“Cryptocurrency is such a powerful concept that it can almost overturn governments.”

___Charlie Lee

Observing the current scenario, many of us will agree with this thought of Charlie Lee– the Founder of Litecoin & MD of the Litecoin Foundation.

Crypto is all rage right now and people are going insane about it. Of course, for a reason.

Besides Tokyo Olympic 2020, if something created the most headlines and swept all limelight in 2021, it’s the cryptocurrency.

From the very beginning of this year, a huge surge and then, suddenly, the dip and again trying to holding up and maintaining its position, cryptocurrency has shown its various phases.

While it’s giving many people an investing goal, several are afraid to take the risk of investing in them. Undoubtedly, cryptos have been in controversy since their inception. But that never stopped people from investing in them.

In fact, today, it’s way more popular than it ever was. Different investors have different say about cryptocurrency. While some are in favor, others are totally trashing it. So, what’s your take on this? Do you support it or are you against it?

Wait a sec, before you say anything, you must understand the crypto meaning and the concept behind it, know the history, associated controversy, its pros, and cons, etc. so that you can make an acquainted decision.

Let us start with the definition of cryptocurrency.

What is Cryptocurrency?

A cryptocurrency is a virtual or digital currency based on a network spread out across a large number of computers. It’s secured by cryptography which almost makes it impossible to double-spend or counterfeit.

Typically, the word “cryptography” originates from the encryption tactics which are used to protect the network.

Various cryptos are decentralized networks based on blockchain technology. Now the question arises- What is Blockchain Technology?

It’s a distributed ledger administered by a diverse computer network. According to experts, blockchain and related tech are going to disrupt various industries, involving finance and law.

The most established characteristic of cryptocurrencies is that they aren’t usually allotted by any central authority, making them apparently resistant to government intervention or administration.

Hence, cryptos can’t be controlled by any central authorities or governments.

Since cryptocurrencies are used for various illegal activities, vulnerabilities of the infrastructure underlying them, and exchange rate volatility, they have faced big criticism from different countries across the world.

The Market Overview

Lately, cryptocurrency has gathered all the attention of investors worldwide due to its wild price swings and then a heavy downfall. However, the market has yet again got a hold on its pace.

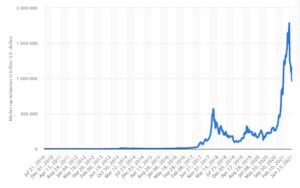

To know how the cryptocurrency market has performed in the last year, let’s have a look at the graph given below provided by Statista:

As we can see from the graph, the main movement in the market started in the year 2013. It was quite a little, but at least it began.

In the year 2018 in January, the market took an extremely high surge and reached a total market capitalization of $567 823.45.

Then again, at the end of 2018, the market took a dip and the market cap witnessed a low of $93 million approximately.

If we talk about the current market condition, the total market cap as of May 2021 stands at a whopping $1.7 trillion. However, at the time of writing this blog, the total market worth of crypto is $1.3 trillion, and over 10,000 listed cryptocurrencies in the world.

Among these, Bitcoin holds the largest share in terms of market capitalization which amounts to a total of $850.01 billion, followed by Ethereum $367.75 billion and Binance Coin amounting to $65.5 billion.

The market witnessed a drastic downfall between May 2021 and June 2021 due to various reasons. One of them is China’s ban on mining and the expansion of cryptocurrencies within the country.

History of Cryptocurrency- From Anonymity to Trailblazer

The history of cryptocurrency is quite exciting as well as mysterious at the same time. Let’s unbox it together from the very beginning:

1983: The Seed of eCash Sown

David Chaum, an American cryptographer formulated an anonymous cryptographic digital money in 1983, known as eCash.

1995: The Year of Germination

David implemented eCash through Digicash- an early cryptographic electronic payment mode- untraceable by the government, issuing bank, or any third party.

1996: The NSA Published a Paper on ‘How to Make a Mint”

A paper entitled “How to Make a Mint: the Cryptography of Anonymous Electronic Cash” was published by the NSA on an MIT mailing list.

1997: American Law Review (Vol.46, Issue 4)

The paper on How to Make a Mint was published in the Americal Law Review (Vol.46, Issue 4).

1998: The Concept of “B-money” Introduced

Wei Dai interjected the idea of cryptocurrency on the cypherpunks mailing list.

2008: bitcoin.org Registered

The domain name bitcoin.org was registered on August 8, 2018.

2009: The First Crypto Bitcoin was Created

Presumably, anonymous developer Satoshi Nakamoto created the first crypto named Bitcoin on 3rd January 2009.

2011: Namecoin & Litecoin was Developed

As an attempt at creating a decentralized DNS, Namecoin was formed in April 2011, and later in October, Litecoin was released, and then Peercoin.

2021: Bitcoin Accepted as Legal Tender for the First Time

El Salvador became the first nation to offer bitcoin legality and accepted it as a legal tender.

An Overview of the World’s Oldest Cryptocurrency

Bitcoin is the oldest cryptocurrency in the world which was first mined in January 2009. Bitcoin was created by an anonymous person or a group person known as Satoshi Nakamoto.

It’s a decentralized virtual currency that can be transferred from one user to another on the peer-to-peer network without the need for intermediaries. Transaction verification is done through network nodes via cryptography and stored in a public distributed ledger called a blockchain, as described earlier in this blog.

The domain name bitcoin.org was registered in 2008 and first mined in January 2009. The currency was started as open-source software.

It began trading at the price of $0.0008 to $0.08 per coin in July 2010 and today it is worth 44,461.10 USD. However, earlier in 2021, it reached an all-time high of $68,000 USD.

How many Cryptocurrencies are There in the World?

At the time of writing this blog, there are more than 7000 and about 10,000 cryptocurrencies in the world. Bitcoin is definitely the one with the highest market capitalization followed by Ethereum and Binance Coin.

Every year number of cryptocurrencies are born but one can’t predict how many of them will be born in the future. Why?

Because the mining of crypto requires a lot of energy and that’s not good for the environment. The possibility is organizations may put a halt to the mining and extraction of cryptos later. The same is the reason behind the fall of bitcoin prices and others this year.

In fact, Elon Musk and his company were thrashed for supporting cryptos even though the company focused on green energy.

Best Cryptocurrencies by Their Market Capitalization

Here’s the list of the top 10 largest trading cryptos in the world based on their market capitalization by CoinMarketCap:

| S.No | Cryptocurrency | Market Capitalization in Billion |

| 1 | Bitcoin | $854.78B |

| 2 | Ethereum | $369.69B |

| 3 | Binance Coin | $65.53B |

| 4 | Tether | $62.99B |

| 5 | Cardano | $58.31B |

| 6 | XRP | $47.03B |

| 7 | Dogecoin | $36.15B |

| 8 | USD Coin | $27.98B |

| 9 | Polkadot | $21.05B |

| 10 | Uniswap | $16.97B |

Is It Legal to Invest in Cryptocurrency?

Well, it totally varies from country to country. While some countries have shown a green signal to the use of crypto and its trading, others like China, Bangladesh, Algeria have put a complete ban over it.

However, if we talk about its legality in India, crypto is pretty safe and legal to invest in here. To know more about the legality of cryptocurrency in India and other countries, keep reading this blog. We have covered the crypto regulations around the world in quite a detailed manner.

How to Invest in Cryptocurrency: A Step-by-Step Guide

Cryptocurrencies are easy to invest in. The process is quite simple and as described below:

Step 1: Find the Best Crypto Exchange

The first and most important step to investing in crypto is to discover a crypto exchange. It’s a platform that lets you trade crypto, just like the stock market exchanges let you trade stocks.

Some of the popular crypto exchanges in India are CoinSwitch Kuber, CoinDCX, WazirX, etc.

Step 2: Create an Account on the Crypto Exchange

Once you have finalized your good-to-go exchange, you need to sign-up and create an account. The platform will ask to verify your identity and you may need to upload a view documents for the verification.

Step 3: Deposit Money

Obviously, if you intend to invest, you need to put funds in your account. To do so, you have to link your crypto account with your bank account and deposit money through wire transfer either using a debit or credit card.

You may have to wait for some time before you can start trading with the fund.

Step 4: Make Your First Investment

Now that you have opened your account and deposited money, you must first prepare yourself before making your first investment. Once you are ready to invest, you need to pick a crypto coin from thousands of them.

We have listed the top ten cryptocurrencies earlier in this blog. It will help you in picking up the best one.

Types of Cryptocurrency Wallets

Broadly, cryptocurrency wallets are divided into two categories:

- Hot Wallets, and

- Cold Wallets

Hot Wallets: These are digital wallets that require an internet connection. They are more flexible and hence, will let you access your funds from anywhere in the world. However, because they are digital, they are exposed to vulnerabilities.

Cold Wallets: Unlike hot wallets, cold wallets don’t require an internet connection. So, comparatively, they offer more security. To be lost, it needs to be physically stolen. Such a security concern will let you face difficulty in trading funds while travelling.

Hot and cold wallets are further divided into cloud wallets, paper wallets, hardware wallets, software wallets, etc.

Tips to Invest in Cryptocurrency Safely

Whether you invest in crypto or in the stock market, investments are always risky. Volatility is just another name for them. But it doesn’t mean that you should never try your hands-on. With the right strategy and correct guidance, you can do wonders.

According to Consumer Reports, cryptocurrencies are one of the riskier investment decisions. However, they are also some of the hottest commodities in the town. As of 10th August 2021, the current market value of cryptocurrency globally stands at $1.85 trillion, an increase of 5.83 per cent in the past 24 hours. Besides, the market is expected to grow by the end of this year and set a mark.

Therefore, if you are planning to invest in crypto, follow these tips to ensure you are safe.

Research the Best Crypto Exchanges

Now that you have ultimately made up your mind about investing in crypto, the first tip is to find yourself the best crypto exchange. Obviously, you would have to go into extensive research. Get suggestions from experts and investigate the best ones. According to Bitcoin.com, you can choose from over 5000 exchanges.

Crypto exchanges provide you with the means to buy and sell virtual currencies. So, perform researches, talk to experienced investors, and read and review before you proceed ahead.

Choose to Store Your Digital Currency in a Cryptocurrency Wallet

A cryptocurrency wallet is a digital wallet or software that lets you store the private and public key that acts as a bridge between you and the blockchain where you store your cryptos.

These keys are nothing but a long string of alphabets and numbers that offers security against any unauthorized access. Without this key or password, you won’t be able to sell or use your cryptos.

There are various crypto wallets having their own benefits, security, and technical requirements. They are paper wallets, cloud wallets, hardware wallets, and software wallets. Hence, along with exchanges, you must identify your storage choices before you start investing.

Choose Your Cryptocurrency Wisely

There’s no doubt that the market is flooded with a plethora of cryptocurrencies. You can invest from thousands of crypto and still be at a loss if don’t make the right selection. Just because something is in the headlines and is gaining fame because of some popular investors like Elon Musk, etc. you must not follow it blindly.

Start with the smallest and best five of them. Of course, you need to do your homework for the sane. Keep a track of the best performing cryptos and have a close at their growth chart. The figures will help in making the right decision.

Start with a Small Amount

A wise man/woman will never put a lot of money into crypto or any other stock at once. Obviously, just like the stock market, the crypto market is also volatile. It will rise and fall unpredictably. We advise to limit your investment to 5-10% of your income in the beginning.

Before you even start with crypto investing, begin with stock market investment. Doing so will give an idea of how the market fluctuates and how it affects the prices of stock. If you have the potential to deal with such risks, then you are ready to invest in crypto and ready to handle ups and downs.

Diversify Your Investments

Diversification, whether in stocks or Ifrypto, plays quite a crucial role in investment. It is one of the best investment strategies by big and every experienced investor.

Just because Bitcoin is the most trusted crypto in the world, you should avoid putting all your money into it. You should rather invest in the other best four after bitcoins. You have thousands of other options for the same.

Not only does this makes your portfolio looks better but it also protects your money in case there’s any downfall or recession in any of the cryptocurrencies.

Be Ready for Volatility

As we have described above, the cryptocurrency market is quite a volatile one, and hence, you need to be prepared for whatever comes your way. You should be able to handle all the ups and downs of the market. In case your mental wellbeing, as well as an investment portfolio, aren’t capable of handling them, then investing in crypto might not be an ideal choice for you.

Crypto Regulations Around the World

Do you know- most digital currencies including bitcoins aren’t backed by any central government?

With the increasing popularity and demand for cryptocurrency, global regulators are having distributed opinions on how to keep up.

Well, each country has distinct standards. While some are already regulating the crypto market, others have proposed to regulate. There are also countries that have completely restricted the use of cryptocurrencies within their nation.

So, would you be surprised- if I tell you that in the last few years, every small regulation announcement has driven the price of bitcoins and other cryptos?

Yes, it is cent per cent true. Now, since you live in India, you might be thinking-

Whether India regulates cryptocurrencies or not?

If not- is the government planning to regulate it?

Will the regulation impact the crypto market?

Hold on! We are going to address all your concerns in this blog.

Countries that Regulates Cryptocurrency

Before you discover what countries regulate cryptocurrency, it’s important you understand why these countries need to regulate it.

So, let me ask you a question first-

How would you feel if you lend somebody your money and that person runs away?

You will feel devastated depending on the sum of money you lent him/her. Right?

Well, for somewhat the same reasons, these countries have introduced laws to regulate cryptocurrency trading.

The main aim is to take care of illegal activities such as money laundering, financial fraud, the financing of terrorism, and more.

