The non-constitutional body, EPFO, promotes the employees to save funds for their retirement, known as EPF. The introduction of online systems by the body to facilitate and make the EPF transfer claims and withdrawals by the members through the online platforms. With this system, the employees can transfer PF online from their previous employer to the new employer. They can also withdraw the amount partially or completely with ease.

The transfer of PF online will save a lot of time and gives the employees the freedom to transfer their funds from the comfort of their homes. If the employee is in the middle of changing their job, the process of EPF transfer can be simplified and can get completed in just a couple of minutes.

The PF transfer process is quite simple. As a PF holder, log in to the Unified EPFO Member Portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/ to transfer your funds.

In order to make it an ideal saving for retirement, it is important to transfer PF to the new employer. But You must be thinking, “How to transfer PF online?”. PF holders can also follow the steps for the PF transfer process mentioned below to transfer PF online.

Table of contents

How To Transfer EPF Online?

Steps to PF Transfer Process:-

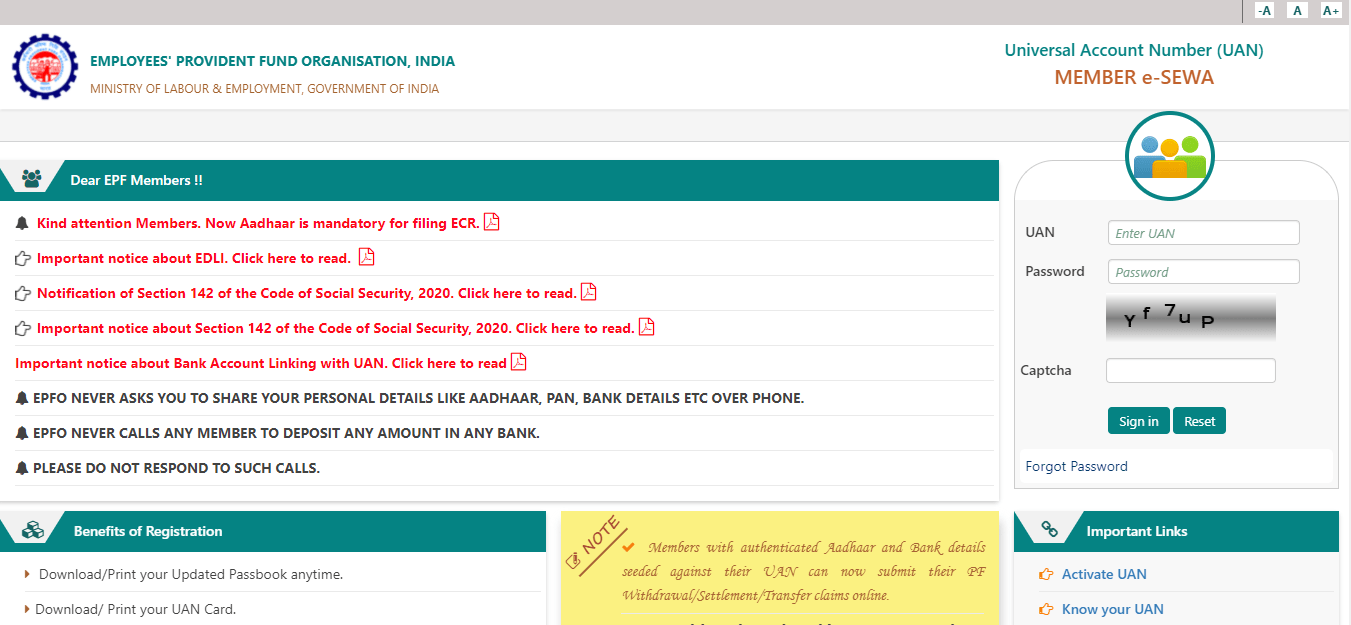

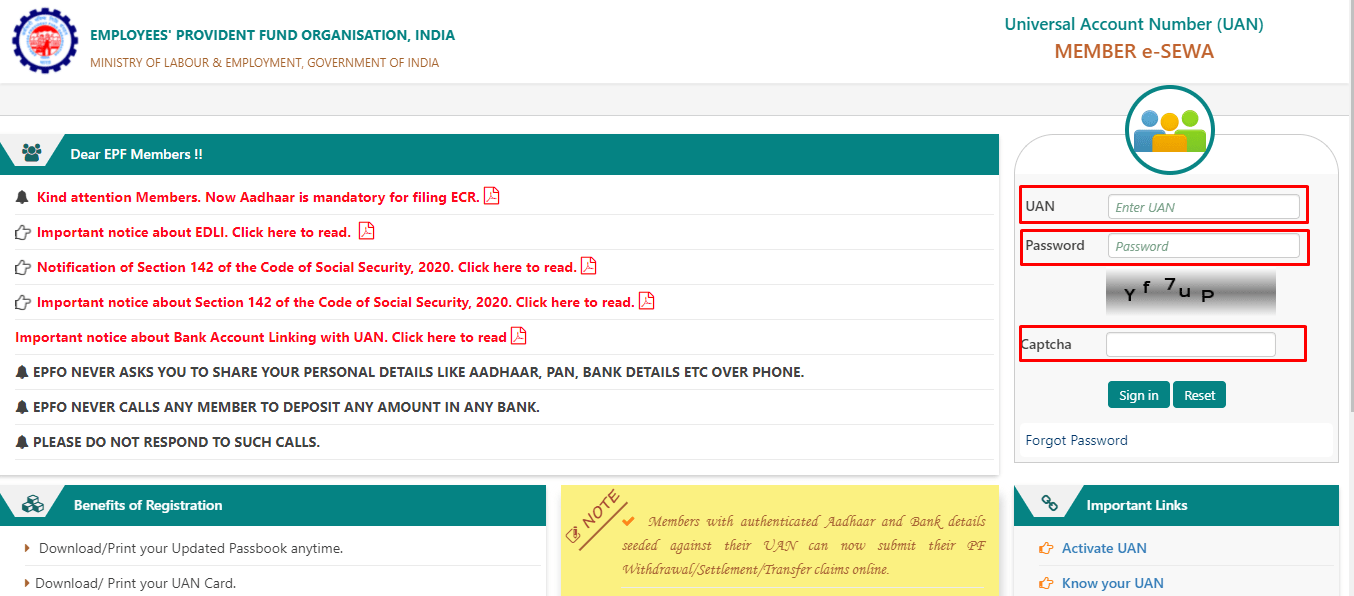

- Visit the official site of Unified EPFO Member Portal, https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Sign in to the EPFO Members Portal using your password and UAN (Universal Account Number).

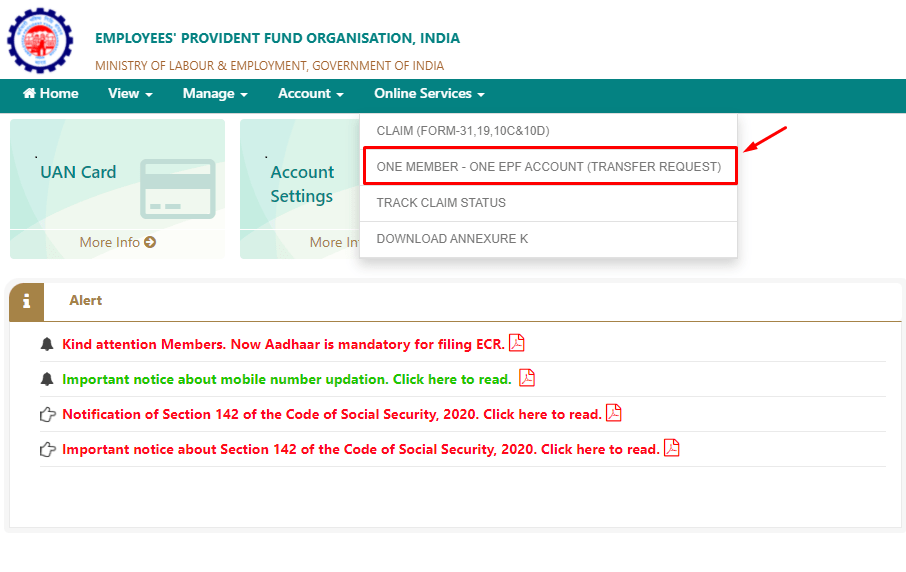

- After logging in, click on the option “Online Services” on the homepage.

