As the Goods and service tax (GST) was introduced in India, a number of GST forms were introduced with GST as well. Earlier, to comply with the Goods and Service Tax, the taxpayers who are registered needed to file only three forms for GST returns in a month. These three forms were GSTR – 1, GSTR – 2, GSTR – 3.

But now, the taxpayers need to fill the GSTR – 3B form. This GSTR – 3B form is a consolidated summary return of self-declared of both inwards and outwards supplies. The taxpayers need to file this GSTR – 3B form on the common portal of GST.

What Is GSTR – 3B Form Exactly?

Under section 39 of CGST or Central Goods and Services Tax Act, 2017, it is mentioned that every registered person is on a mandatory basis required to file a monthly return to the centre through the electronic medium. The different particulars include availed input tax credit, inwards as well as outwards supplies of the goods and services, paid amount of tax, tax amount that needs to be paid, and many more are required to be declared by the taxpayers in such return.

Although there is still a certain class of registered persons who will need to furnish the GSTR – 3B returns quarterly.

In this regard, GST rules number Rule 61, 2017 prescribed that Form GSTR – 3B will be required to be filled by the registered taxpayers on a monthly or quarterly basis, depending upon the case.

In short, GSTR – 3B meaning that this form is a simple return summary of all the normal taxpayers of the country, which needs to be filed for a period of nine months. With the help of the GSTR -3B form, the taxpayers will be summarizing and will report all the total values of the sales and purchases without the need to submit the list of invoice details.

Some Important Points To Remember About GSTR – 3B

- Even if there is no business activity, that is nil returns, you will still need to file for GSTR – 3B.

- After filing, you cannot amend or revise GSTR – 3B.

- For every GSTIN you have, you will need to file a new GSTR – 3B.

Who Is Responsible For Filing GSTR – 3B Returns?

If you are registered under Goods and Services Tax (GST), then you will need to file for GSTR – 3B returns by filing the GSTR – 3B form. Every citizen who is registered under GST will need to file form GSTR – 3B. But there are still some exceptions. Below-mentioned is the people who do not need to file GSTR 3B:

- Taxpayers who are registered under the composition scheme.

- Distributor of Input Service.

- Non-resident taxable citizen of India.

- A person who is liable to deduct tax amount at the source.

- A person who is liable to collect the tax amount at the source.

Invoice Matching On The GSTR – 3B Filing

There is nothing and no process of matching the invoices as the taxpayers are not required to list the invoice details on the GSTR – 3B form.

However, if the purchases and sales values filled in the GSTR – 3B does not match with the values that are later reported on the other three GST forms for the corresponding months – GSTR -1, GSTR -2, GSTR -3, then the taxpayer will be required to pay extra GST amount along with penalties and interest amount.

GSTR – 3B Filing Due Date

GSTR – 3B should be filed by the 20th of the following month. For example, the due date for February 2021 GSTR – 3B is March 20, 2021.

Every month the due date is the 20th of the following month for GSTR – 3B filing. If you fail to do it on time, you will have to pay late fees and penalties set by the Act.

Late Fees And Penalty For GSTR – 3B

According to the GST Acts, for the supplies of intrastate, the late fees by the taxpayers will be liable under both Central Goods and Services Tax (CGST) as well as State Goods and Services Tax (SGST).

| Name of the Act | Late fees per day of delay |

| Central Goods and Services Act, 2017. |

₹ 25 |

| State Goods and Services Tax Act, 2017 of the respective state / Union Territory Goods and Services Tax Act, 2017. |

₹ 25 |

| Total late fees that needs to be paid on per day of the delay |

₹ 50 |

Up to May 2021, the law had fixed that the maximum late fees can be ₹ 10,000. Hence, this means that the maximum late fees charged by both Central and State governments can be up to ₹ 5,000 on each return being filed under each Act. However, the maximum late fees for GSTR – 3B have been rationalized from June 2021 period onwards.