Hence, some countries like the United Kingdom, Indonesia, Singapore, Canada, Switzerland, Germany, etc. have introduced laws for cryptocurrency regulation.

India is also going to follow a similar approach (as discussed above).

Now, let us find out the regulatory authority in these countries that regulates cryptocurrency.

United Kingdom

The Financial Conduct Authority (FCA) in the UK regulated virtual currencies. Therefore, all the businesses dealing in crypto-asset-related activities have to register them with the UK’s FCA. Besides, crypto-businesses may apply for the ‘Authorised Payment Institution’ license.

Singapore

Cryptocurrency trading in Singapore is regulated under Singapore’s Payment Services Act, 2020, by the Monetary Authority of Singapore. Hence, businesses involved in crypto activities need to acquire a license to operate a cryptocurrency exchange.

Indonesia

Initially, the country banned cryptocurrency. However, in 2019, the Indonesian govt. lifted all the bans and published regulations to regulated crypto trading in the country under the supervision of its Commodity Futures Trading Regulatory Agency. The entities dealing in crypto need to report to the Indonesian Financial Transaction Reports and Analysis Center.

Canada

All crypto-businesses offering coins or tokens in Canada have to report to the Canadian Securities Administrators (CSA). Canada’s money laundering requires all virtual currency entities to register with the Financial Transactions and Reports Analysis Centre of Canada (‘FINTRAC’) and implement the applicable AML/CFT measures.

Similarly, other countries like the Philippines, Switzerland, Germany, Australia, Netherlands, Thailand and South Korea also regulate crypto trading.

Countries that Have Proposed for Cryptocurrency Regulation

Now, there are some countries that haven’t completely regulated crypto trading but have proposed the regulation. They are:

United States of America

A few states in America have already regulated cryptocurrencies while others are considering regulating laws. While New York has proposed a regulatory framework for companies dealing in virtual currencies, Wyoming and Oklahoma have already introduced the bills to regulate.

The Financial Crimes Enforcement Network of the US Treasury Department has issued a draft law requiring cryptocurrency operators to maintain records, and verify the customer’s identity in transactions involving digital assets or cryptocurrencies.

South Africa

It’s another country that has proposed cryptocurrencies for the regulation of crypto with sufficient checks and balances.

Pakistan

Earlier, the country issued a notice to ban all the activities related to virtual currencies. However, in November 2020, the Securities and Exchange Commission of Pakistan issued a position paper on the regulation of cryptocurrency, proposing standards for regulating it.

Brazil

Recently, Brazil’s finance ministry issued a guidance document where cryptocurrencies will be recognized as financial assets. The bill lets crypto trade, issue, use, and transfer freely.

Countries Where Cryptocurrency is Banned and Announced Illegal

While some countries have regulated and others have proposed to regulate, a few have banned crypto trading completely.

Let’s find out which and why-

China

According to a notice issued by the Chinese government agencies, any ‘fundraising and trading platforms’ like crypto-exchanges cannot operate in China.

Bangladesh

In 2017, Bangladesh’s central bank issued a notice that state that cryptocurrencies are illegal in the country. Such transactions violate existing money laundering, foreign exchange, and terrorist financing regulations.

Algeria

The country has banned the sale, purchase, possession, and use of any cryptocurrencies, making them a punishable offence.

Other countries like bolivia, Qatar, Morocco, Ecuador, and Macedonia have also announced cryptocurrencies as illegal. Such countries generally have regressive social, political, and economic policies on various issues.

Let us have a look at the table below to get a quick glance at countries regulating, proposed to regulate, and that have banned crypto.

| Countries that Regulate Cryptocurrencies | Nations that Have Proposed to Regulate Cryptocurrencies | Countries that Have Banned Cryptocurrencies |

|

|

|

Have a look at mapped cryptocurrency regulations around the world

Now that we have learned about cryptocurrency regulations around the world in 2021, it’s time we find out the actual scenario of crypto regulation in India.

Let’s find out-

Cryptocurrency Regulation in India- An Overview

As you might be aware, in 2018, the RBI banned every bank and other financial institution dealing in cryptocurrencies. However, the Supreme Court ordered to overturn this ban on a plea filed by IMAI (Internet and Mobile Association of India).

The court said that-

“While the RBI possesses the power to regulate digital currencies, in the absence of any legislation, the business dealing in such currencies ought to be treated as a legitimate trade that is protected by the fundamental right to carry on any occupation, trade or business under Article 19(1)(g) of the Constitution.”

So, as of now, bitcoins and other cryptocurrencies are legal to deal with.