- Click the option “One Member- One EPF Account (Online Transfer)”

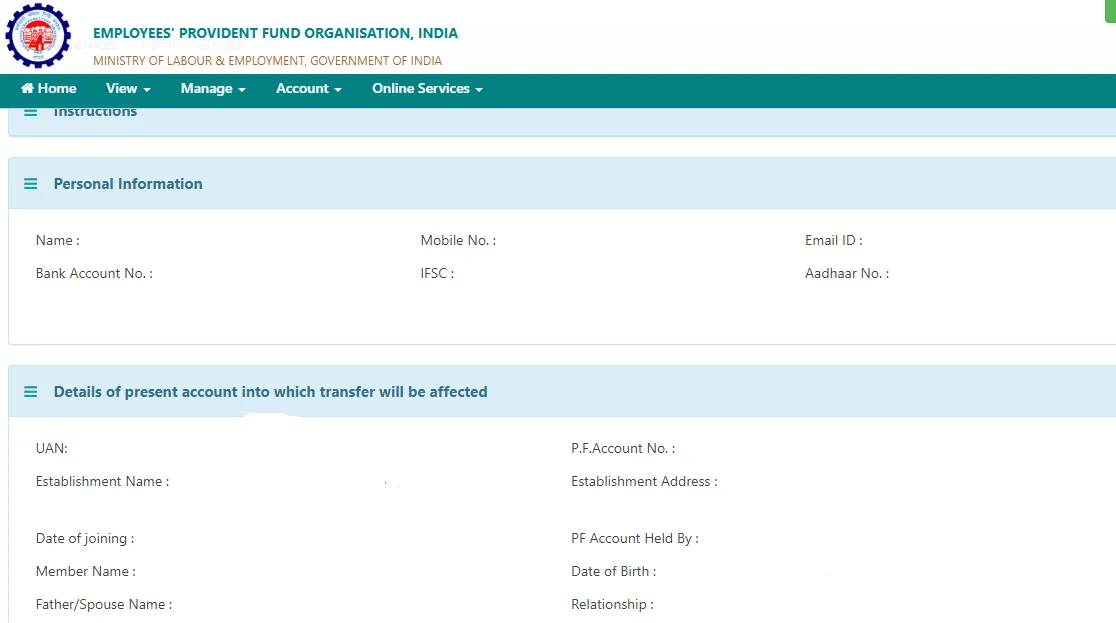

- Then click on the option “Get Details”.

- After clicking on the option, the details of PF from your previous employer will appear on the screen.

- After you have confirmed and verified your details (EPF number, date of birth, and date of joining), go to the page where you need to provide the details of your previous employer.

