The Income Tax Department has established an easy process for the taxpayers to file their returns. To make compliance easy, the taxpayers are categorised based on their source of income and other factors. Hence, individuals with different incomes must fill out different forms to file their returns. ITR 2 is one such form.

Table of contents

What is ITR-2 Form?

The ITR-2 Form has to be filled by the HUFs or individuals who do not pursue any profession or business. Both Indian residents and non-residents use the form to file their income tax returns. Scroll down to learn more about the structure, eligibility, and the method to file ITR 2.

ITR 2 Form Structure

The composition of the ITR 2 Form has been segregated into 2 parts, Part A and Part B. Part A consists of general information, and Part B indicates the calculation of the total income along with the tax which has to be paid on the accumulated earnings. Additionally, the form contains numerous schedules like income from property or house, income generated from capital gains, the income from salary, and income generated from various other sources.

ITR-2 Form Components

The ITR-2 Form contains 22 components:

- Part A – Regarding general information.

- Part B-TI – Details regarding the total income computation.

- Part B-TTI – Details related to the liability of tax on the total income.

- Schedule S – Income details from the salary.

- Schedule HP – House property income details.

- Schedule CG –Income computation related to capital gains.

- Schedule OS – Computation of income from other sources.

- Schedule CYLA – Income information after the set-off of present year losses.

- Schedule BFLA – Income information after the set-off of the previous year’s losses brought forward.

- Schedule CFL – Losses will be transferred to the future.

- Schedule VIA – This includes the deductions/exemptions under VI-A section.

- Schedule 80G – Details regarding eligible donations for deduction as per Section 80G.

- Schedule SPI – Details regarding the income of certain stated persons like spouses, minors etc.

- Schedule SI – Information regarding chargeable tax income as per the special rates.

- Schedule EI – This includes the details regarding Exempt income.

- Schedule IT – Includes the tax statement on advance tax payments and self-assessment.

- Schedule TDS1 – This includes tax deducted at source or TDS on the salary.

- Schedule TDS2 – This includes the TDS on income other than salary.

- Schedule FSI – Information on income from outside of India or tax relief.

- Schedule TR – Includes the summary of claimed tax relief for taxes that are remunerated outside India.

- Schedule FA – Includes information on any foreign asset and any source which is outside India.

- Schedule 5A – Contains details on the income apportionment between spouses.

ITR 2 Form Eligibility Criteria for AY 2021-22

The following individuals are eligible to file the ITR 2 Form:

- Income from Pension/Salary

- Income from the House Property (the income derived can be from multiple house properties)

- Income from property/loss on sale of investments/Capital gains

- Income from other sources (which includes winning from bets on Horse races, lottery and other legal sources of gambling).

- Foreign Income/Foreign Assets

- Income from agriculture is more than ₹5000

- Non-resident and resident who is not ordinarily resident

Who is Not Eligible to File the ITR 2 for AY 2021-2022?

- Any HUF (Hindu Undivided Family) or individual having an income from Profession or Business.

- Individuals eligible to fill the ITR-1 Form

Documents Required to File ITR 2 Form

- Bank statements

- Savings certificates

- DS certificate

- Preceding year’s ITR

- Interest statement of the interest paid in the financial year

- Balance sheet

- Profit and loss statement

- Audit reports, if applicable

How to File ITR 2 Form

Online Filing of ITR 2 Form

Follow the given instructions to file the ITR 2 Form online

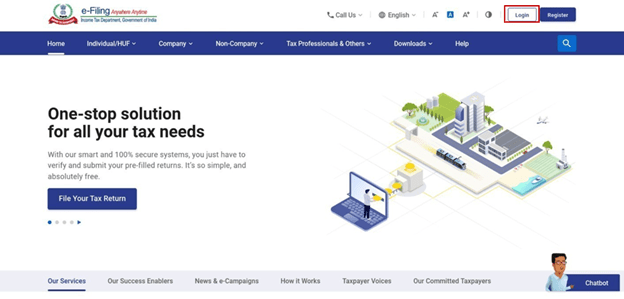

Step 1: Head to the official website of e-Filing and log in with your User ID and password.