For the NIL return filers, the below-mentioned fees are to be paid by them:

| Name of the Act | Late fees per day of delay |

| Central Goods and Services Act, 2017. |

₹ 10 |

| State Goods and Services Tax Act, 2017 of the respective state / Union Territory Goods and Services Tax Act, 2017. |

₹ 10 |

| Total late fees that needs to be paid on per day of the delay |

₹ 20 |

The maximum fees for GSTR – 1 and GSTR – 3B have been rationalized from the June 2021 period for returns.

If the interest rate is still not paid after the due date, then the taxpayers will have to pay 18 percent per year. The interest amount will be calculated from the day of the due date to the actual payment date.

For instance, if a taxpayer has filed the GSTR – 3B for November 2020 on December 25 while the deadline was December 20, 2020, the number of late fees that the person needs to pay will be ₹ 250 (₹ 50 per day for 5 days). The fees will be ₹ 125 under Central Goods and Services Tax Act (CGST) and ₹ 125 under State Goods and Services Tax (SGST).

If the above-mentioned return was a ‘NIL’ return, then the amount of the late fee will be ₹ 100 for 5 days which is ₹ 50 under Central Goods and Services Tax Act (CGST) and ₹ 50 under State Goods and Services Tax (SGST).

Steps To File GSTR – 3B

If you want to file GSTR – 3B, you will need to visit the official common portal of GST. After logging in to the portal, follow the steps mentioned below:

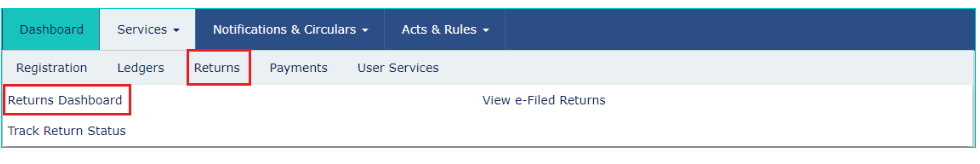

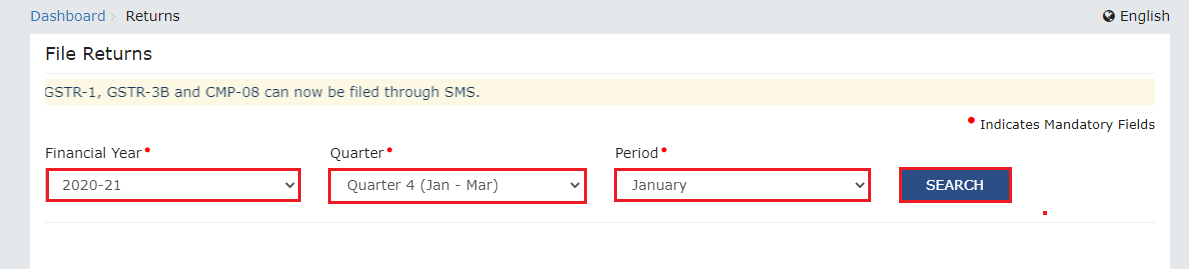

Step 1: Go on ‘Returns Dashboard’. Under this, select the period for which you want to file GSTR – 3B.

Step 2: Then, select ‘File Returns’.

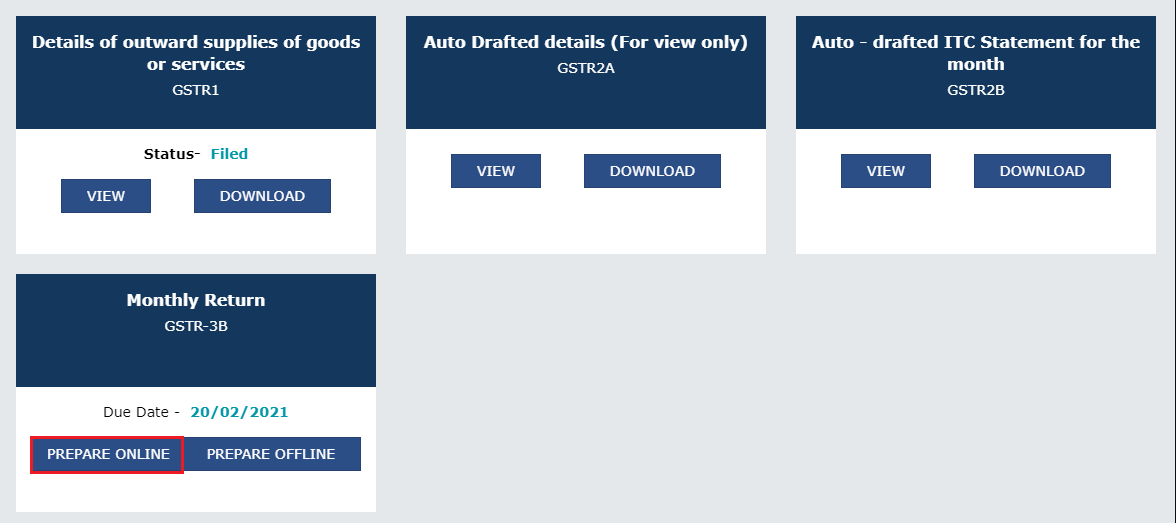

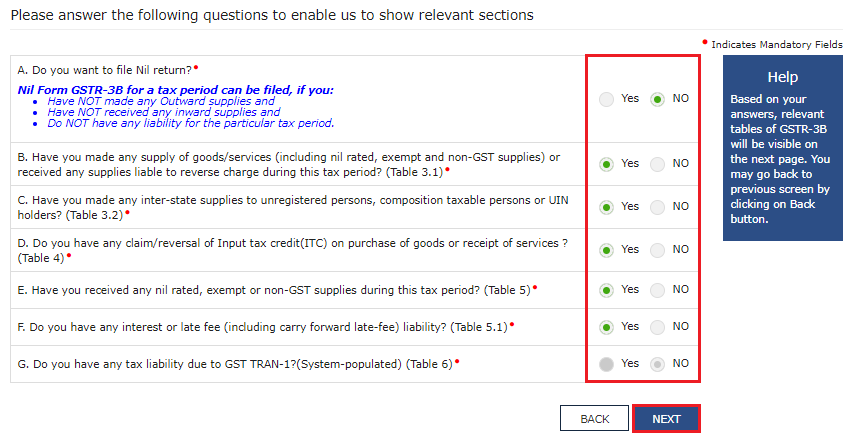

Step 4: Then select ‘or the Monthly returns GSTR – 3B’ and click on ‘Prepare Online’. Fill the data asked in the form GSTR – 3B with uttermost care.

Step 4: The next process is to discharge all the liabilities towards interest, tax, fees, penalty, or any other amount that needs to be paid by debiting the credit ledger or the electronic cash.

Step 5: Using a Digital signature certificate (DSC) of class 2 or higher, or electronic verification code (EVC), verify the returns.

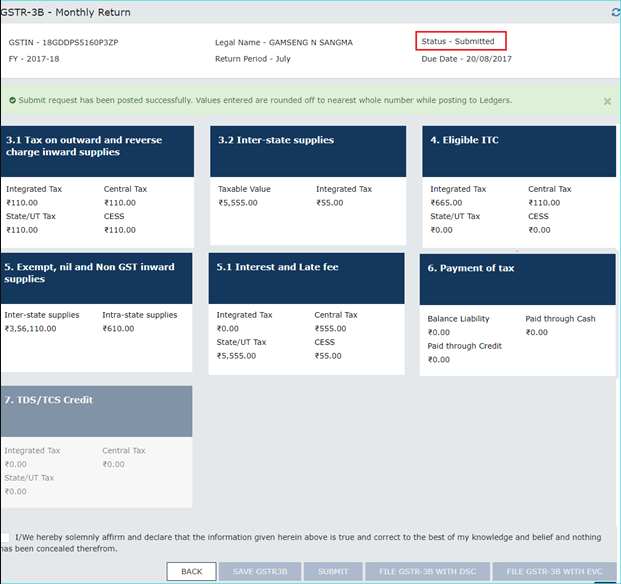

Step 6: After a successful verification, a message will appear along with the Acknowledgement Reference Number (ARN).

