Do you fall under the slab of TDS deduction? If yes, then hop on to understand the entire TDS process, its purpose, eligibility, and much more in this blog. Since you have to pay TDS on every payment and on time, too, it is good to have complete information about it. So, let’s begin!

What Do You Need To Know About TDS?

Tax Deducted at Source (TDS) is a particular amount that is deducted from payments such as rent, salary, interest on securities, commission, professional fee, and so on. Any individual who initiates the payment has the responsibility to pay the taxes. That is how tax evasion gets lower as tax collection is done while making the payment.

Note: In the Union Budget, it was proposed that since pension and interest income are the only sources of earnings for senior citizens, they don’t have to pay or file the income tax.

Section 194P under the Income Tax Act, 1961 forces banks to not deduct tax on senior citizens above 75 years of age with a pension income and interest income.

Table of contents

- What Do You Need To Know About TDS?

- At What Time is TDS deducted?

- What Are the Types of TDS?

- What are the Different TDS Rates on Salaries?

- How Can You File TDS Return Online?

- What is the TDS Due Date of the Financial Year 2021-2022?

- Tax Deducted at Source Payment Due Date

- What are the Steps to Upload TDS Statements?

- What Do You Mean by Challan for TDS Payment?

- What is the Penalty for Late Filing TDS Return?

- What is the Process to Check TDS Deduction Status?

- How Can You Claim TDS Refund?

- What is a TDS Certificate?

- What are the Advantages of TDS?

- Frequently Asked Questions (FAQ)

At What Time is TDS deducted?

Here are some instances in which TDS is deducted:

- Any individual making payments under the Income Tax Act has to deduct the TDS when making any payment. But there will be no deduction if the payment made by the person is an individual or a HUF (Hindu Undivided Family) whose books don’t need any auditing.

- In case the total taxable income is low, you can file and claim the return of TDS refund if you fail to submit investment proof to your employer.

- If the rent payment by any individual or a HUF member exceeds Rs. 50,000, 5% TDS will be deducted (even if entries are not liable for tax audit). Also, they will not be liable to apply for the TDAN (Tax Deduction Account Number).

- If you are a working person, the TDS will be deducted as per the relevant income tax slab rates. And, the bank in which you have your bank account will deduct 10% TDS and 20% TDS if there are no details of your PAN available.

- If you have submitted your investment proof, then you don’t have to pay any tax. Therefore, no TDS is deducted. You have to submit Form 15G or Form 15H if the payable amount is low. Thus, the bank won’t charge any TDS on interest income.

What Are the Types of TDS?

Our finance minister, Mrs. Nirmala Sitharaman, added two new sections namely, 194K and 194-O, under the Income Tax Act in the Union Budget 2020.

In Section 194K, our financial minister introduces TDS on dividend income from share and mutual funds units by putting an end to DDT (Dividend Distribution Tax).

As per Section 194-O, the TDS sale at 1% for the sale of goods and services by an e-commerce participant is now aided by an e-commerce operator.

Here is the list of some of the income sources that are under the purview of the tax deducted at source:

- Any payment from an employer to an employee.

- Security interest.

- Interest excluding security interests.

- Prize money won in a game.

- Payments from contractors.

- Insurance commission.

- Maturity amount from LIC.

- Commission or brokerage.

- Any transfer of immovable assets.

- Commission on getting a property.

- Rent payment.

- Payment from commissions.

- Bank deposit interest.

- Payment paid to the director of the company, among others.

What are the Different TDS Rates on Salaries?

- The TDS rates are the same as tax rate slabs for a salaried individual. If you are below the age of 60 and earn less than Rs. 2.5 lakh per year, the liability of paying TDS will be nil.

- Individuals who earn between the income slab of Rs. 2.5 lakh per year to Rs. 5 lakh per year will have to pay TDS of a total of 5%.

- The salaried individual between Rs. 5 lakh per year to Rs. 10 lakh per year has to pay the TDS of 20%.

- And, every single person who earns more than Rs. 10 lakh annually is liable to pay the tax deducted at a source of up to 30%.

According to new rules:

- For salary between Rs. 5 lakh to Rs. 7.5 lakh, 10% TDS will be deductible.