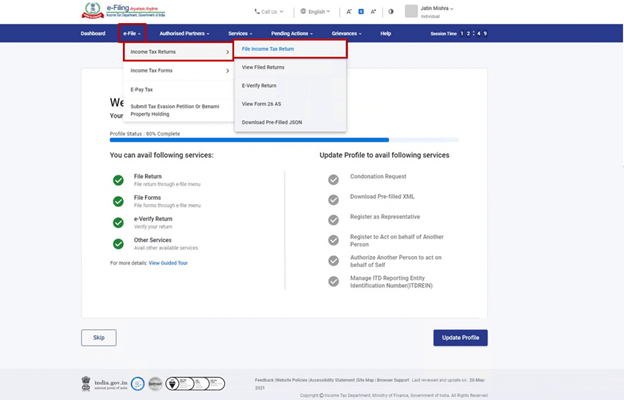

Step 2: On the Dashboard, select e-File >> Income Tax Returns >> File Income Tax Return.

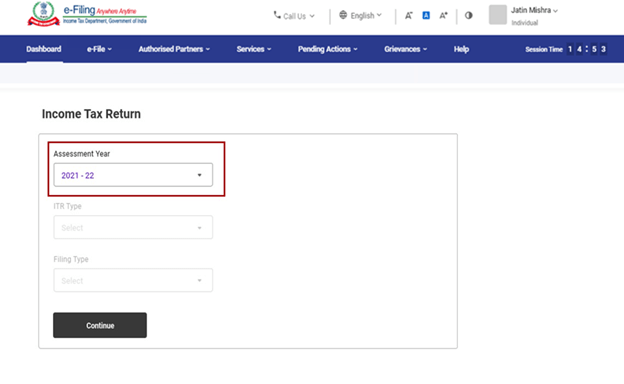

Step 3: Choose the Assessment Year to be 2021-22 and then click on Continue.

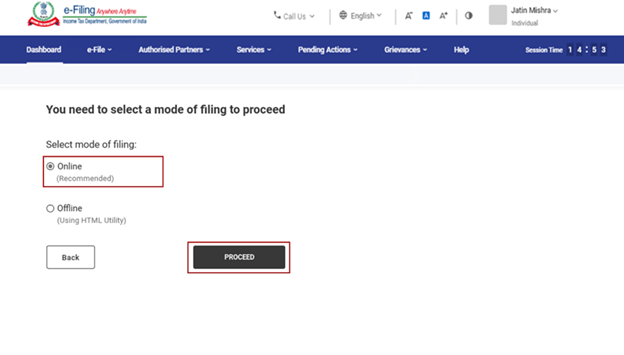

Step 4: Click on Online in the Select Mode of Filing option and then click on Proceed.

Please Note: If the Income Tax Return has already been filled but is pending submission, click on Resume Filing. If you are looking to get rid of the Saved Return and start the return preparation from the beginning, then select Start New Filing.

Step 5: Select the suitable status for you and then click on Continue to move to the next step.

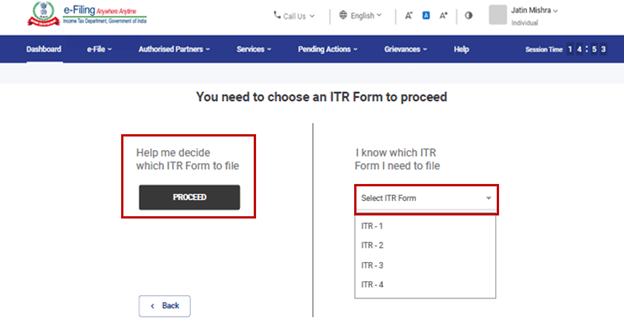

Step 6: You will be provided with two options for the Income Tax Return category:

● If you are unsure about the type of ITR to be filed, select Help me decide which ITR Form to file and click on Proceed. The system will then help you choose the right ITR, and you can continue to file the ITR.

- If you have an idea of which ITR has to be filed, then choose I know which ITR Form I need to file. Choose the Income Tax Return which is applicable from the dropdown option and then Proceed with ITR 2.

Please Note:

- If you are sure about the type of ITR or schedules, deduction and income details that are relevant for you, the answers which you provide to the questions will help you determine it and aid you in correcting or providing an error-free ITR filing.

