According to the unified portal of the Employees’ Provident Fund Organisation, mandatorily linking your UAN with Aadhaar is a pressing priority. If you wish to withdraw or transfer your PF balance, then linking your Aadhaar card number to your employee provident fund (EPF) should be on top of your priority list as it helps in speeding up the claim settlement process. When the PF Aadhaar link is successfully done, chances of discrepancies become zero as the information across other platforms remains coherent and accurate. The icing on the cake is that the prospects of fake accounts or duplication are mitigated.

Employees can opt for either online or offline methods to link their EPF account with an Aadhaar card. It totally depends on their suitability and convenience. According to the unified portal of EPFO, if you yearn to file an online claim, then for the same you need your UAN account linked with Aadhaar. Linking of Aadhaar with an EPF account proves to be a boon as it helps in establishing their identity and it makes the employee eligible for claiming the benefit related to gratuity, pension and many other.

Latest Update About EPF Aadhaar Link

As per the latest EPF Aadhaar update – all the employees who contribute a certain amount of their salary towards the PF are obligated to link their UAN with Aadhaar, that too afore 31st August so that the EPF amount is credited to their account on a timely basis. The government of India has made the linking process mandatory so that employers can effortlessly file Employee Cum Return (ECR) challan and deposit the money in Employees EPF accounts on time. In case, any employee fails to link their Universal Account Number (UAN) with Aadhaar before the deadline which has been extended till 31st March 2024, the employer will not be able to add an amount to your Employees Provident Fund (EPF) account. Additionally, you will also be circumscribed from making a withdrawal from your very own account. For the existing EPF members, the government announced this via section 142 which came into effect from May 3, 2021, via an official notification dated April 30, 2021.

Table of contents

EPF Account with Aadhaar Card Linking Process

All in all, there are four ways to link Aadhaar with an EPF account online. Have a Glance!

Methods

- Link UAN with Aadhaar on the Member Sewa Portal.

- Linking through UMANG App.

- Through OTP verification on the e-KYC portal of Employees’ Provident Fund.

- Linking with the use of biometric credentials on the e-KYC portal of EPFO.

