Whether you wish to open a bank account, avail a credit card, want to have a locker facility or make any financial transaction, PAN KYC is essential. All the banks acknowledge the PAN KYC status to let their customers make hassle-free transactions.

PAN KYC policies are now stringently managed by banking firms and financial institutions to ensure the safety of customers’ assets. These procedures aid banks and other financial firms to expand and deal efficiently with all the fraudulent practices any individual or non-individuals carry out.

The provision for PAN card KYC was framed to counter bribery, tax evasion, terrorist financing money laundering, and more. To meet the regulatory and legal demands of the customers, the Reserve Bank of India (RBI) has directed KYC rules and regulations to all the banks in the country.

To know what KYC means, why it is important, and more, keep reading further!

What is KYC?

KYC or Know Your Customers is a process that helps banks and other financial institutions to know their customers.

For the process, the firms require your thumbprint, Aadhaar Data, PAN, and digital signature. Obviously, the process will be completed only when you furnish all such data and documents to the bank.

Note: The process of KYC is carried out for your enhanced security only.

The main motive of carrying out this process is to mitigate fraudulent activities such as money laundering, terrorist funding, tax evasion, identity theft, internet fraud, and more.

KYC allows banks to have access to all your details, personal information, and financial transactions. This will further help banks to monitor all forms of activities in your account.

According to the rules of the RBI, all such features lie under the legal and regulatory framework of the bank.

Why and When is KYC Required?

KYC is needed for the following situations:

- To open a bank account

- Mutual funds

- Applying for a credit card

- Making applications for a loan

- Requesting for a locker facility in the bank

- Employing changes in signatories or beneficiaries

- New landline or mobile connections

Importance of KYC for PAN Card

Completing the KYC process for PAN Card is mandatory to prevent your card from any fraudulent or kind of misuse.

PAN is considered one of the most significant documents to be submitted to complete the KYC process.

PAN Card denotes the essential financial transactions such as asset purchase of more than a specific amount, payable Bank accounts, or others.

Necessity of KYC for Mutual Fund Investments

The prime objective of KYC in mutual fund investments is to ascertain only if the real person is making the investment or deposits in the mutual fund. It also helps in mitigating the risk of black money pouring in.

Therefore, every mutual fund investor is required to follow the KYC procedure via a KYC Registration Agency (KRA). KRA is a SEBI (Securities and Exchange Board of India) registered company that stores information about the investor in a single database to which all the intermediaries and mutual fund companies have access.

Later, SEBI launched a standardised Know Your Client approach to ensure uniformity and consistency across SEBI-registered intermediaries.

Venture capital funds, mutual fund firms, portfolio managers and stockbrokers along with others found it fairly easy to prevent the duplication of KYC papers. As a result of this, investors won’t face any difficulty while complying with the KYC.

Documents Required for KYC

Following documents must be submitted for the KYC verification process:

- ID Proof: PAN, Bank Passbook, Passport, Aadhar Card, Driving Licence, or Voter ID Card.

- Address Proof: Ration Card, Utility Bill, Aadhar Card, Rental Agreement, or Driving Licence.

- Client Application Form

- Passport-sized photograph.

Steps to Check Your PAN KYC Status Online

If you have submitted the KYC forms online, you can view the PAN card KYC status in just a few steps as described below:

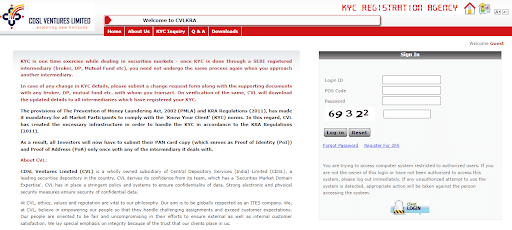

Step 1: Visit the official website of CDSL (Central Depository Services Limited) Ventures. https://www.cvlkra.com/kycpaninquiry.aspx.

Step 2: Hover over the menu bar and click on the “KYC Inquiry” option.

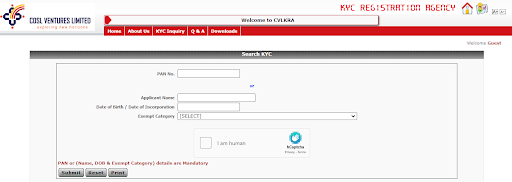

Step 3: You will be redirected to a new page namely, Search KYC.

Step 4: Enter your PAN number or fill up other particulars like your name, date of birth/ date of incorporation, and exempt category. Then, enter the captcha and click on the ‘Submit’ button.

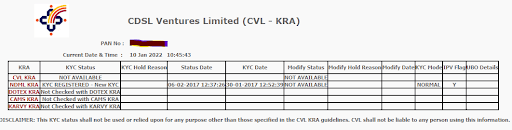

Step 5: If your KYC has been verified and registered, your KYC status will show “KYC Registered.”

However, if it’s not verified, you will view the “Pending” status on the screen.

As you can see in the picture, not only will you get the status of KYC registration, but you will also get access to view the KYC date and Status date.

In Conclusion

PAN KYC is a crucial process if you want to have a credit card, loan or initiate any financial transactions. Banks and other financial institutions will always ask you to get your PAN card KYC verification done if you want to open a bank account or invest in any mutual funds.

KYC Status by PAN is pretty easy to find out, as you may have found it in the above section. All you have to do is to submit the required documents and furnish all the important information correctly. Once the authority is satisfied with your application and document, your PAN card KYC status will stand verified and registered.

Frequently Asked Questions (FAQs)

What do KYC control?

Following are the things KYC controls:

- Collection and analysis of basic details related to the identity of an individual.

- Matching the customers’ names against a list of known parties.

- The expectation of the customers’ transactional behaviour.

Who is a ‘Customer’ according to KYC regulations?

As per KYC guidelines, a customer is considered an individual or entity having a business relationship or account with a bank.

What are the documents needed for KYC?

Often, documents vary for different banks and financial institutions based on the requirements. However, the most commonly requested documents for KYC are address proof and proof of identity.

These may comprise PAN card, Voter ID, Passport, Birth Certificate, Utility Bills, Driving licence, etc.

Besides these, a customer may also have to file a client application that must be signed along with a recent passport-sized photograph. Also, the customer must be attentive while furnishing information in the form.

In case the documents aren’t valid according to the norms of Banks, it can terminate or close the account after sending a notice to the customer detailing the reasons for it.

In case specific details such as an address is changed, will the KYC form have to be submitted again?

Yes, if the address or any other crucial information detail such as the identity of the customer has changed, the KYC form will be filled and submitted again.

Where can we obtain the KYC form?

You can get a KYC form either from your broker or the financial institution. Furthermore, you can also try downloading the same from the website of a mutual fund company, if you invest in one.