AIN is an identification number with 7 digits that helps the Accounts Office in submitting Form 24G to the Income Tax Department of India.

Once the AO successfully registered for AIN, they can log in using the credentials and further apply for an Allotment Application of Accounts Office form. Moreover, it will be forwarded to PAO/CDDO/DTO using email or letter as mentioned in the form.

But one question might be baffling your mind: what is the use of AIN Registration in PAN?

Read here to know,

What is PAN AIN Registration?

Account Information Number (AIN) is an identification number with seven digits issued by the Indian Income Tax Department. The PAN AIN registration is mandatory so that an Accounts Officer uses it to submit Form 24G.

What is the AIN Registration Process?

You can register for AIN in two ways: Online Method and Offline Method. We have mentioned both the procedures below.

Procedure for AIN Registration Online:

You have to follow the steps below for registering Account Identification Numbers online.

Step 1: The first step is to access the TIN website. So, for the allotment of AIN, you can register with the help of the NSDL website.

Step 2: You must press the AIN Registration Online option on the page.

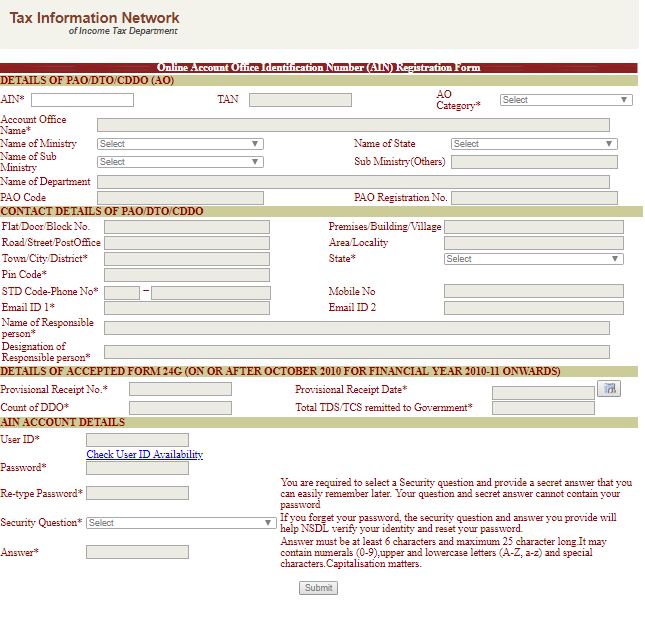

Step 3: You can see the Online AIN Registration Form below.

Step 4: Here is the information you have to provide for filing the AO registration number as mentioned below:

1. Details of Account Office:

- You must mention your AIN or TAN (optional).

- Select the Account Office category from the dropdown menu list.

- Mention the Names of Account Office, Ministry (AO category is Central Government), sub-ministry, and other sub-ministries.

- Fill in the PAO (Pay and Accounts Office) code and PAO registration number.

- Select your state for the AO category.

2. Contacting Details of Account Office:

- Fill in your demographic information that includes the complete address along with the pin code.

- Use the STD code Phone number for future communications.

- If possible, mention your mobile number.

- Enter one valid email address.

- Write the name of a responsible person and the designation of that person.

3. Specifications of Form 24G onwards:

- Enter your PRN (a Provisional Receipt Number) of 15 digits in Form 24G.

- Make sure to enter your PRN date.

- Enter the count of DDO (District Treasury Office) records in Form 24G.

- Finally, enter Total TDS & TCS that will be sent to the Indian government.

4. Details About AIN Account’s Privacy:

- Enter your user ID and password.

- Make sure to enter a strong password.

- You can save the user ID and password.

- Now, select one security question along with the answer.

- Save the security question for future purposes.

5. Generation of Acknowledgement/ AO registration number:

- Once you fill the form, hit the submit button. In case you found any errors just clear them and re-submit the form.

- A new screen will appear with a confirmation message.

- However, if there is anything wrong, you can rectify it and edit it accordingly.

- Choose the ‘confirmation’ option. You will be able to see a 12-digit acknowledgment number.

- For future use, you can take out the print of the receipt.

- You have to enter the AIN registration number provided by TIN along with AIN.

Step 5: After filling in all the necessary details, you can hit the submit option.

Step 6: After successfully registering the AIN, you will receive a twelve-digit alpha-numeric registration code. Further, you can take the printout of the acknowledgment slip for all future purposes.

Step 7: Now, you can finally have your credentials and information about a question for security parameters.

Procedure for AIN Registration Offline:

You must follow the steps below for registering Account Identification Numbers offline.

Step 1: For AIN registration, you have to visit the Income Tax department.

Step 2: You can get the form from the office and fill the application form.

Note: You can download the AIN allotment application form by clicking the following link.

Step 3: Make sure to fill the form with the right information and fill in the mandatory details such as the Ministry name, office name, and the name of the department.

Step 4: You have to manually submit the AIM allocation form to legal CIT.

Step 5: The CIT will validate the details filled in AIN as given by the PAO, CDDO, and DTO. Further, after the validation process, it will be moved to NSDL governance.

Step 7: You will get the AIN on the application form with the verified receipt.

Step 8: The details of AIN will be shared either by email or letter with DTO / CDDO / PAO. The address used will be the same as mentioned by you in the allotment form of AIN.

Why is AIN Important for Form 24G?

Every AO has an Account Identification Number with the legalized TDS office for filing Form 24G. However, to file the TDS statement in Form 24G, one has to give information about the Pay and Accounts Office (PAO) / Cheque Drawing and Disbursing Office (CDDO) / District Treasury Office (DTO) every month, as per the Indian Income Tax Department Notification in 2010.

Therefore, the Account Information Number is important for Form 24G.

Frequently Asked Questions (FAQ)

What is an Accounts Office or AO?

Accounts Office (AO) are government officials that include the Pay and Accounts office. Further, the Account Office must have AIN if they want to submit Form 24G.

What is Form 24G?

Form 24G helps in submitting the information such as Pay and Accounts Office, Cheque Drawing and Disbursing Office, and District Treasury Office. The Account Office uses Form 24G for filing TDS. However, they must follow a structured format and some guidelines too.

What are the steps for updating demographic and contact details in AIN registration?

You have to click on the ‘Update Profile’ option. Now, select the option of demographic, contact details, and email address. Additionally, you can update the latest information.

How is AIN allotment given to the Accounts Officer?

During the allocation of AIN, all the details will be shared via email or letter to PAO / CDDO / DTO in the allotment form.

What changes are needed in the details of DDOs with the AO? And to whom this be communicated?

The changes in the details of DDOs related to AO must be written in Form 24G. Moreover, this is all prepared according to the prescribed data structure.

Is it necessary to file Form 24G in electronic form?

Yes, it is necessary to file Form 24G in electronic format only by every Accounts Officer.

Is TAN important for AO?

Yes, TAN (Tax Deduction and Collection Account Number) is a necessary document for an Account Officer.