Since July 7 2018, the designs of PAN cards have been modified by the Income Tax Department. They have implemented new components to the e-PAN and PAN and changed some information on the PAN card.

The new PAN card design & updates in PAN Card also has a QR code to scan and read your information. You can read here for detailed information about the updation in PAN and its design.

Table of contents

- What Are the Latest Changes in a Pan Card?

- Modifications at the Place of Details on the Card

- Embedding of QR Code

- What are the Differences Between Old and New PAN Cards?

- What is the Current New Design of e-PAN?

- How to Digitally Sign the New e-PAN?

- What is the Relation Between Digi locker App and PAN Card?

- Pan Card Design & Updates in PAN Card

- Frequently Asked Questions (FAQ)

What Are the Latest Changes in a Pan Card?

There are two updates in the PAN card, with the addition of the following two components:

– Modifications at the Place of Details on the Card.

– Embedding of QR Code.

Let’s understand the qualities of both the elements added to the PAN card.

Modifications at the Place of Details on the Card

There are a few modifications at the places of details on the PAN card. Here we have written the complete list of those changes.

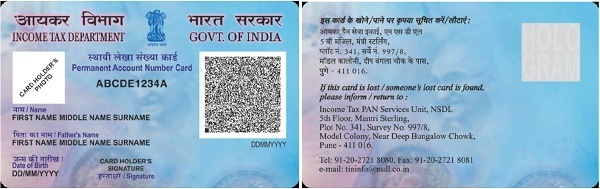

- Your photo on the card is now present at the left top-side corner below the heading – Income Tax Department on the PAN card.

- You can see your PAN number at the centre of your PAN card and below the National Emblem.

- Your Name and father’s Name is below your photograph.

- Your date of birth is present at the bottom left side of the card.

- The hologram is at the front end of the card.

- You can see your Signature at the bottom centre of the PAN card.

Embedding of QR Code

The Income Tax Department embedded a scanning QR code. And your complete information is encoded in the scan code and is signed digitally.

Note: Information like your Signature, photograph, Name, birth date is already mentioned in the PAN.

But you have to mention the date of incorporation for non-individuals at the place of the birth date.

To read the information from the QR code, you have to use a specific mobile application. The mobile application is known as Enhance QR Code Reader.

Further, the Indian Income Tax Department recommends using a camera with 12 or high megapixels for better clarity. And, if you have an e-PAN, then there is nothing to worry about as Enhance QR Code is a component of the new e PAN.

What are the Differences Between Old and New PAN Cards?

The table below shows the differences and modifications in old and new PAN cards.

| Changes in Details | Old PAN Card | New PAN Card |

| Name | On the top left side of the PAN card | On the left side below, QR code |

| Father’s Name | Below your Name on the left-side | Below your Name at the middle of the left side |

| PAN Number | At the left-side bottom of the PAN card | At the top centre of the PAN card |

| Birth Date | Below your father’s name | At the bottom of the PAN card |

| Signature | At the bottom left-side of PAN | At the Centre bottom of PAN |

| Photograph | At the left top-side corner | At the bottom right-side of PAN |

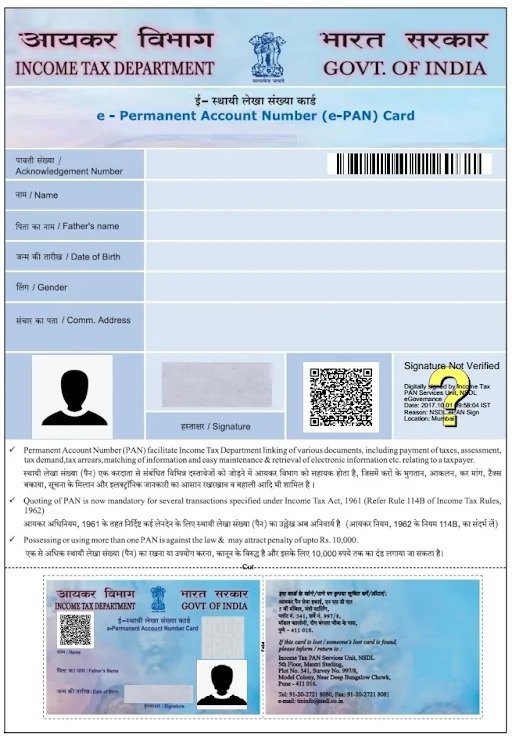

What is the Current New Design of e-PAN?

The Income Tax Department added components to the new e-PAN card. You can see the image below to understand the transformations in the new e PAN.

PAN Acknowledgement Number: e-PAN has an acknowledgement number of 15 digits and a barcode. Both help in tracking the status of a PAN card application.

Your Name: Your Name will be present on the e-PAN.

Your Father’s Name: Your father’s name will also be present on e-PAN.

Your Gender & Birth Date: Your gender and birth date will also be present on the e-PAN.

Your Communication Address: Your primary communication address will be there on e-PAN. The address is mandatory as it will help deliver the hard copy of the PAN.

Your Photograph: Your photograph will be present on the e-PAN as it will fetch the data from the database of Aadhaar.

Your Signature: You will receive your e-PAN at your registered email address.

Using the PDF, you have to sign your e-PAN digitally.

How to Digitally Sign the New e-PAN?

You will receive a PDF file of your e-PAN as discussed above. You have to download it first, and after that, you have to follow the steps written below:

Step 1: Open the PDF in any online PDF Converter (professional).

Step 2: Select the Digital Signature Field by pressing left-click.

Step 3: Now, press the option of Verify Signature.

Step 4: Press on the Properties option.

Step 5: Click the option of Verify Identity.

Step 6: Press the add option to add the contact information for the certificate owner.

Step 7: Press on the option of Add to List.

Step 8: Select the Close option.

Step 9: You have to press the option of Verify Signature.

Step 10: Your status will be on-screen, showing the validity of the Signature.

Step 11: Press the Close button.

Step 12: A green tick will appear to show that your Signature is valid.

What is the Relation Between Digi locker App and PAN Card?

The only relation between Digilocker and PAN cards is that now the Income Tax Department of India allows DigiLocker to issue PAN cards to the citizens.

The PAN card will offer the same information and an enhanced QR code. You can use this code and verify the details of your PAN card. Moreover, the PAN card from Digilocker also has a

“Digilocker Verified” logo.

You can follow the steps to get your PAN card using Digilocker:

Step 1: Either download the Digilocker app or go directly to its website.

Use your credentials to log in to the website.

Step 2: Select the Income Tax Department PAN verification section.

Step 3: Now, enter the information as asked, along with the PAN card number.

Step 4: Presson the option of getting a Document and give your consent.

Step 5: Your PAN card will automatically come to your account after downloading.

Pan Card Design & Updates in PAN Card

Thinking of submitting your Income Tax Returns (ITR)? You would need a PAN card. It’s crucial to make sure all the information on the card is current and accurate.

This article explains the steps for updating or correcting your PAN card online or offline through NSDL and UTIITSL.

How to convert an old PAN card to a new PAN card?

You can easily correct/update PAN card details via the NSDL (now Protean) website by following the below-mentioned steps:

- Step 1: Go to the NSDL E-Governance official website at https://www.protean-tinpan.com

- