Bitcoin halving is not just a prominent technical term in the Bitcoin ecosystem but is a predominant controller of the entire Bitcoin market. When investors are running to put their money on Bitcoin, know it’s that time of the year or soon to be. Occurring every four years, Bitcoin halving is a massive event that might disappoint Bitcoin miners and put a smile on Bitcoin investors’ faces. However, it bears its own risks.

In this article, let’s know what bitcoin halving is and its process and impact on the Bitcoin network.

What is Bitcoin Halving?

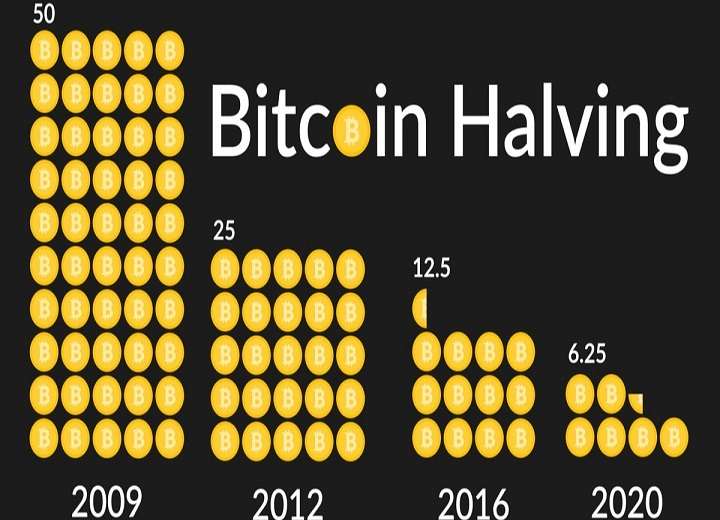

The block reward received by Bitcoin miners is halved after almost every four years or after a set of 210,000 blocks of Bitcoin are mined. This event cuts the rate by 50 percent of the new bitcoins to be released into circulation and is therefore known as Bitcoin halving. This is how Bitcoin executes inflation on price until all Bitcoins are released.

The rewarding system is expected to continue in the same manner till the year 2140. This will be when the miners are expected to get rewarded with fees paid by the respective network users for processing their transactions. This amount or fees will make it certain that miners are left with an incentive to continue mining and regulating the network.

To understand the process of bitcoin halving further, we first need to grasp the concepts of Bitcoin Mining and Bitcoin Network.

Understanding Bitcoin Mining and Bitcoin Network

The two mechanisms of Bitcoin mining and the Bitcoin network are crucial for Bitcoin halving. Consider these as the initial stages before the halving occurs. So, let’s get to know about these two crucial terms below.

Bitcoin Mining

When we talk about mining, it does not indicate the literal meaning of the term. Rather, it’s a reference that has been used to showcase its importance. When an individual uses their systems or computers to engage themselves in the Bitcoin Blockchain, this entire process of transaction processor or transaction validator engagement is known as Bitcoin Mining.

The system used by these bitcoins is known as POW (Proof of Work). This, in turn, means that the miners need to prove the efforts they have put in the process of Bitcoin transactions. The efforts include everything from the time invested to activities performed, like running their computer hardware and solving difficult equations.

A user (miner) is supposed to solve various mathematical problems and then confirm the rightfulness of the transactions. After the legality of the transactions is confirmed, they add the transactions into a block and keep on creating the chains of the block transactions. This entire process of forming the chain is known as the blockchain.

Once the blocks get filled with the transactions, the users are then rewarded with Bitcoins.

Also note, that transactions with higher monetary value are required to fill in more confirmations to ensure the security of their transactions.

Bitcoin Network

Bitcoin network is an extensive payment system wherein all Bitcoin transactions take place. These transactions are run via blockchain (public database), a series of nodes or computers powered by Bitcoin’s software. These chains are said to contain all sorts of transaction histories occurring on the software.

This chain of history is known to play a very important role in approving the transactions in the Bitcoins network. To do the same, the node or the computer goes through an entire process of checking the transaction validity. This entire process of verification includes a thorough checking of the parameters that have been set by the software, for instance, nonces. They make sure that the length does not exceed the requirement.