Detail Required For GSTR – 3B

Below mentioned are the details required to report on the GSTR – 3B form by the taxpayers:

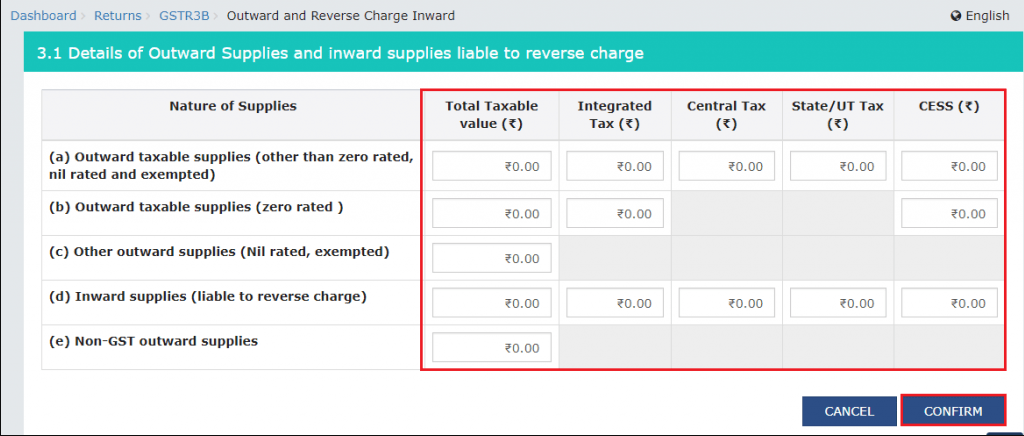

Outward tax and reverse charge on inward supplies, along with:

- Details of all the outward supplies along with the details of inward supplies (those who are eligible for the reverse charge).

- The total value of the tax, CGST, ISGT, SGST, and the cess of supplies. For the nil-rated, exempted supplies as well as the non-GST supplies, the taxpayers are required to report the exact total value.

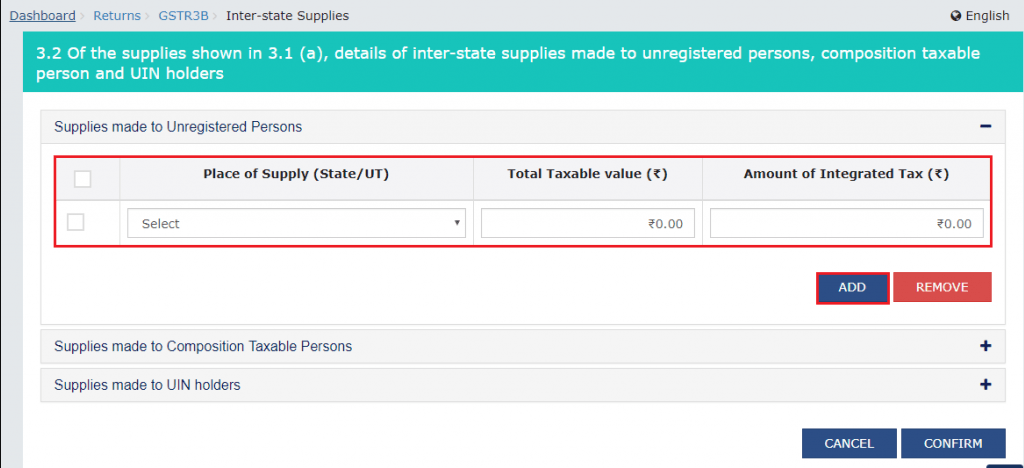

Interstate Supplies

- Composition dealers, details of the interstate supplies that are made to the unregistered persons, UIN holders. The taxpayers also need to mention the place of supply, the total value of the tax, and the IGST amount.

ITC Eligibility

- The total amount available under the Input Tax Credit (ITC) along with the ITC has been reversed as per the CGST or SGST rule numbers 42 and 43.

- Any ineligible ITC as per Section 17 (5).

NIL, Non-GST, and Exempted Inward Supplies

- For the GSTR – 3B form, the taxpayers are also required to report the details of NIL, non-GST, and exempted inward supplies.