- For a salary between Rs.7.5 lakh annually to Rs.10 lakh, the TDS liability is 15%.

- If the income of a person falls between Rs. 10 lakh to Rs 12.5 lakh, annually then the TDS liability is 20%

- For salary between Rs. 12.5 lakh and Rs. 15 lakh, the total TDS deducted will be computed as per 25%.

- And, for a salary more than or above Rs.15 lakh per annum, TDS liability will be 30%.

How Can You File TDS Return Online?

Here is the complete process to file TDS returns online as mentioned below:

- Form 27 A has multiple columns that you have to fill completely. In case you have filled in the hard copy of the form, you have to verify it with the e-TDS return (to be filed electronically)

- Mention the tax deducted at the source and the complete amount correctly in the forms.

- Mention in detail the TAN (Tax Deduction Account Number) of the establishment in Form 27A. The validation process becomes tough if the TAN number is not there.

- The right Challan number, mode of payment, and tax information must be mentioned in the TDS returns. Wrong, missed, or incorrect details would result in a mismatch with the payment dates and challan numbers, and you will have to file for the TDS return again.

- Use the basic form to file an e-TDS. Submit the seven-digit BSR Code (Basic Statistical Return Code) to ease the tally process.

- You must also submit your TDS returns physically at the TIN-FC. And the NSDL will manage the complete TIN-FCs. Submit TDS returns file on the official website of the TIN NSDL. Enter a level 2 digit and signature if your file for TDS returns online.

- If all the information is correct, you will receive a token or receipt number as an official confirmation of your TDS file acceptance. If the TDS is rejected, you will receive a non-acceptance note with all the reasons stated for rejection. Therefore, you have to file the TDS return again.

What is the TDS Due Date of the Financial Year 2021-2022?

Here are the TDS and TCS last filing dates for the financial year 2021 – 2022.

Return Filing Due Dates for TDS of Financial Year 2021-2022:

| Quarter Number | Period | Last Filing Date |

| First Quarter | From 1st April to 30th June | July 31, 2021 |

| Second Quarter | From 1st July to 30th September | October 31st, 2021 |

| Third Quarter | From 1st October to 31st December | January 31st, 2022 |

| Fourth Quarter | From 1st January to 31st March | May 31st, 2022 |

Return Filing Due Dates for TCS of Financial Year 2021-2022:

| Quarter Number | Period | Last Filing Date |

| First Quarter | From 1st April to 30th June | July 15th, 2021 |

| Second Quarter | From 1st July to 30th September | October 15th, 2021 |

| Third Quarter | From 1st October to 31st December | January 15th, 2022 |

| Fourth Quarter | From 1st January to 31st March | May 15th, 2022 |

Note: Once you upload a quarterly TDS return, you are eligible to generate a quarterly TDS/TCS certificate within 15 days.

The payment deposit due date for both government and non-government personnel is the 7th of the upcoming month (except for March; the due date is April 30th).

Tax Deducted at Source Payment Due Date

If the upcoming TDS return date falls on Sunday or a public holiday, then you can pay the TDS on the upcoming working day or a Monday.

In case you are employed in a company, you will not have to worry as the TDS will get deducted automatically at the time of salary payment.

However, if you are self-employed, you have to file your TDS on your own. Keep track of TDS filing due dates near Sundays or public holidays so that you don’t incur a late penalty.

What are the Steps to Upload TDS Statements?

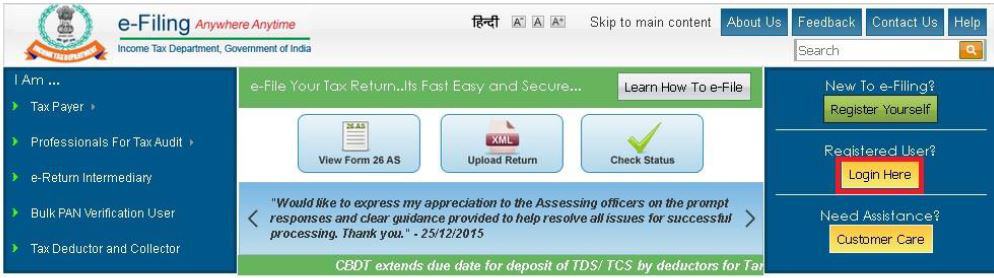

Here is a guide for you on how to upload TDS statements on the Income Tax portal.

