks have a supreme chance of playing an integral role for the crypto by providing the much-needed security and commitment where crypto lacks. With the support of banks, the unregulated network of crypto will surely fix the loopholes. With the adoption of crypto, the banking sector will have high chances to streamline its management and reach new heights.