Late Fees and Interest

- All the interest and late fees are due because of the late filing of the GST returns or the late GST payments.

GSTR – 3B Format

GSTR – 2B Format is quite simple. Following are the details mentioned in the GSTR – 3B Format:

Section 1: In this section, the questions pertaining to the business activities as well as the tax liabilities for the current period of tax are included.

Section 2: Then, a box related to the information GST returns along with the Return status is shown.

Section 3.1: Next in the GSTR – 3B format comes to the boxes where you will need to fill the details of inwards as well as outwards supplies which are liable for reverse charge.

Section 3.2: Next is the box for details about interstate supplies that are made to the unregistered person, UIN holders, composition taxable people).

Section 4: In this section, the pertaining details that are eligible for Input Tax Credit (ITC).

Section 5.1: In GSTR – 3B format, nil, non-GST, and exempted inward supplies need to be filled.

Section 5.2: Fill in a late fee and interest in this section.

Section 6.1: This section is all about the payment of tax.

Note: Section 7 of the GSTR – 3B related to TDS/TCS credit is not applicable anymore.

Conflict Between GSTR – 3B and GSTR – 2A & GSTR – 2B

GSTR – 3B Form is a monthly summary of the returns, which is filed by the taxpayers on every 20th of the next month or by 22nd or 24th of the month of the following quarter. The taxpayers can take the Input Tax Credit (ITC) based on the details submitted by the taxpayers in the form.

While the GSTR – 2A form is an auto populated GST form that is generated on the login of recipients, covering every outward supply (GSTR – 1 Form) declared by their suppliers. GSTR -2B is similar, and this form needs to be filed for all the Input Tax Credit (ITC). Form GSTR – 2B is not required to be filed by the taxpayers and this form is only for information purposes.

When a supplier files GSTR -1 in any of the particular months and discloses his sales, the analogous details are captured in GSTR – 2A and GSTR – 2B form of the recipient. However, the filing of the GSTR – 2 forms has been kept in abeyance and still made important under the framework of GST for the taxpayers to reconcile with the ITC claims in both GSTR – 3B form and GSTR – 2A form. The form GSTR – 3B is a summary return. So, the amount that is mentioned and available in the ITC should match with the details of tax, which is disclosed in the form GSTR – 2B on a regular basis along with the GSTR – 2A form.

Importance of GSTR – 2A & 2B and GSTR – 3B

Here are the reasons why you should reconcile both GSTR – 3B and GSTR – 2A & 2B Form:

- The authorities of GST have issued the notice to the taxpayers for reconciling the Input Tax Credit (ITC), which will be claimed in a self-declared summary return form of GSTR – 3B and will get auto generated from the form GSTR – 2B and form GSTR – 2A. Such kinds of notices are issued in the form of GST – ASMT 10. The taxpayers are either required to reply to such notices issued by the authorities or pay the differential amount.

- Taxpayers who are claiming Input Tax Credit (ITC) on the basis of fake invoices have been penalized in the past and will be punished in the future too.

- With the reconciliation, it is ensured that the claimed credit for the tax is being actually paid to the suppliers of the taxpayers.

- It also ensures that the invoices are not missed or recorded more than once, etc.

- In any case, if the supplier has not recorded any outward supplies in the form GSTR -1, then it will reach out to the supplier and ensure that the discrepancies in the supplies are corrected.

- If any errors are being committed while reporting the details in GSTR -1 form by the supplier or GSTR – 3B by the recipients, then it can be rectified.

Grounds For Non-Reconciliation Of GSTR – 2A & 2B And GSTR – 3B

Here are the reasons why the GSTR – 2A & 2B cannot reconcile with GSTR – 3B based upon the details reported in these forms:

- The IGST claimed credit on the import of goods.

- The credit of IGST on the import of services.

- The paid GST credit on the mechanism of reverse charge, etc.

- Claimed transitional credit in the TRAN – I and TRAN – II.

- Input Tax Credit (ITC) for both goods and services in the Financial Year 2020 – 21 but availed in the financial year 20221 – 22.