Method 1: Link EPF Account with Aadhaar by Member Sewa Portal

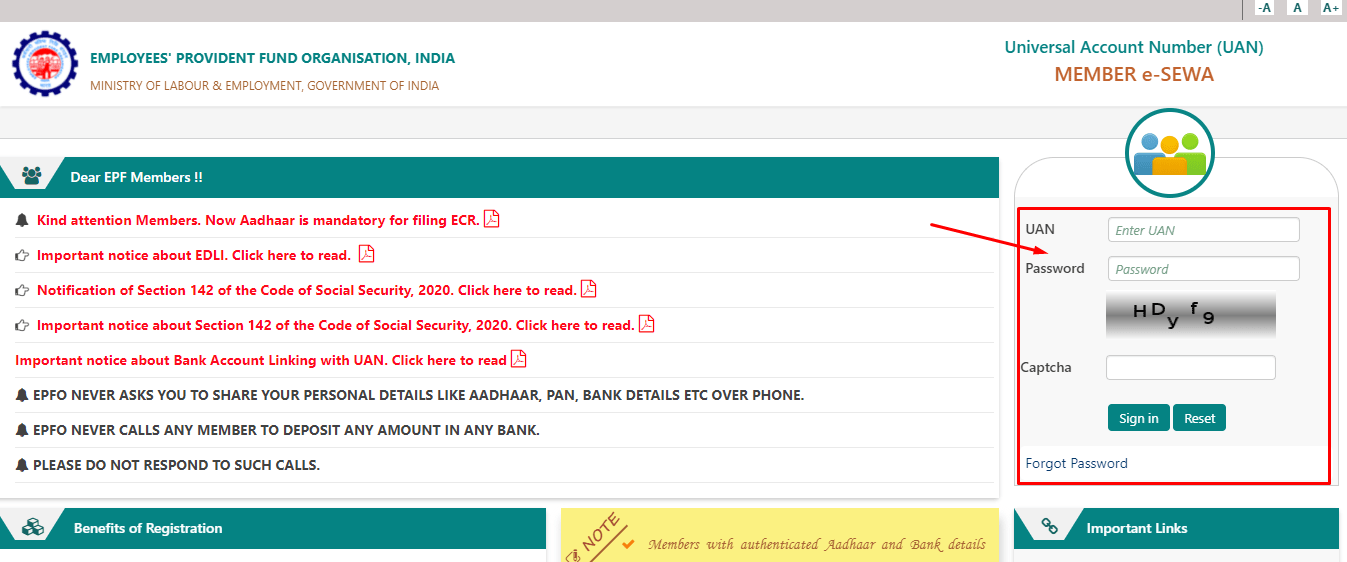

- First of all, log in to the Member Sewa Portal via this authentic link https://unifiedportal-mem.epfindia.gov.in/.

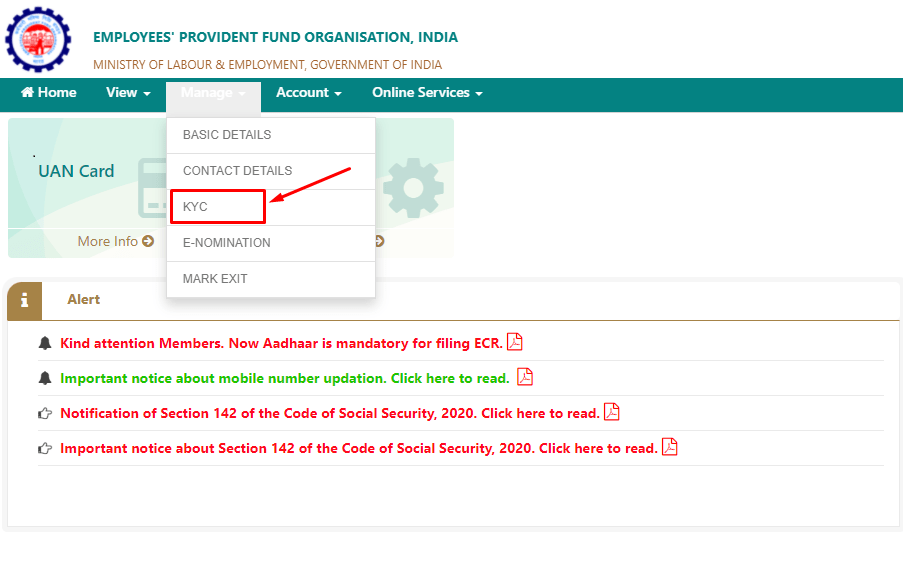

- Next, click on the KYC option that will be under the ‘Manage’ tab.

