Due to the problem of duplicate PAN details, the government of India cancelled more than 11 lakh PAN cards recently. Moreover, it was discovered recently that over 1500 fake PANs were issued to either false identities or non-existent people. Having more than one PAN card is punishable under Section 272B of the Income Tax Act. Certain individuals may have received multiple PANs due to clerical errors. Therefore, it is important to check whether your PAN is active or not. In this blog, we will discuss how you can check if your PAN card is active. Take a look.

Step-by-Step Guide to Check if PAN Card is Active

Given below are the steps to check if the PAN card is active or not:

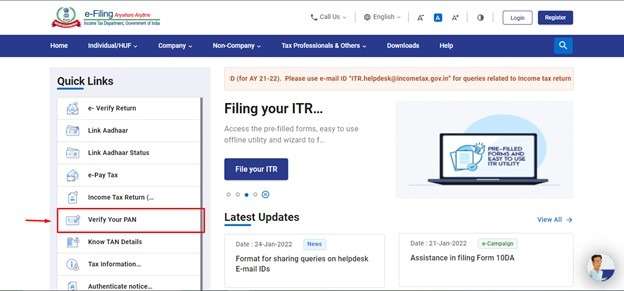

Step 1: Visit the official income tax e-filing website (https://www.incometax.gov.in/)

Step 2: Click on the ‘PAN Verification’ tab on the left-side of the homepage.

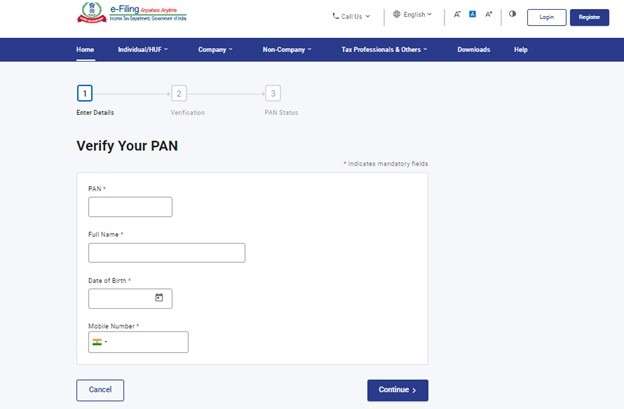

Step 3: On the next page, the applicant has to enter a PAN number, full name, birth date, and registered mobile number. After filing the document click on the ‘Submit’.

Note: In case the individual has multiple PANs, an error will appear at this step.

Step 4: This will trigger an OTP being sent to the registered mobile number.

Step 5: Next, verify the OTP. The PAN card status will then be displayed on the screen.

Note: The OTP will not be sent to the registered mobile number, if the applicant is found having multiple PANs.

Deactivation of PAN by Income Tax Department

In recent times, the Income Tax Department has been on a mission to deactivate any additional PAN that might have been issued. This initiative has been slowly but surely affecting people who have more than one PAN card. Such individuals will find out that their PAN details are invalid to file ITR.

Moreover, when the PAN of an individual is deactivated, the person’s income tax e-filing login will also be deactivated. The taxpayer will also be unable to receive or respond to a communication from the Income Tax Department.

What to do When PAN is Deactivated?

When the income tax authorities deactivate any individual’s PAN card, they may have to face various issues. Given below are some of the steps that can be taken to rectify the problem:

- The applicant will be required to send an application to the Assessing Officer (AO) in their jurisdiction, requesting them to reactivate the PAN.

- Attach all the necessary documents for reactivating your PAN. You will have to attach a copy of your PAN and the Income Tax Return that has been filed using the PAN card.

Note: Once the application has been received and reviewed by the Income Tax Department, it will take up to 15 days for your PAN to be reactivated.

What to do Upon Receiving a Notification from Income Tax Department

There might be instances in which individuals may get an intimation or notification, and they might be required to respond online. In case your PAN has been deactivated, then the income tax login will also be deactivated, which means such an individual will not be able to respond to such notifications. In such cases, the assessee should get in touch with their Assessing Officer (AO) to reactivate the PAN at the earliest.