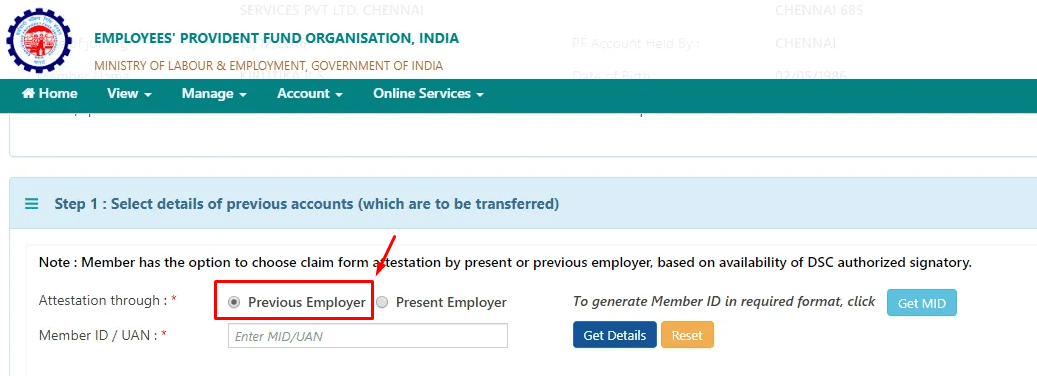

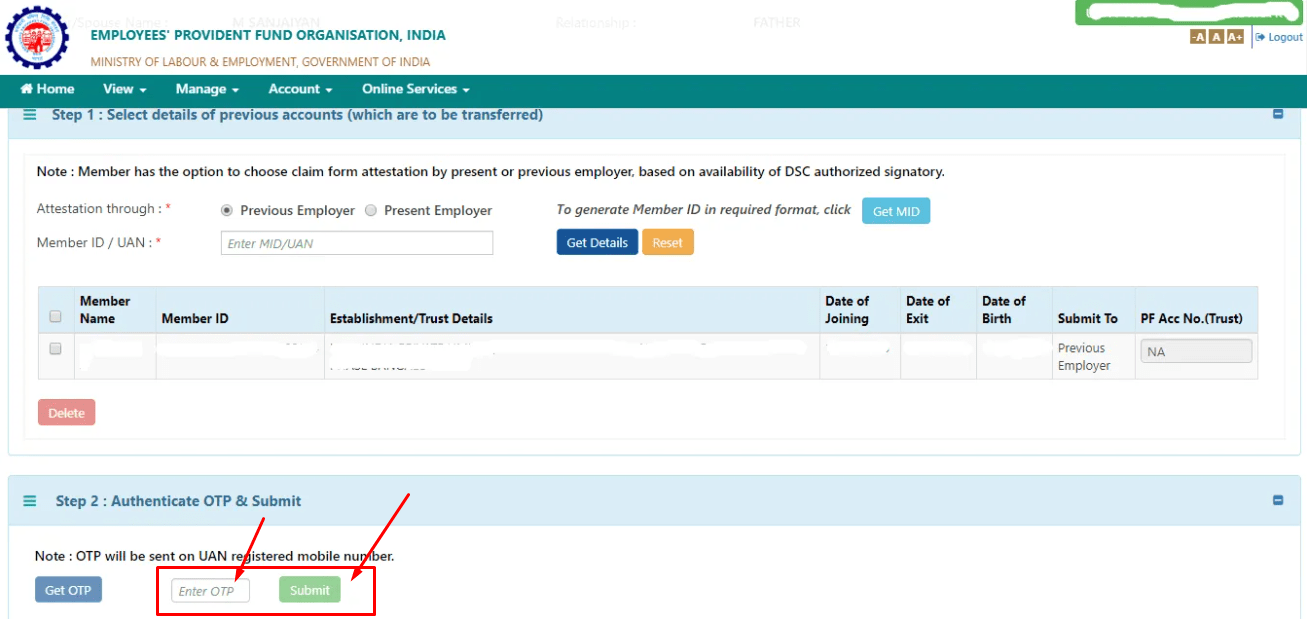

- From the displayed details and the attested form, employees need to choose the previous employer or the current employer to transfer the funds.

- Now, click on the option to get the OTP on your mobile number registered with the UAN.

- Enter the received OTP on the page and then click on submit.

A tracking id will be generated after submitting the request that you can use to keep track of and status of the request that you raised.

Note: If the PF holder wants to transfer PF online, it should be made sure that the UAN registered mobile should be working or active in order to receive the OTP. The EPF transfer will only be successful when it will be attested by your current employer or the previous employer based on the option you chose.

How To Transfer PF Online Using UAN?

With the help of UAN, the transfer PF online process becomes easy. It is the simplest way to transfer your PF account. But let’s first know what a Universal Account Number or UAN is.

After becoming an EPFO member, a 12-digit unique number is given to you by the Ministry of Employment and Labor. This unique number will help you in maintaining your EPF account(s). At the same time, this UAN number helps the government to keep track of the PF activities of the citizens. It also helps the government in centralizing the track record data of citizens. With the active UAN, you can easily transfer PF online.

- While joining a new company, you will have to fill out the Composite Declaration Form or F-11 Form and submit it to the new employer.

- This form will have details about your previous employer and the UAN number. The new employer will then submit the details on the EPFO website.

- The new employer will verify your application and whether the UAN is linked with Aadhar or not. If the previous employer has already verified this detail, the EPFO portal will automatically start the PF transfer process.

- Then, you will get a message on the UAN registered mobile number that the PF transfer process has started.

- As soon as the new employer deposits the first month’s PF contribution to your EPF account, the EPF transfer process will be complete.

Eligibility To Transfer PF Online:

- An activated UAN of the employee on the EPF portal.

- The employee should provide his bank details that including the account number and IFSC code that should be verified by the employer when the transfer request is made.

- The Aadhaar details of the employee should be linked to the UAN number.

- Both the Date of Joining (DoJ) and Date of Exit (DoE) should be updated on the EPFO portal, along with the reason for exit from the company.

- Against one ID, only one transfer request will be accepted by EPFO.

Why Do You Need to Transfer Your PF?

The employee no longer needs to close the EPF account with their previous employer. Instead, they can transfer PF online to the new employer. It is a safe, long-term investment by the employees backed by the Government Of India. So, it is better to do the EPF transfer rather than withdraw the PF amount.

If your EPF transfer has not been done, do it as soon as possible. But in any case, such as lack of UAN, PF account number, or any other formalities, you are unable to complete the PF transfer process, and your old account will still continue to earn the EPF interest.

There are cases where the employees do not transfer their EPF because of the formalities and lack of the UAN or PF account number. Their EPF account still continues to earn the EPF interest rates (currently, it is 8.5 percent), but at the same time, because of non-contribution to the account, the interest earned in that EPF account becomes taxable.