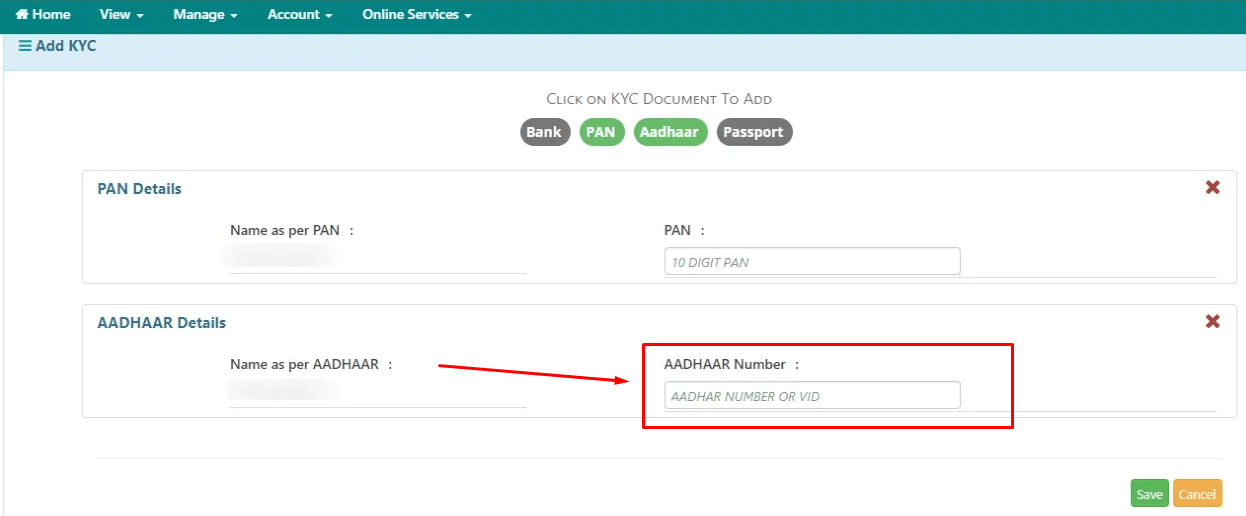

- After that, click on the Aadhaar option to add a KYC document.

- In the next screen, you will see your Name, the one that is mentioned in Aadhaar. Subsequently, you will be prompted to enter your Aadhaar number.

- In case, you do not want to share your confidential Aadhaar number, then in that scenario, you can enter your virtual ID number as well.

- Furthermore, you will be required to provide your consent for linking the EPFO account with Aadhaar.

- At last, save the changes by selecting the save option. Once your Aadhaar number is saved, it will start showing under the ‘pending/incomplete KYC’ tab. Ask your current employer to approve so that your UAN is linked with Aadhaar.

Now, after getting it approved by the employer, it needs to be ratified by the EPFO since after that only the linking process will be completed.

Method 2: Link EPF Account with Aadhaar Using UMANG App

For linking EPFO account with Aadhaar, download UMANG App from Apple Store or Google Play store. Register yourself on the app to enjoy the benefits. Follow the below-mentioned steps for trouble-free UMANG UAN Activation.

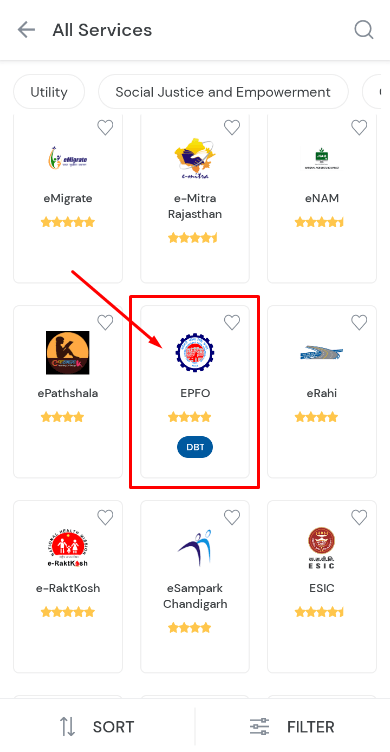

- First and foremost, click on the EPFO option which is present under the ‘All Services’ Tab.

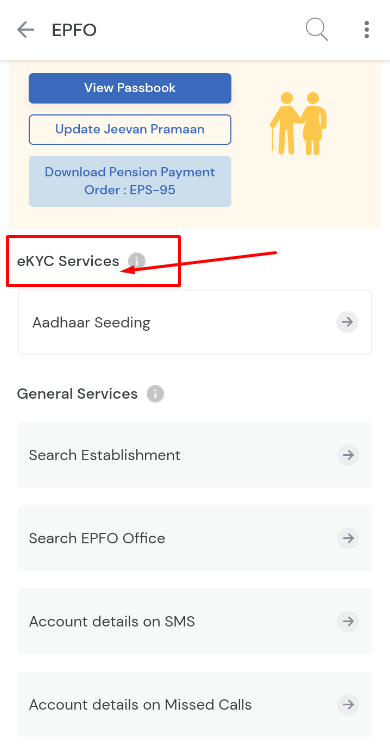

- Now, select the option ‘eKYC services’ which is present under the ‘EPFO’ option. Subsequently, select ‘Aadhaar Seeding’ option

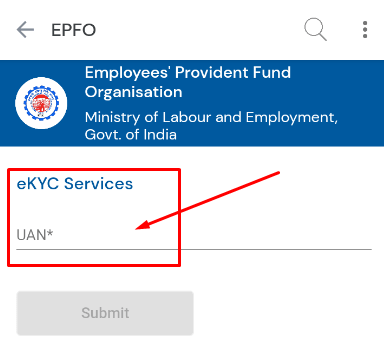

- After that, enter your UAN number and click on the ‘Get OTP’ option.