- Skip the questions asked if you are sure about the schedule, deduction, or income details or ITR relevant to you.

- You can also refer to the Generation and Identification of ITR for the annual year 21-22 user manual for more information.

Step 7: After you have chosen the ITR relevant to you, take a note of the list of required documents and click on Let’s Get Started.

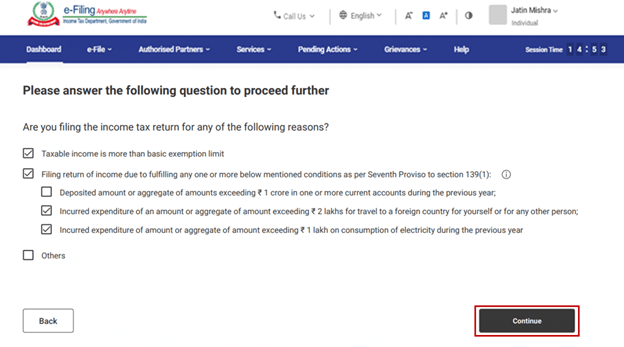

Step 8: Tick on the checkboxes that are relevant to you and then click on Continue.

Step 9: Take a look at the already filled data and make edits if need be. Insert the additional or remaining data (only if required). Click on confirm after reviewing every section.

Step 10: Insert your deduction details and income in the various sections. Once you have completed and confirmed each section in the form, select Proceed.

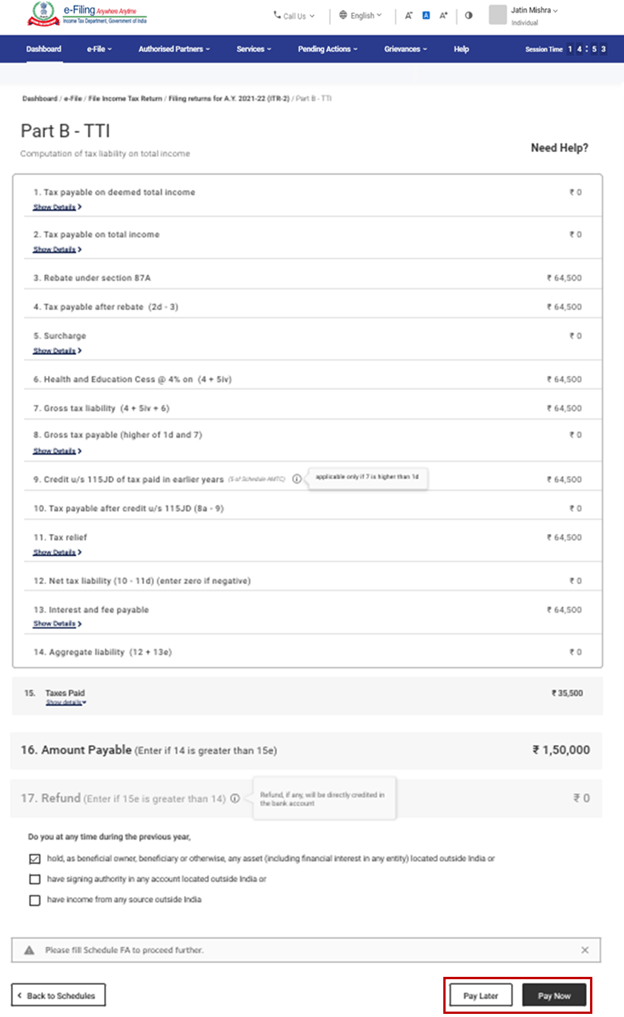

Step 10a: If tax liability is applicable

A synopsis of the tax computation will be shown to you based on your details provided. The Pay Now and Pay Later option will appear at the lower end of the respected page if the tax liability must be paid according to the computation.

Please note:

- It is advocated to make use of the Pay Now choice. Note down the Challan Serial Number and BSR Code and insert them in the payment details.

- If you choose to Pay Later, you have the option of making the payment post when you have filed your Income Tax Return. However, keep in mind that risk poses that you might be reviewed as an assessee in default, and there may arise a liability to make the payment of interest on the tax payable.

