In the realm of financial documentation in India, the Permanent Account Number (PAN) card stands as a cornerstone, wielding significant importance in various financial transactions and legal obligations. Introduced by the Indian government to track financial transactions and prevent tax evasion, the PAN card serves as a unique identifier for individuals and entities engaging in economic activities across the nation. This is what makes the process of online PAN card registration so important. Much more than just a laminated piece of paper, the PAN card is a symbol of financial integrity and accountability. Its significance reverberates through a myriad of transactions, from filing income tax returns and opening bank accounts to investing in securities and purchasing high-value assets. The online PAN card registration process acts as a crucial tool for the government to monitor and regulate financial activities, ensuring transparency and compliance with tax laws.The following blog outlines a step-by-step guide for applying for the card, the documents you’ll need, and tips to ensure a smooth approval process through the income tax portal.

Table of contents

Steps for Online PAN Card Registration

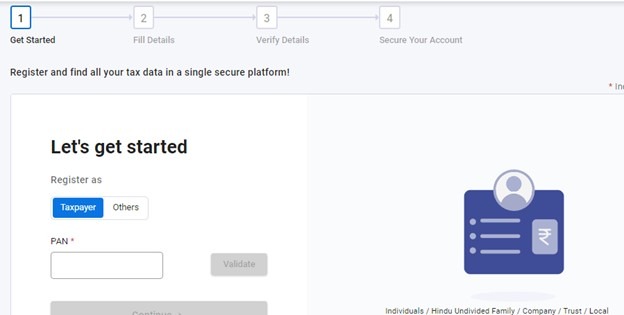

Given below are the steps for PAN card registration on the income tax portal.

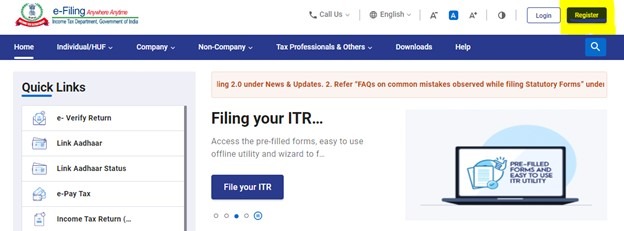

Step 1: Visit the online e-filing portal incometax.gov.in

Step 2: Press on the Register tab.

Step 3: Select the applicant type and hit the Continue option.

Step 4: Enter all your personal details such as name, gender, birth date, contact details, email address, and others.

Step 5: Fill in the online registration form with the proper information.

Step 6: After submitting the form, a link will be sent to your email address.

Step 7: Press the link and successfully activate your account.

How to Check for PAN Card Information?

To access your online PAN card registration details through the Income Tax Department’s e-filing portal, simply navigate to the website and follow these steps to view your information:-

Step 1: Input your PAN account number.

Step 2: Choose the ‘My Account’ option.

Step 3: Go to ‘Profile Settings’ and select ‘PAN Details’.

Step 4: Your 10-digit PAN number, along with your permanent address and additional information, will be displayed.Registering for a PAN card is a straightforward process, and, according to the Income Tax Department, it’s essential for e-filing your taxes.

Online PAN Card Registration Fees and Number

The process of obtaining a PAN card involves certain charges that applicants must be aware of. These charges for PAN card encompass various aspects of the application process, including the printing of the PAN card itself. The printing charge is an integral part of the total fee levied for applying for a PAN card, as it covers the cost of physically producing the PAN card and ensuring its delivery to the applicant.

For individuals applying within India, the fee for applying for a PAN card is set at Rs 91, which does not include the Goods and Services Tax (GST). This fee incorporates the charges for printing the PAN card and other administrative and processing expenses incurred during the application process. For applicants with foreign communication addresses, the charges for a PAN card are significantly higher, amounting to Rs 862, excluding GST. This increase accounts for the additional logistics and handling required to dispatch the PAN card to an overseas location.

Applicants need to understand that these charges for a PAN card must be paid upfront during the application process. Various payment methods are available to facilitate this, including credit/debit cards, demand drafts, and net banking, offering convenience and flexibility to applicants. The charges for a PAN card, including the fee for applying and the cost of printing the card, are critical components of the application process. Applicants need to budget for these expenses to ensure a smooth and uninterrupted application process, leading to the successful issuance of their PAN card.

PAN Card Correction Charges

Of course, there is also a fee for mishandling the PAN card. When rectifying details on a PAN card, the charges for PAN card correction are set at Rs 110 for those whose communication address is within India. This amount covers both the processing fee and the applicable Goods and Services Tax (GST) at 18%. The correction in PAN card fees is designed to facilitate the update process, ensuring that any inaccuracies or changes in personal information are corrected promptly and accurately.

For individuals outside India who require a new PAN card or need to make corrections or reprints, the fees are structured differently to account for international dispatch. The charges for PAN card correction or reprint for those with an overseas communication address are Rs 1020.00. This includes a base application fee, dispatch charges tailored for international logistics, and the standard 18% GST. These fees ensure that PAN card services remain accessible and efficient for domestic and international cardholders, facilitating seamless financial transactions and compliance with Indian tax regulations.

Wrapping Up

In today’s digital era, where financial transactions are predominantly carried out online, the importance of the PAN card has been magnified. It plays a crucial role in monitoring financial movements and acts as a key authenticator for numerous online transactions and applications. This functionality enhances security and helps reduce instances of fraud. Furthermore, online verification of PAN cards adds a layer of convenience and reliability, making it an essential tool in our increasingly digital financial landscape.

FAQ’s on PAN Card Registration Procedure:-

You can apply for a PAN card online through the authorised NSDL or UTIITSL websites. The Government of India sanctions the issuing of PAN cards and facilitates updates or corrections on behalf of the Income Tax Department. PAN is a 10-digit alphanumeric unique code and a Permanent Account Number. The Indian Income Tax Department issues it to individuals and companies. The applicable PAN card fee is Rs. 93 for an Indian communication address and Rs. 864 for foreign address, excluding GST. The PAN card fee is payable using a credit card, debit card, demand draft to the official address of NSDL or UTIITSL office or net banking. If you are a minor while applying for PAN, the guardian’s identity and address proof are considered valid and legal. Like its first and second alphabets, the third alphabet in PAN stands for alphabetic series running from A to Z. How to apply for a PAN card online in 2024?

What is the PAN card registration number?

Is there any payable PAN card fee?

How to apply for a PAN card under 18?

What does the 3rd letter in PAN stand for?