- Wait for the OTP that will be sent to your registered mobile number. The one that is linked with your EPFO account.

- Once you are done with OTP verification, then enter your Aadhaar details.

- In a while, another OTP will be sent to your Aadhaar registered mobile number and email.

- Once you are done with the second OTP verification, your Aadhaar will get linked with your UAN number successfully.

Method 3: Link EPF Account with Aadhaar on e-KYC Portal Using the OTP Feature

- First and foremost, open the link https://iwu.epfindia.gov.in/eKYC/.

- Now, select the EPFO members’ option and then click on the ‘Link UAN Aadhaar’ option.

- Next, in your UAN form, fill the accurate details and once you are done filling click on the ‘Submit’ option.

- After that, OTP will be sent to the registered mobile number.

- Once OTP verification is completed, enter your Aadhaar details.

- Now, as per your suitability you can select the Aadhaar verification method either by using mobile or email.

- In a short span of time, another OTP will be sent on a registered email or mobile number.

- Once the verification is done successfully, Aadhaar will be securely linked to your EPF number.

Method 4: Link EPF Account with Aadhaar by Using Biometric Credentials on e-KYC Portal of EPFO

For linking through this way, you ought to have a registered biometric device for Aadhaar verification.

| POINT TO BE NOTED

To learn about the specific guidelines on biometric devices, refer to UIDAI’s website. |

Follow the below-mentioned steps for linking UAN to Aadhaar using biometric credentials:

- First and foremost, open the link https://iwu.epfindia.gov.in/eKYC/

- After the page is opened, under the EPFO member section, click on the ‘Link UAN Aadhaar’ option.

- Enter your Universal Account Number details.

- Next, a One-time password will be sent to the UAN registered mobile number.

- Once the OTP verification is completed, enter your Aadhaar details.

- Now using the Biometric option, select the Aadhaar verification method.

- After verification, Aadhaar will be automatically linked with UAN.

How to Link EPF Account with Aadhaar Offline?

If you are pondering whether the EPF/UAN Aadhaar link offline process is available or not, then be relieved as an offline option is available too. For the offline process, the cardholder needs to be physically presented at any of the common service centres or EPFO’s branches. For this account holder is obligated to submit an application in person with a self-attested photocopy of your Aadhaar card. Hence, PF Aadhaar Link Offline process is pretty effortless and straightforward. Have a look.

- Predominantly visit the EPFO branch and after that fill the accurate information in ‘Aadhaar Seeding‘ Application Form.

- Cautiously fill in the UAN details and requested Aadhaar card number details.

- After self-attesting the copies of your UAN, PAN and Aadhaar card, submit the application form.

- Once it is verified, your Aadhaar number will be linked to your EPF account successfully.

- Post verification, you will assuredly get a notification on your registered mobile number.

| DISCLAIMER

Before you move ahead with linking the EPF account to Aadhaar, ensure your Universal Account Number (UAN) is active. |

How to Activate Your UAN?

- Open the online website https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- After that, click on the ‘Activate UAN’ option. Once you click on it the website will redirect you to a new tab. On the redirected page, enter the details such as Universal Account Number, PAN, Aadhaar, Member ID and other necessary details like mobile number, your good name and date of birth.

- Next, enter the captcha code and select the ‘Get Authorization Pin’ option.

- Once you select the option, OTP or PIN will be sent to your Aadhaar registered mobile number. You will be prompted to check the details and enter the OTP Pin.

- Subsequently, select the ‘Validate One Time Password’ option and click on ‘Activate UAN’ as well. After your UAN is activated, the password will be sent to your Aadhaar registered mobile number.