Step 1: Visit the income tax portal on the official website and click on the login option.

Step 2: Enter your credentials to log in. Your user ID is always your TAN. .

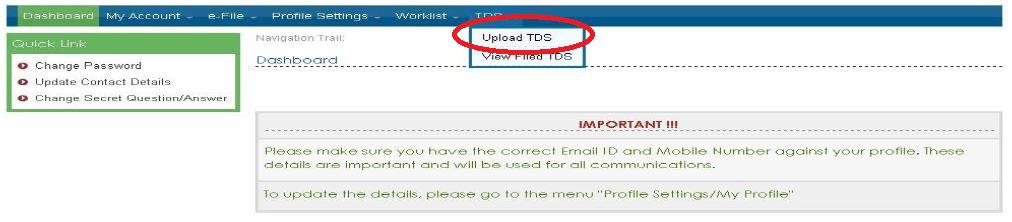

Step 3: Click on option Upload TDS present under the tab of TDS.

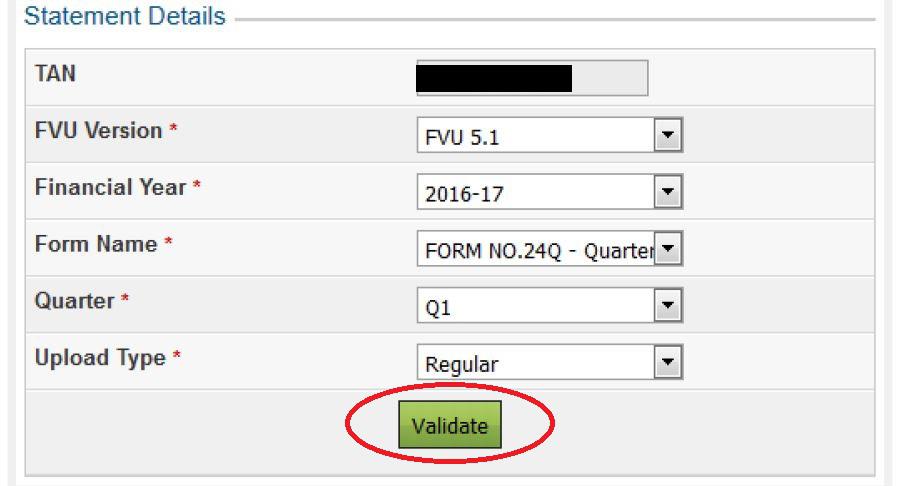

Step 4: Fill in the details like TAN, preferred FVU (File Validation Utility) version, financial year of the TDS statement, quarter of the year, statement upload type and click on Validate.

Note: You can upload TDS statements from the financial year 2010-11 and regular statements of the financial year, available on the income tax website.

Step 5: Your income tax return will be validated in two formats:

