Do you know about PAN Jurisdiction? Are you aware of your AO code?

An AO code helps you in defining your location, your AO type, range and AO number. It makes your PAN code unique from other individuals. Also known as PAN jurisdiction, it facilitates the efficient processing of your documents based on various parameters. Read here to know about PAN jurisdiction and how to change your Assessing Officer as per your request or when you are changing address.

What is PAN Jurisdiction?

Every PAN card bearer carries a ten-digit alphanumeric code attached to its PAN card. This code is known as AO. However, for an assessing officer a PAN card AO code works as an interpretation of your Area code, AO type, Range code and AO number used while applying for PAN. All this is variable depending on your geographical location and source of income. This helps in segregating one PAN card bearer from another.

Moving ahead, each set is divided into numerous units named circle and wards. It is divided depending upon the income and in which category you fall in. If you declare a lower cap then a sub-jurisdiction will be offered to you.

Further, PAN applicants have to submit an application form with an AO code.You can have your AO code from your nearest Income Tax Department or by visiting the official website online.

Why is PAN Jurisdiction Necessary?

Here are the reasons that make PAN jurisdiction necessary:

- It helps in specifying the role, range, place and designation of the Commissioner, Chief Commissioner, Joint Commissioner and the Assessing Officer.

- If you have applied and received a PAN card on the basis of permanent address in the application form, then the status of a PAN card can be inspected anytime.

- If you want to change your permanent address, apply for it on the official website. After this, the IT department will change your PAN jurisdiction as per your new address and allot you a new Assessing Officer.

How to Know Your PAN Jurisdiction and AO Code?

You can easily know your PAN jurisdiction by following the steps written below. Follow these steps and learn about your AO code.

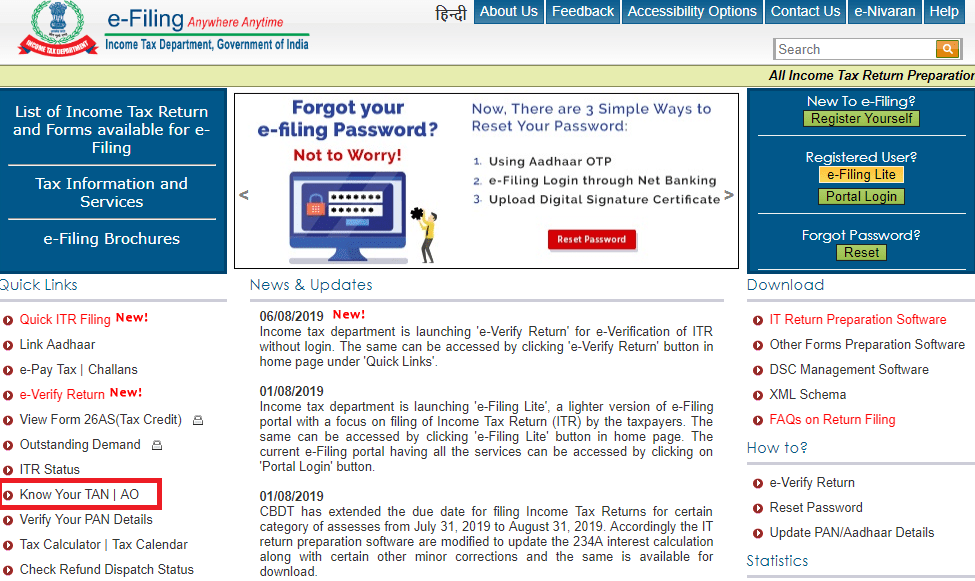

Step 1: Go to the official website of Income Tax incometaxindiaefiling_gov_in (Replace _ with .).

Step 2: Choose AO from the option Know Your TAN|AO.

