Initially, the return filing process concluded only after sending the ITR V to the Centralised Processing Centre (CPC) through the post. Eventually, the process was shifted online, also known as the ‘process to e-verify ITR’ owing to the wave of digitalization. The final step for wrapping up the return filing process has now been made convenient for the general public.

Verifying the income tax return is important as otherwise, your return will be considered invalid. Hence, e-verifying has been adopted by the Income Tax Department through different modes. This article describes the process to e-verify income tax returns through net banking as one of the modes approved by the income tax authorities.

Table of contents

| Update:

In a notification on 11 January 2022, the CBDT has furnished a circular stating that the deadlines for different direct tax compliances have been extended for the year 2021-22.

2. Serving audit report:

|

Steps to E-Verify Income Tax Return

To e-verify income tax returns through net banking, you need to ensure that your bank is approved by the Income Tax Department and that you have an active Net Banking service. Additionally, the PAN should be linked with your respective bank account.

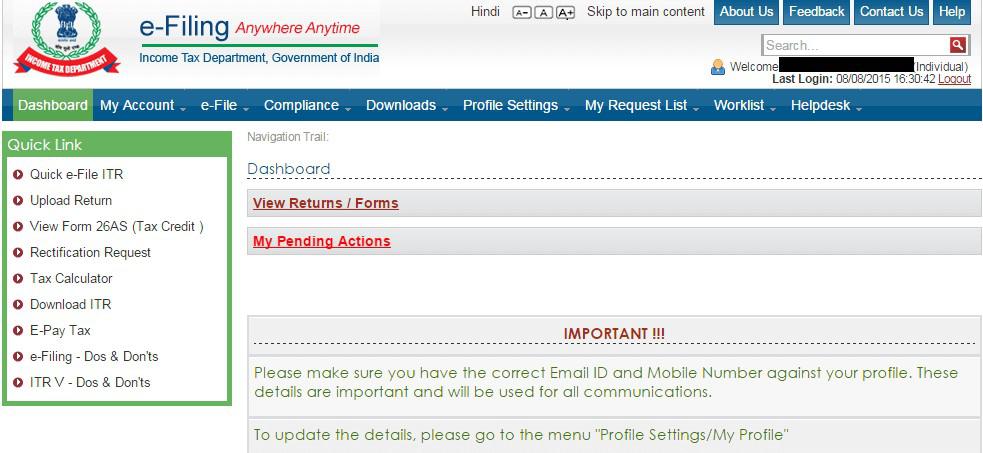

Step 1: Head to the official website of the IT Department and log in to your e-filing account via the e-filing portal.

Step 2: You will be able to see your dashboard on the next page. Choose the option ‘Forms/View Returns’ to see your e-filed tax returns.

Step 3: Select option ‘View e-filed returns/forms’ and select ‘Income Tax Returns’ from the drop-down menu.

Step 4: Choose the ‘e-verify Return’ option.

Step 5: You will be able to see a list of ITR(s) filed for various assessment years. Now, click on the ‘e-verify’ option.

Step 6: Choose option 2 which states ‘I do not have an EVC and I would like to generate EVC to verify ITR. A box will appear on the screen, here choose ‘EVC-via Net Banking’.

Step 7: The screen will display a confirmation message with an EVC code and transaction ID. Select the green button to download the displayed attachment. The file is for your record and no further action is required.

To check whether your bank is approved by the Income Tax Department or not follow the above steps. You will then be redirected to a page where the banks approved by the Income Tax Department will be displayed for the e-verification of ITR via Net Banking. Choose your preferred bank and if your chosen bank’s name is not present, this means that the bank does not have the approval for Net Banking e-verification and you would have to choose another method.

Why Should you E-Verify ITR?

It is important that you verify your ITR because of the following reasons:

- If you do not verify your ITR, your return will stand invalidated even if you have filed it on time.

- The ITR is processed only after the verification of the same.

- As long as you do not verify your ITR you are not going to receive your Income Tax Refund. Hence, with the delay in the verification process, your refund process will also get delayed.

- Furthermore, if you are unable to verify your ITR within 120 days of filing, then you will have to file a delayed return along with penalties related to late filing.

Ensure that you verify your ITR and also get it validated within a period of 120 days of filing.

| Income Tax Top Blogs | Income Tax Other Blogs |

| Income Tax Slabs | Sales Tax |

| Income Tax Return | Service Tax |

| Income Tax e-Filing | Direct Tax |

| Income Tax Refund Status | Indirect Tax |

| Income Tax Refund | Form 26AS |

| Online Tax Payment | Challan 280 |

| Income Tax Portal | Self Assessment Tax |

You May Also Read:

Frequently Asked Questions (FAQ’s)

What is ITR verification?

The process of authentication of the uploaded ITR is called ITR verification. The ITR will be null and void if you do not verify it. It is essential that you e-verify ITR within 120 days of filing to prevent paying the penalties. The verification can be done both physically and electronically.

How do you check if ITR is verified or not?

To check the status of your ITR verification you need to head to the homepage of the e-Filing portal. Then, click on the Income Tax Return status. After you have been redirected to the page, insert your acknowledgment number and your valid mobile number. Click on continue and you will be able to verify the status.

What is EVC?

An Electronic Verification Code (EVC) is a 10-digit alphanumeric code that is sent to the tax filer’s registered mobile number. This code is sent when an individual is filing the returns online. Additionally, it helps in verifying the tax filer’s identity.