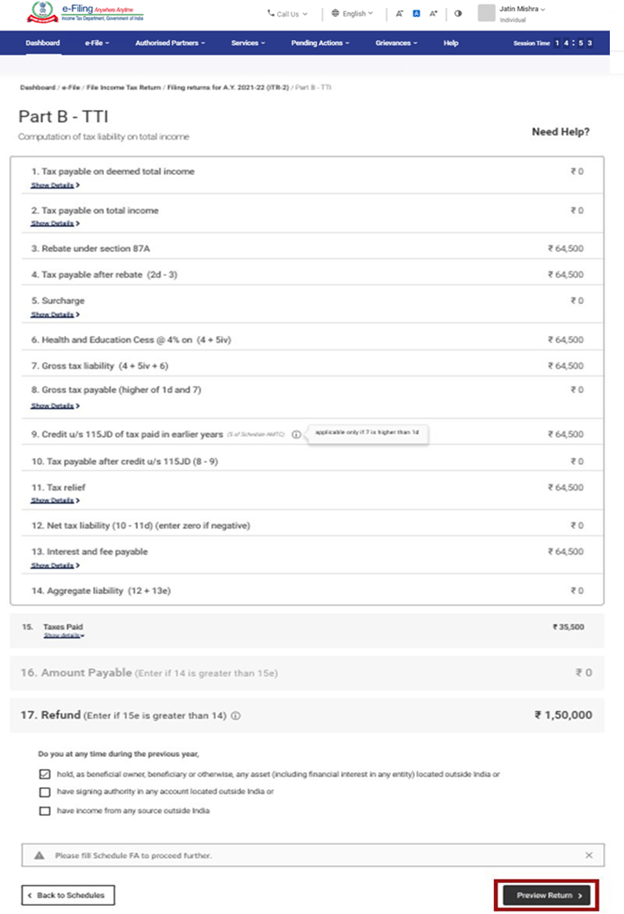

Step 10b: If entitled for Refund/No tax liability

After you have paid the tax, select the Preview Return. If a refund is generated based on the tax computation or if no tax liability must be paid, you will be redirected to the Preview and Submit Your Return page.

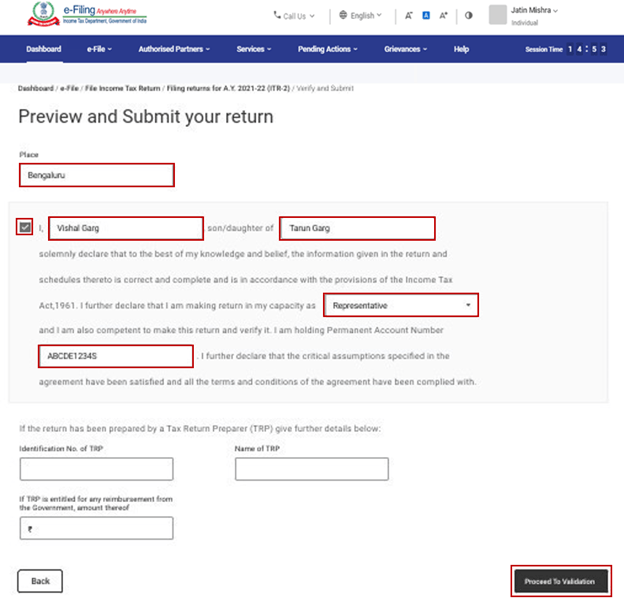

Step 11: On the page Preview and Submit Your Return, enter the Place, choose the declaration checkbox, then select Proceed to Validation.

Please note: If a TRP or tax return preparer is not involved in the preparation of the return, the TRP related text boxes can be left blank.

Step 12: Once the information is validated, head to the Preview and Submit your Return page, then click on the Proceed to Verification.

Please note: If an error list is displayed in return, return to the form to rectify the errors. If no errors are found, you can continue with the process of e-verifying by clicking on the Proceed to Verification button.