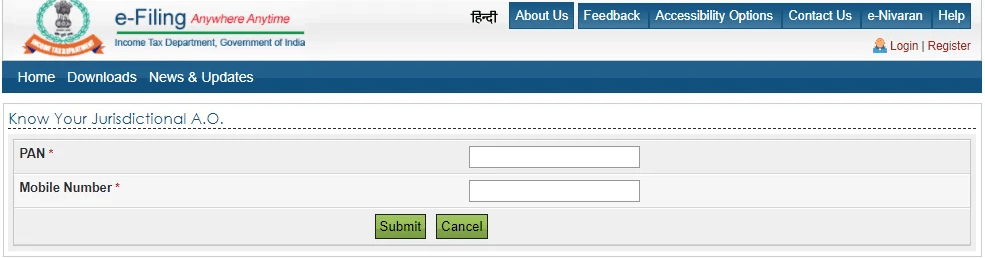

Step 3: Write your PAN card and Mobile Number details. Hit the Submit button.

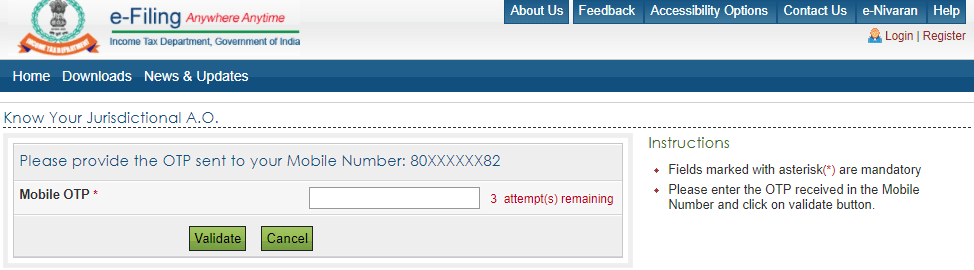

Step 4: Enter the one-time password you received on your registered number. Hit the submit option afterwards.

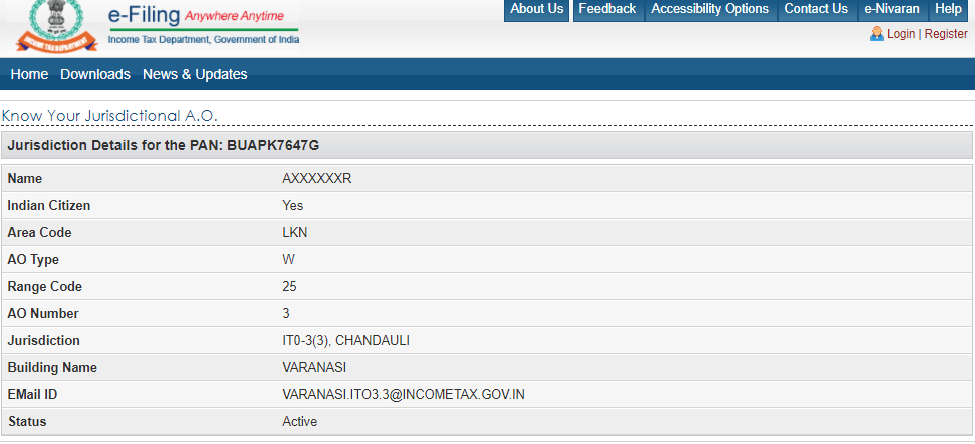

Step 5: On your screen, you can now see the complete details of PAN jurisdiction.

When Can One Change PAN Jurisdiction?

You can change PAN jurisdiction in two situations mentioned below:

- While changing your permanent residential address.

- When the behaviour of the Assessing Officer is unprofessional.

| While Changing Permanent Address | When the AO behaviour is unprofessional |

| If you change your residential address, you have to upload your new address for filing the return. The need to update the address is to make the communication between you and the income tax department easy. Here are the steps you have to follow for changing your AO as per your residential address. | If somehow your current AO is not able to carry out any task or may exhibit unprofessional behaviour then you can apply for changing your AO. You must follow the steps written below: |

| Submit your application to your current AO along with your cause of address change. | Send a complete application to the Income Tax Ombudsman. |

| Send an application to a new AO that you have submitted one application to your existing AO for address and AO change. | You have to mention your name, address, name and designation of present AO along with the reason behind your dissatisfaction.. |

| The old AO must accept the request. | Your Ombudsman must accept your application and sign it. |

| The application further will be submitted to the Income Tax Commissioner. | Along with your application make sure to send some documents in your support. |

| After the IncomeTax commissioner approves your request. Your AO will be changed. | Once the application is accepted and signed by the Ombudsman, it will be forwarded to the Income Tax Commissioner. Further, he will accept it. |

| Your current AO will be replaced by a new one shortly after. |

How Is an AO Assigned?