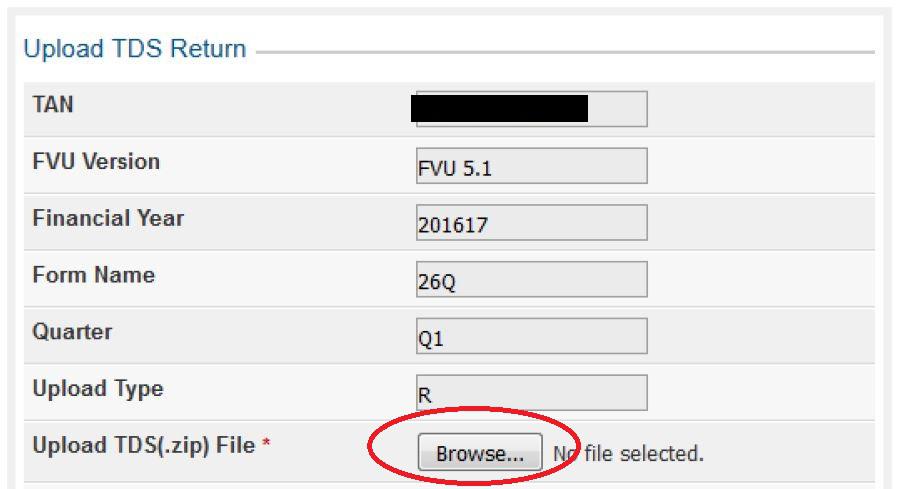

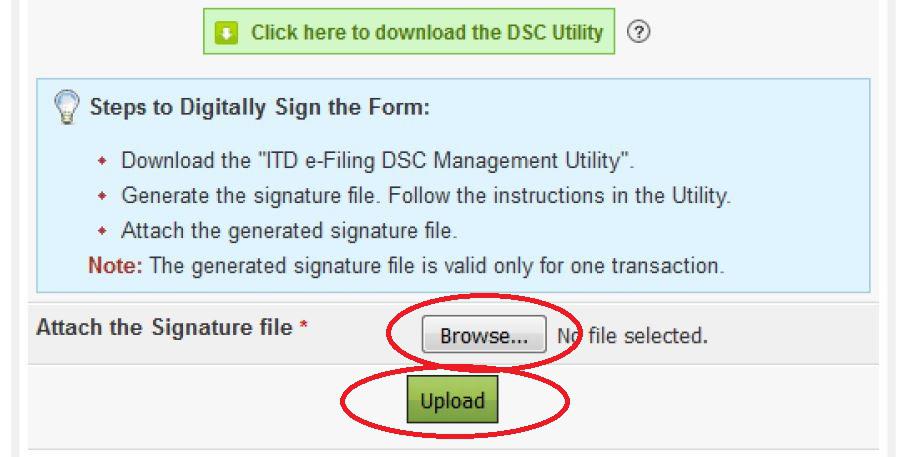

Step 5A: Verification will be done using Digital Signature Certificate (DSC). You can also upload the TDS statements using DSC. First, upload the TDS statement file in a zip format. Then, attach your digital signature and hit the Upload button.

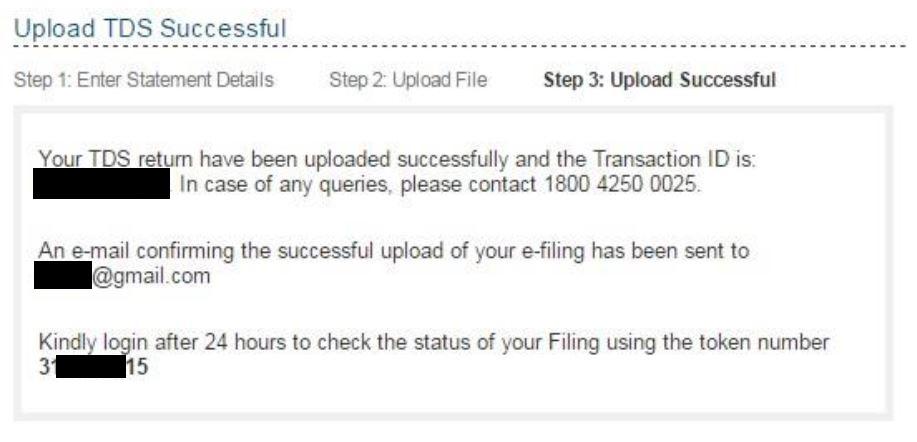

Once the TDS statement is uploaded, a message stating SUCCESSFUL will display on your screen. An email will be sent to your mailing address as well for confirmation.