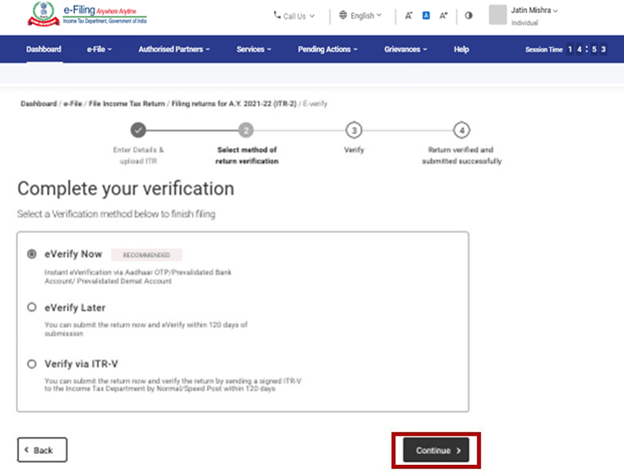

Step 13: On the Complete your Verification page, choose the option you prefer and click on continue.

Please note: It is compulsory to confirm your returns. E-verify is the simplest method to confirm your ITR. The process is easy, hassle-free, paperless, quick, and more secure than sending an attested physical ITR-V to the CPC by post.

Also, if you choose the option e-verify Later, you will be able to provide your return, but you must verify the return within a period of 120 days of ITR filing.

Step 14: On the e-verify page, choose the option you would like to e-verify your ITR and then click on continue.

Please note:

- For more information, refer to How to e-Verify user manual.

- If you choose Verify via ITR-V, you will have to send a self-attested physical copy of the ITR-V to the Centralised Processing Centre, Income Tax Department, Bengaluru 560500 by speed post or normal within a period of 120 days.

- Ensure that your account is pre-validated so that any due refunds can be credited to the bank account.

- You can use the My Bank Account user manual for more information.

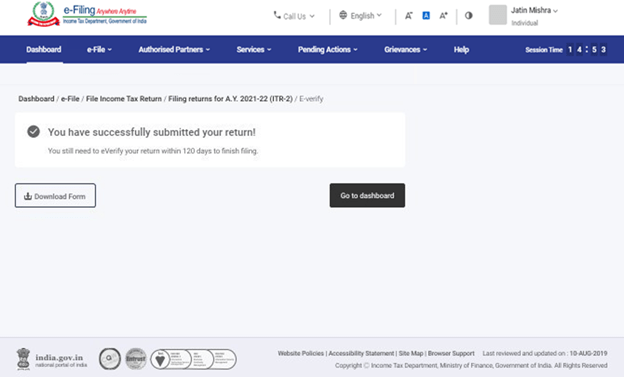

Once you have e-verified your returns, a success message will appear along with the Acknowledgement Number and Transaction ID. A message of confirmation will also be sent on your registered mobile number and email ID on the official portal.

Offline Filing of ITR 2 Form

Taxpayers using the offline mode (instead of the online mode) to file the Income Tax Returns need to use the Offline Utility for ITRs. Through the utility feature, the Income Tax Return can be filed by uploading the utility-generated JSON:

- After you have logged into the e-filing portal, or

- Directly through the offline utility

The platform offers two different offline utilities to file the ITRs –

- ITR-1 to ITR-4

- ITR-5 to ITR-7

Instructions for Filling Out the ITR 2 Form

The following sequence has to be followed to file the ITR 2 Form:

- Part A, along with all the other schedules

- Part B-TI and then Part B-TTI

- Ensure that you mark N/A for the schedules which are not applicable

- After filing the form carefully, verify the return

- All numerical figures have to be rounded off to the nearest one rupee except the figures related to lose and tax/total income payable, which have to be rounded off to the nearest multiple of ten.

- Individuals who belong to the Employer Category should choose the ‘Government’ option if they are a State/Central Government employee.

- Individuals working in a public sector company of the State/Central Government must select ‘PSU’.

- ITR-2 does not have an annexure. There is no need to fix any document during the form submission.

What is the ITR-2 Download Process for AY 2021-22?

Step 1: Visit the Income Tax Department portal at https://www.incometax.gov.in/iec/foportal.

Step 2: On the dashboard, select Downloads.

Step 3: Under Income Tax Returns, select ITR-2.

Step 4: Download the required form according to the category of taxpayer you belong to.

Related ITR Form

Major Changes Made in ITR 2 for AY 2021-22

- Updates have been made in the ITR forms for the inclusion of a declaration of selecting between new or old tax regime initiated by the Finance Act 2020, under section 115 BAC. Form 101E has to be provided to the ITR department prior to filing ITR on a condition that the assessee decides to pay the tax as per the newly formulated tax regime. The acknowledgement number of Form 101E has to be provided for the ITR form if the assessee opts for a new tax system.