It is important for you to note that all the transactions are approved individually by the network. This happens when every transaction in the block gets approved. Once the approval gets done, the transactions are then attached to your current blockchain, which finally gets broadcasted to the other nodes.

Also, the more the nodes are attached, the more are chances for you to increase the chain’s stability and security. However, any individual can indulge themselves in the Bitcoin Network, provided your computers have enough space for you to download the history of all the blockchain transactions.

When does Bitcoin Halving Occur and its Effect on Bitcoin Price?

The first-ever bitcoin halving took place on 28th November 2012, after 10,500,000 total BTC got mined. The next halving took place on 9th July 2016, followed by the current halving on 11th May 2020. The upcoming event of Bitcoin Halving is assumed to occur in the year 2024.

Here, let’s know how Bitcoin halving occurs and its impact on Bitcoin price.

Occurs in less than 4 Years

Bitcoin halving generally occurs every four years as the Bitcoin mining algorithm usually identifies new blocks every 10 minutes. However, recently, the incidence of halving has become more frequent.

In other words, it’s occurring in less than four years. This is mostly because the number of miners in the Bitcoin network has increased exponentially, contributing to the computational or hashing power of the network, thus reducing the time to find new blocks.

To bring in a balance and restore the algorithm to a 10-minute cap, the mining difficulty level is rebooted every two weeks. Even after this initiative, the average time of identifying a block remains at 9.5 minutes (less than the regular 10 minutes.

Its Effect on the Bitcoin Price

Since 2009, there has been a significant increase in bitcoin prices. Initially, the bitcoins were traded in pennies, but as of April 2021, the bitcoins were seen trading at $ 63,000. As halving the blocks significantly doubles the price of the miners (producers), it has positive effects on the price as now they need to adjust the selling price according to the costs. This is why bitcoin prices are expected to rise even a few months prior to bitcoin halving.

How does Bitcoin Halving Impact the Bitcoin Network?

Bitcoin halving is a crucial process intrinsic to the functioning of the Bitcoin network, impacting both bitcoin investors and miners.

Effects on Investors

Halving normally increases the cryptocurrency prices, which happens because of lowered supply and heightened demand, benefitting the investors. This results in cryptocurrency trades in the same blockchain shooting up before or during the halving. However, the price differs according to the logistics and conditions applied to that particular price halving.

Effects on Miners

Normally a bitcoin ecosystem is quite complex. On one side, a reduction in bitcoin supply tends to increase the demand and prices of bitcoin, on the other, it results in lesser rewards to the producers. While large mining organisations may survive this spell, it becomes especially challenging for small mining individuals. Since an increase in the bitcoin price leads to most miners abandoning the network, the incidence of the predominance of those miners holding 50 percent capacity of the computing power of the network spike. This not only negatively impacts transactions but also halts payments rendering the network unsafe for any bitcoin transaction.

What is the Impact of Bitcoin Halving Since 2012?

It is believed by a majority of investors that Bitcoin’s value will see a rise in terms of price from the current period to its fourth halving in the year 2024. The first and second halving turned out to be a massive success for Bitcoin as the price value skyrocketed in both halving events.

The first halving done in 2012 had an increase in value from $12 to $1,150 within a period of just 12 months. The second halving event was done in 2016, and the value was estimated to be around $20,000, which later dropped to $3,200.

As per experts or investors, there isn’t any specific date for giving rewards. It completely relies on mining the 210,000th block from the former event. As the new Bitcoins are mined around every 10 minutes, the upcoming halving event is anticipated to occur in the initial months of 2024, further leading to a drop in miners’ reward to 3.125 BTC. It is a must for Bitcoin investors to understand that the event of Bitcoin Halving comes with great risk.

Bottomline

The impact of Bitcoin Halving on its network is very significant. In 2009, the reward distributed for every mined block of the blockchain was 50 Bitcoins. When the first halving event happened, it reduced to 25 Bitcoins, and from then kept on reducing by 50% until it was left at 6.25 Bitcoins on 11th May 2020.

Investors are expecting a growth in value in the upcoming days, which has halving events in line and even after the event, the growth is expected to augment further. For the miners, the upcoming event of Bitcoin Halving may possibly turn out to be a chance of getting consolidated as bigger players are taking over individual miners.