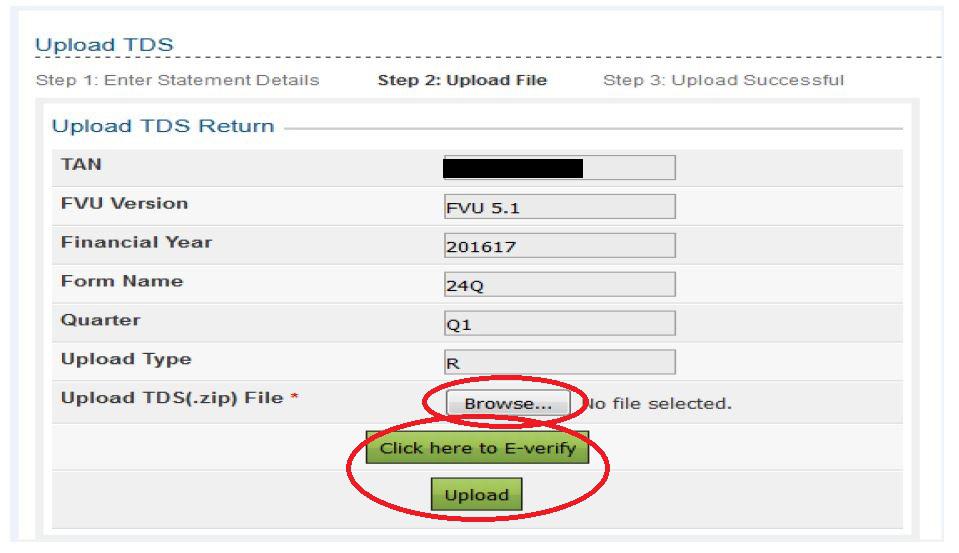

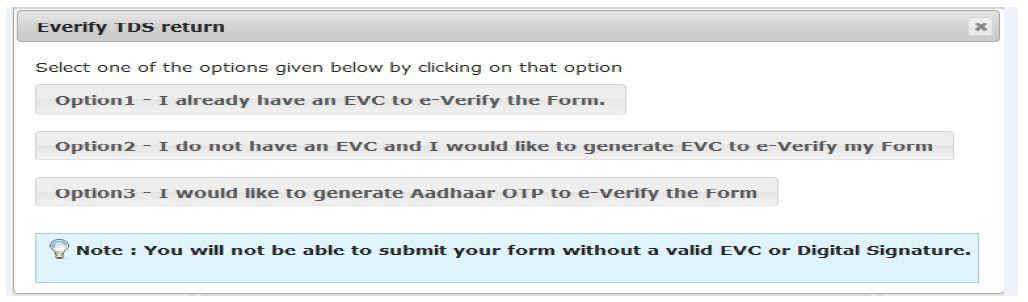

Step 5B: Use your EVC (electronic verification code) that you received after completing step 4. You have to first Upload the TDS zip file and press Click here to E-verify.

In the next screen, you will have the option to use an EVC. The EVC is either already generated or you have to generate a new EVC.

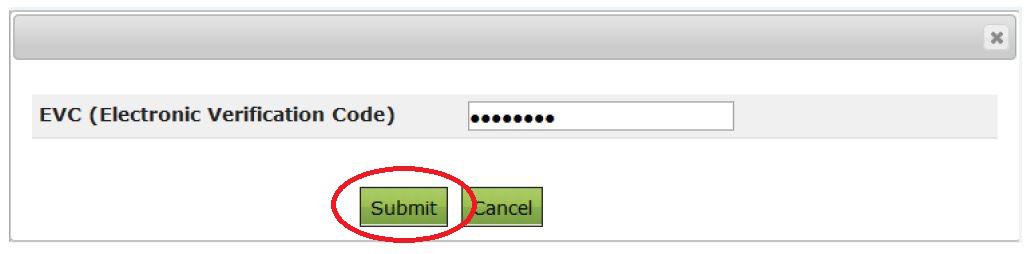

Select the suitable option, enter the EVC and hit Submit.

What Do You Mean by Challan for TDS Payment?

The Challan form for making online TDS and TCS payments is known as Challan ITNS 281. It is applicable for corporates and non-corporates and is issued when TDS or TCS is paid.

What is the Penalty for Late Filing TDS Return?

Different penalties are levied upon by the Income Tax Department for not paying or submitting the TDS return or statements on time. Let’s check what conditions incur these penalties.

When You Fail to Submit Your Returns

As per Section 272 A (2) of the Income Tax Act, 1961, there will be a daily fine of Rs. 100 till the TDS is paid.

When You Fail to File Your Returns on Time

As per section 234 E of the Income Tax Act, 1961, there will be a daily fine of Rs. 200 till the remaining return is filed.

When You Fail to File a TDS Statement for Defaults

According to Section 271 H of the Income Tax Act, 1961, one has to pay a hefty charge of Rs. 10,000 to Rs. 1,00,000 if you made default statements while filing TDS returns within its due date.