But if we talk about the regulation, currently, there’s no regulatory authority for cryptocurrency in India. However, there are multiple uncertainties around the future of crypto and the crypto industry seems quite happy over reports that the Indian government may soon set up a new panel to discuss Cryptocurrency regulation in the country.

So, you can finally have a sigh of relief now!

Let us now see what experts have to say about this.

Experts’ Opinion on Cryptocurrency Regulation in India

According to Sharat Chandra, Blockchain Expert, IET Future Tech Panel, said’

“The crypto ecosystem of India has surely come of age. With retail investors holding more than 1.5 crore assets worth 15,000 crores, crypto is definitely a force to reckon with.”

Expressing his views on the recent bloodbath in crypto markets, he said-

“Once crypto exchanges begin embracing governance and investor protection guidelines, meant for stock exchanges, the risk associated with volatility in the market can be fairly addressed.”

The Co-CEO of ZebPay, Avinash Shekhar also seemed concerned about the government setting up a panel for crypto and said-

“The government setting up a panel for crypto regulation would be in the right direction. We believe that the government will discuss with all stakeholders and take a calibrated approach to crypto regulations in India. Besides, it will guarantee investors who have invested in cryptos are safe.”

In a nutshell, the cryptocurrency regulation in India would be a wise step the government will take as it will protect the public interest.

Good News on the Way

On 31st May 2021, the RBI (Reserve Bank of India) clarified that-

“Banks and other regulated entities can’t cite its circular from 2018 on cryptocurrencies as it has been set aside by the Hon’ble Supreme Court in March 2020. The circular isn’t valid from the date of the SC order and can’t be cited or quoted from.”

According to the recent circular issued by RBI, banks are allowed to carry out due diligence for crypto investors and users amount to “legitimizing trading in the country.”

So, if you have invested in Bitcoins or any other cryptocurrencies in India, you don’t need to worry about its legitimation anymore because the Supreme Court has ordered RBI to regulate them finally.

Future of Cryptocurrencies: What the Future Holds

With technological advancements at their peak, cryptos are becoming easily accessible and more understandable to everyone. Hence, people nowadays seemed more inclined toward investing in cryptos.

Various businesses have accepted digital coins as a payment method with an open arm. As a result, this has increased its acceptance and which in turn, are tending to invite people to use it more and with new technologies.

Even governments and various countries are planning to create their own cryptocurrency as a way to take part in the ongoing technological revolution. Besides, several countries have come up with their own set of regulations regarding crypto, as mentioned above. In the upcoming time, we may be able to witness even more regulations that will ultimately accelerate the use of digital coins in everyday activities.

Cryptocurrency is extensively safe and one can use it for a long time as the currency in the future.

Frequently Asked Questions

1. How does a cryptocurrency work?

Cryptocurrency acts like a credit card or PayPal, but you trade digital assets for goods and services instead of US dollars or cash. In order to initiate a transaction with cryptocurrency, you must use a cryptocurrency wallet- software that lets you move funds from one account to another. You will need access to a password or key to complete the transaction. The private key serves as a bank account- you can have more than one key and own all the funds sent to them.

Every transaction initiated is recorded on a public ledger. It indicates the transaction totals without revealing the identities of the parties involved.

2. What is cryptocurrency mining?

Crypto mining or cryptocurrency mining is the process of extracting cryptocurrencies by solving cryptography problems through computers. In the process, the transaction of several cryptos is verified and added to the blockchain digital ledger.

3. What exactly is a cryptocurrency?

A cryptocurrency is a virtual or digital currency based on a network spread out across a large number of computers. It’s secured by cryptography which almost makes it impossible to double-spend or counterfeit.

4. Is cryptocurrency legal?

In India, the use of cryptocurrency is completely legal, and in fact, the RBI is planning to launch its own crypto very soon. Countries like the UK, Canada, Indonesia, etc. have given a green signal to the use of crypto, and hence, dealing in cryptocurrencies in such countries is completely legal.

However, countries like China, Bangladesh, etc. have banned the use of crypto. Hence, dealing in cryptos in these countries is illegal.

5. What is an example of cryptocurrency?

Bitcoin, Dogecoin, Ethereum, Binance Coin, Tether, etc. are some popular examples of cryptocurrencies.

6. What is the Point of Cryptocurrency?

The main point of cryptocurrency is to solve the issues of traditional currencies by installing the power and obligation in the hands of currency holders.

7. How does Cryptocurrency Make Money?

To make money from cryptocurrency, you need to invest in crypto, trade for it, mining cryptos, and more.

8. What are the Most Popular Cryptocurrencies?

Bitcoin, Dogecoin, Ethereum, Binance Coin, and Tether are the most popular cryptocurrencies.