You can use the password that is sent on your mobile to sign in to your account on the unified portal of EPFO (https://unifiedportal-mem.epfindia.gov.in/memberinterface/).

Once your UAN will be activated, the portal will show the status of UAN activation.

Benefits of Linking EPF Account with Aadhaar Card?

If you link your 12-digit Aadhaar number to your Employee Provident Fund (EPF), then one can enjoy an assortment of benefits, specifically those employees who are planning to withdraw money from their EPF account. Here are the detailed benefits of linking the Aadhaar with the EPFO account.

- Less Prospect of Discrepancy and Errors: When Aadhaar is linked with the EPF account, the error becomes fewer as the information remains coherent across every platform.

- No Requirement of Attestation from Employer: Once Aadhaar is linked with an EPF account, then for withdrawing the amount there is no requirement to attain an attestation by your employer.

- Gives Access to Track Multiple Member IDs: After linking Aadhaar with EPFO, you can easily track multiple member IDs.

- Helps in Accelerating the Claim Settlement Process: When you link the EPF account with Aadhaar, your claim settlement process is escalated at a fast pace.

- Verification of Detail Becomes Easy: It gets effortless to scrutinize your details and identity as the UIDAI can access all your biometric and basic information.

- Alleviates the chances of Duplicate or Fake Accounts: When you link your Aadhaar to EPF, there are fewer prospects of duplicate or fake accounts. Since a single employee can only possess one EPF account that is linked to one Aadhaar account.

How to Scrutinize if Your EPFO Account is Linked with Aadhaar?

If you are irresolute whether your UAN is linked to your Aadhaar or not, then follow the below-mentioned steps for the same.

- First and foremost, visit the member sewa portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Next, to sign in to your EPF account, enter your Universal Account Number (UAN) and password.

- After you are logged in successfully, click on the ‘KYC’ option under the manage tab menu.

Now, under the substantiated documents tab, check whether your Aadhaar number is visible and approved, if it does then it means your UAN is linked with Aadhaar. In case, not visible under the verified documents tab, then that means you are obligated to link your UAN with Aadhaar.

Now, you must be wondering how to link Aadhaar with EPFO or how to update Aadhaar card in EPFO. Did we fathom it right? If the answer is yes, then look no further. Check out the different processes of the EPFO Aadhaar link online.

| Key Takeaways

If you wish to file an EPF withdrawal claim online, then it is compulsory to link your EPF account with Aadhaar. However, before starting the linking process ensure your UAN is active and is working without any error. |

You May Also Like

Frequently Asked Questions (FAQ’s)

What is the cost for linking Aadhaar with an EPF Account?

There is no additional fee to link your Aadhaar to an EPF account.

Is it possible to delink the Aadhaar number from the UAN portal?

No, once the Aadhaar is linked you cannot unlink your Aadhaar number from the UAN portal.

Is it obligatory to link an Aadhaar card to an EPF account?

Yes, EPFO has made it mandatory to link the Aadhaar card to the UAN number. Therefore, before 31st August 2021 link your Aadhaar with your EPF account to avail spectrum of benefits.

What are the different ways through which you can link Aadhaar with an EPF account?

You can link your Aadhaar with EPF through online or offline mediums. If you cherry-pick the online method, then there are four ways – through the UMANG app, Member Sewa Portal, biometric credentials on the e-KYC portal of EPFO and OTP verification on the e-KYC portal of Employeesu2019 provident fund.

What to do If I forget my UAN password?

You can simply reset your password online in a few simple steps.

Can I inspect if my Aadhaar number is linked with the EPF account or not?

Yes, you can scrutinize whether the Aadhaar card is linked with the EPF account on the unified portal of the Employeesu2019 Provident Fund Organisation.

How can I know if my Aadhaar number is linked with my PF account or not?

To know whether it is linked or not, go to the portal link https://iwu.epfindia.gov.in/eKYC/trackingUanStatus. After that, enter your UAN number and then click on Submit. If it gets linked, then it will show the status that your Aadhaar is linked with the EPF account.