When You Mistakenly Provide Incorrect Details

According to Section 271 H of the Income Tax Act 1961, a penalty of Rs. 10,000 to Rs. 1,00,000 will be imposed on the defaulter for submitting incorrect data such as wrong PAN number or Challan particulars, TDS amount, and so on.

For Zero Payment of TDS

As per Section 201 A, both interest and penalty are charged if the TDS is not paid within the due dates. If a part of the entire tax amount or the whole is deducted at the source, there will be an interest of 1.5% per month. This interest will be charged from the date on which the tax was deducted till the date on which the tax actually got deducted.

What is the Process to Check TDS Deduction Status?

Here is a step by step guide for you to check the status of TDS:

- Go to the official website of the Income Tax Department.

- Log in using your credentials.

- Under the “My Accounts” tab, you have to click on “View Form 26 AS.”

- Select the year and the PDF format in which you want to download the file.

- The file you will download is password protected. Mostly the password created is the date of birth on your PAN card.

- Use all the information related to the TDS deduction.

- You can also use your bank facilities or net banking facility to check whether your TDS has been deducted or not as it is linked to your PAN.

How Can You Claim TDS Refund?

All citizens can claim the TDS refund on the official Income Tax Department website. Nevertheless, the Income Tax Returns needed to be filled, and the TDS refund must be displayed. Once the ITR is filled, the refund of TDS will be processed by the Income Tax Department. Within the time period of six months, your refund will be credited back into your account. Also, the individuals can check the status of the refund on the same official website.

What is a TDS Certificate?

There are two types of TDS certificates:

These two forms, under Section 203 of the Income Tax Act 1961, are certificates the deductor offers to the taxpayer. The certificate displays the total amount deducted as tax.

For a salaried class:

For salaried individuals, employers will have to provide them with Form 16 and mention the amount that will be deducted in the form of TDS. Form 16 has all the information such as the calculated tax, deduction of tax, and payment of TDS. The employers, therefore, must issue this form to their employees before May 31st of the subsequent financial year.

For a non-salaried class:

The person deducting the tax offers the tax-paying person with Form 16A that has all the information of the calculated tax, the deduction of TDS, and the payments made.

What are the Advantages of TDS?

The advantages of TDS are as follows:

- TDS ensures that people cannot avoid or evade paying taxes.

- TDS acts as a constant source of revenue for the Indian government.

- TDS deduction is a more convenient method and easy if automatically deducted rather than paying.

- TDS reduces the load of Tax Collection Agencies.

You May Also Read:

Frequently Asked Questions (FAQ)

What is the full form of TDS?

TDS is an acronym for – Tax Deducted at Source.

Tell the use of the TDS challan.

TDS challan is used for collecting the tax deducted at source (TDS) by the Indian government.

Is TDS deductible only by salaried individuals?

Any person with an annual income of Rs.2.5 lakh or Rs. 5 lakh will have to pay taxes. Hence TDS is required to be paid by all salaried and self-employed persons.

Is PAN necessary for the payment of TDS?

Yes. PAN details are needed for TDS payment.

What penalty does a company have to pay if it fails to submit the returns within the due date?

A company has to pay a penalty fee between Rs.10,000 and Rs.1 lakh under Section 271 H.

What penalty does a company have to pay if it fails to deduct TDS on time?

According to the rules under Section 201 A, the per annum interest is 1% only. And, it will be charged from the deduction date to the date on which TDS got deducted.

What makes TDS and TCS different from each other?

TDS is a tax that is deducted when a payment made by a company to an individual exceeds a certain limit. Whereas, TCS is the tax collected by the sellers while they sell something to the customers or buyers.

How much TDS will be deducted if my salary is Rs. 5,00,000 annually?

If you have an annual salary of Rs. 5,00,000 then 5% TDS will be deducted from your salary.

Can TDS be refunded?

Yes. If the TDS collected from you is more than the payable amount to the government then you can get a TDS refund.

What is the new TDS rate?

The TDS rate varies from 1% to 10% depending on the payment of contractors or professional services. The TDS rate as per the newly introduced Union Budget for 2021 varies between 1% to 30%.