In any of the above mentioned cases, the reconciliation of the figures as there is no corresponding Form GSTR -1 will be filed by the supplier, or the Input Tax Credit (ITC) will be claimed at a different date.

After all the situations mentioned above, if there are any discrepancies found in the GSTR – 2A form and GSTR – 3B form, which will lead to the excess claimed Input Tax Credit (ITC) by the recipient, and the same will also be paid by the taxpayers, along with the interest. Therefore, this necessary reconcile exercise will be done regularly to ensure the claimed bonafide Input Tax Credit (ITC).

Conflict Between GSTR – 3B Vs GSTR -1

GSTR – 1 Form is a monthly or quarterly return form that states the details of all the outward supplies. The outward supplies of the are considered to determine whether the GSTR – 1 form will be filed monthly or quarterly basis.

While the GSTR – 3B form is a summary and self-assessment of the returns filed by the recipient with the details of all the outward supplies as well as inwards supplies which means the purchases and the expenses. Irrespective of the turnover, the recipient needs to file this form every month.

Importance of GSTR – 1 and GSTR – 3B

Below mentioned is the importance of reconciliation between GSTR -1 and GSTR – 3B:

- It makes sure that no invoice will be left behind or gets recorded more than once.

- The reconciliation will be of great help to the taxpayers as they get to determine the right output of payable tax amount on the sales that are made. Any late declaration of the tax can lead to interest, penalties, and late fees.

- According to the new rules, the taxpayers are required to reconcile GSTR – 1 with GSTR – 3B because any mismatch in the data can lead to cancellation or suspension of the GST registration.

- The reconciliation of the GSTR – 3B form and GSTR – 1 form will help the recipients to avail the right and accurate Input Tax Credit (ITC).

Reasons For Mismatch Between GSTR – 3B And GSTR – 1

Here are the reasons that cause a mismatch between GSTR – 3B form and GSTR – 1 form:

- Filling the right data in the wrong column of GSTR – 3B form whereas filing the right data in the right column of the GSTR – 1 form.

- Due to the changed dates in the issued invoices as well as the changes in the date of issued credit and debit notes.

- When the interstate supplies are made to the unregistered persons who are not mentioned in GSTR – 3B but are registered under GSTR – 1.

- Wrong head payment of supply value tax which is correctly mentioned in Goods and Services Tax (GST) returns.

- Supplies that might have been corrected by the recipient in GSTR – 1 because of which there comes a difference in the liability of tax at the time of filing the GSTR – 3B form.

- Mismatch in the two forms because of differences in the time of filing the forms.

YOU MAY ALSO LIKE

Frequently Asked Questions (FAQ’s)

What is the meaning of GSTR – 3B?

GSTR – 3B refers to the Goods and Services Tax Returns – 3B form which is filed by the taxpayers for summarizing the returns on all the supplies made in a month.

What are the GSTR 3B late fees?

The late fees are ₹ 25 for SGST and ₹ 25 for CGST/ per day after the due date. In total, the return filer will have to pay ₹ 50 per day. For NIL returns, the taxpayers will need to pay ₹ 10 for CGST and ₹ 10 for SGST/ per day after the due date.

Can revision/resetting be possible in GSTR – 3B form?

No, revision or resetting of the GSTR – 3B form is not possible after it has been submitted. Hence, it is important to make sure that you fill in all the details correctly while filling the form.

Is filing GSTR – 3B mandatory?

Yes, filing for form GSTR – 3B is mandatory for both normal and casual taxpayers. It also includes no business in the particular period for tax.

What is the purpose of GSTR – 3B?

GSTR – 3B form is a monthly return form. This form needs to be filed every 20th of the next month.

Is GSTR – 3B required to fill on a monthly or quarterly basis?

The form GSTR – 3B can be filed both monthly and quarterly depending on the turnover of the supplies.

Is it important to file GSTR – 3B even after zero return?

Even if it is NIL returns, the NIL form should be filed like a normal GSTR – 3B form.

How do I file NIL GSTR -3B?

The GSTR – 3B form can be filed both online and offline. You can file it online on the official common portal of GST and download the form and submit it to the GST office.