In some cases, it can also affect the continuity of PF contributions that can dent the pension benefits of the EPF account holders. The interest earned EPF amount becomes taxable from the moment the EPF contribution stops. Also, according to the new EPFO norms, three years after the 58 years of EPF account holders will continue to incur the EPF interest through the EPF contribution in the left EPF account. This PF income will also become taxable.

If you fail your EPF transfer, you might also lose the continuity of your EPF account too. The EPFO subscribers get EPF benefits after at least 15 years of continuous contribution to the EPF account under the EPS scheme.

So, if in case a person has not done the PF transfer process, they can link their old EPF account to their new UAN number anytime. This will help in maintaining the continuity of the account and claim the benefits under the EPS scheme after the scheduled time.

Info or Documents Required for Transferring the PF Online

Here is the list of documents and information that the employee should keep with themselves while applying for transfer PF online:

- Revision Form 13.

- Valid identity proof such as Aadhar card, PAN card, or driving license.

- Details of old and current PF accounts.

- Mobile numbers registered on the EPFO website should be active.

- Activated Universal Account Number or UAN in the UAN portal.

- Approved and verified e-KYC from the employer.

- Details of the current employer.

- Establishment Number.

- PF Account Number.

- Bank account details of the account in which the employee receives or received the salary.

To transfer PF online, an employee should meet the criteria mentioned above and submit it on the EPFO portal. If by any chance, the employee fails to meet any of the mentioned requirements, they can visit the E-Sewa portal managed by the EPFO. Here, they can raise their query as the portal is meant to seed the KYC and other details required for the transfer.

Stride Through the PF Transfer Process

The EPF transfer or the Employee Proficient Fund transfer can be done both online and offline. You can go for the option that is more convenient. Those who want to transfer PF online should have an activated UAN and the Aadhaar, bank account details with IFSC, and mobile number linked with it. The PF transfer process through an online portal is mentioned above.

And those who want to go for offline EPF transfer can simply follow the steps mentioned below:

- In the offline mode of PF transfer, employees are required to fill the Form-13 and submit it to their new or current employer.

- The current employer will forward the form to the EPF office. Then, the EPF office will send the form to the previous employer of the employee for verification and attestation.

- Once the receipt is verified as well as attested by the previous employer, the EPF office will transfer the balance of the old EPF account to the new EPF account.

Note: Through the offline PF transfer process, the employee does not need UAN or Aadhaar details.

Status Check Of EPF Transfer Request

If you are applying for PF transfer through offline mode, it will be impossible to track the PF transfer request. But in the online mode, you can simply log in to the Online Transfer Claim portal. Or you can also visit the EPF claim status check on the EPFO portal to check the status of your transfer PF online request.

Also, if the applicant is not happy with the status or has any other issue regarding his/her request’s status, they can simply go to the EPF Grievance Portal to know the exact track of their EPF transfer request.

The bottom line is that being an employee, one should never forget EPF transfer while joining a new company. It is important to make your EPF transfer successful by uploading the documents, and keeping your UAN activated link with the Aadhaar and bank details. Also, keep the number associated with the number active. By continuing your contributions to the EPF account, you can get numerous benefits after a certain time.

You May Also Like

Frequently Asked Questions (FAQ’s)

How Long Does it Take for PF to Transfer Online?

Requesting the EPF transfer online is easy, and the approval for the request can take up to 20 days.

How Can I Transfer My PF From One Account to Another in UAN?

On the EPFO portal, log in to your EPF account using your password UAN. In the ‘Online Services’ choice on the portal, select ‘Transfer Request’. Fill in the EPF account details of the previous one and then submit the transfer request for attestation to your previous or current employer.

How Can I Transfer My PF From One Company to Another?

To transfer your PF from the old company to the new one, you will have to fill out Form-13, as well as a copy of signed download claims. Submit the documents to your current or previous employer within a span of 10 days. You can also apply for PF transfer through the EPFO portal.

What if I Do Not Transfer My PF Amount for a Long Time?

If an employee does not transfer their PF account, they will keep receiving the interest in that account. But the interest earned will become taxable during withdrawal.

Is it Mandatory to Transfer PF to a New Employer?

It is important to transfer the PF account from the previous employer to the current employer by submitting Form-13 to take the benefits of EPF schemes. The employee can apply for transfer through the EPFO portal.

Can I Have 2 active PF Accounts?

It is not possible to have two PF accounts under the same UAN and get the benefits. As the PF requires verification through the Aadhaar, you will have to submit the UAN number and get the PF amount contribution in one account.