- Finance Act 2020 has permitted the deferment of the deduction or payment of tax on ESOPs assigned by a permitted startup mentioned in Section 80-IAC. Suppose an employee gets ESOPs from an eligible start-up as mentioned in Section 80-IAC related to which the tax has been delayed. In that case, the Part B of Schedule TTI (the computation of tax liability on the accumulated income) demands the disclosure of this delayed tax.

- The Finance Act of 2020 shifted the dividend income tax from the hands of the company to the investor’s lap. Sections 10(34), 10 (35), 115-O, 115-R, 115BBDA have been rectified. A fresh line has been inculcated in the Schedule OS to permit the abstraction of expenses. Additionally, a new line has also been attached under the Schedule OS to inculcate the details of taxable dividend income under the purview of the unitholders of business trust.

- The ITR forms impel the return filers to furnish a quarterly break up of the dividend income to calculate interest under Section 234C.

- ITR forms have been updated to inculcate the marginal relief effect by displaying the surcharge calculated after marginal relief and before marginal relief. Before this change, no separate effect has to be shown in the ITR Forms.

- Section 50C commands the value determination of the sale consideration in the scenario of building or land or both. If the sale consideration is less than the value of stamp duty, the stamp duty value will be noted as the full value of the consideration, except for a difference of 5%. Finance 2020 expanded the limit of tolerance from 5% to 10%, and these changes have been executed in the ITR.

- Schedule DI inculcated in the preceding ITR forms for an investment done during the allowed extended period, which is from 1 April 20 to 31 July 2020, has now been removed from all the ITR Forms.

- A different disclosure of the cash donation has to be provided under schedule 80GGA along with the date in the ITR Form.

- A new update has been provided in the ITR Form with a new column under the schedule 115AD (1)(b)(iii) and 112A. The provision to mention the details of the type of the securities transferred. Additionally, both schedules are updated to affect the ‘grandfathering clause’ by permitting details like FMV, COA of the securities, and Sale price.

Major Changes Made in ITR 2 for AY 2020-21

- Non-resident individuals and RNORs must file their income tax returns in ITR-2 even if the total income is below ₹50 lakh.

- The taxpayers need to disclose (a) the cash deposit amount, which is above ₹ one crore in the present accounts in the bank, (b) the expense incurred above ₹2 lakh on the foreign travel c) expense incurred more than ₹1 lakh on electricity.

- Resident individuals with the ownership of multiple properties also have to file their income tax return in Form ITR-2.

- Resident individuals with a total income of more than ₹50 lakh have to file ITR-2 Form.

- An individual taxpayer who has an income from any business or profession cannot use the ITR-2 Form.

- In a scenario where a person is a company’s director or holds unlisted equity investments, they need to disclose the ‘type of company’.

- In case of long-term or short-term capital gains from the sale of building or land or both, the buyer(s) details, including Aadhaar or PAN, address, and percentage share, have to be provided.

- A different schedule 112A is made to calculate the gains from long-term capital on selling the units of a business trust or equity shares that are liable to STT.

- Under the point ‘income from other sources,’ the details of ‘any other income’ must be provided by the taxpayer.

- The details of deductions against the ‘income from other sources must be provided.

- The ‘Schedule VI-A’ for the tax deductions is altered, including the deduction under sections 80EEB and 80EEA.

- In the case of an investment fund or a business trust, the details of ‘dividend’ and ‘capital gains’ income must be provided.

- Details of the tax deduction claims for payments, expenditure, or investments that were made between 1 April 2020 to 30 June 2020.

- Suppose an individual taxpayer chooses more than one bank accounts while providing the bank account details for refund credit. In that case, the Income Tax Department has the right to select any account to credit the refund.

You May Also Read:

Frequently Asked Questions (FAQs)

Who can File the ITR-2 Form?

ITR-2 has to be filed by the HUF (Hindu Undivided Family) and individuals earning income from sources other than gains and profits from a profession or business.

Who cannot File the ITR-2 Form?

A taxpayer who earns their income from a profession or business cannot use ITR-2 Form.