Contrary to beliefs, AOs are not assigned based on the information given by you. The assigning works depending on the region or ward of Income-tax you belong to. Further, the Income Tax circle depends on your geographical location, individual or not, or an Indian citizen or NRI.

The circles or wards are created to make the segregation of tax-paying persons easy to monitor, collect tax, issue refunds, impose penalties, and so on.

Below is the list of designations your ward’s Assessing Officer may possess:

- Income Tax Officer

- Deputy Commissioner

- Assistant Commissioner

- Additional Commissioner

- Joint Commissioner

Jurisdiction Details

The jurisdiction information includes the complete address of the taxpayer and the official address of the Assessing Officer and their contact particulars. These details help while applying for a new PAN or filing income tax.

Details of Jurisdiction Helpful in Various Ways

- The jurisdiction details help the income tax department in sending you a notification about any information they need or to send you your PAN card.

- Reduce the risk of inadvertent mix-ups of PAN cards or any other official letters.

- Helps in e-filing of the income tax return.

- Required this information while applying for the PAN.

AO Code

The AO code has FOUR elements, as mentioned below:

Area Code: The area you live in is known as the area code.

AO Type: The AO type represents the category in which a taxpayer comes. For example, If the AO type is C – you belong to a circle and have an annual income of more than Rs. 10 lakh. If you have an AO type W, you belong to a ward.

Range Code: It represents your Income Range and the category you belong to.

AO Number: This number signifies the Assessing Officer assigned to a particular region of the taxpayer.

Why Is Knowing Your AO and PAN Number Jurisdiction Important?

An Assessing Officer has the authority to waive or issue penalties to a PAN card holder. Also, any region or a ward can have more than one AO officer. You can contact the AO for reviewing your notice, application, notice dispute and complaint about any element related to the Income Tax. Here are the responsibilities of an AO. These reasons will explain why it is necessary to know your Jurisdiction of PAN and AO.

- For the issuance of tax refunds.

- For sending the notice if in case there is a discrepancy in the ITR.

- For assessing your income and calculating the tax owed by you.

- For offering solutions to the filed complaints in their jurisdiction.

- For the issuance of a PAN card.

- For ensuring tax collection.

- For evaluating the ITR (Income Tax Return).

Frequently Asked Questions (FAQs)

What is the purpose of the jurisdiction AO code for individuals owning PAN cards?

The sole purpose of the jurisdiction Assessing Officer code is to help identify the jurisdiction under which the PAN owner comes.

Name the elements that make an AO code?

The elements AO code is made up of are as follows:

- Code of the Area

- Type of AO

- Type of Range

- AO Number

What is the count of AO codes?

Primarily, there are four types of AO codes that identify any company or individual and affiliate them with the applicable tax laws.

What do you mean by migration of PAN?

By migration of PAN means your PAN is re-assigned to the new Assessing Officer.

How to change PAN card jurisdiction?

To change PAN card jurisdiction, you have to visit the NSDL website, apply to the option of changing the address on your PAN card and pay the chargeable fee. Afterwards, you have to apply to present your AO officer for transferring the assessment records to a new AO of your jurisdiction.

Why is migrating PAN mandatory for changing residential addresses?

It is mandatory because it allows the new Assessing Officer to process the return filed by you as per the new address.

How to know the jurisdiction of the new Assessing Officer?

You have to visit the official website of incometaxindia_COM (Replace _ with .) and select the option of Field Offices. From there, you can find the contact number and designation of AO officers.

Is it possible to migrate PAN without the transfer request getting accepted by the existing Assessing Officer?

No, it is not possible. It is because when the current Assessing Officer accepts the request, then only your application will reach the Income Tax office for final verification.

How to know that PAN has migrated to the new AO?

You can check the status of the jurisdictional AO of the PAN, need to visit the official incometaxefiling_gov_in (Replace _ with .) website. Once you reach the homepage, choose the option Know your AO.

Is it possible for me to change my Assessing Officer because of their behaviour?

You can request to change your Assessing officer if you found any behaviour issue with them.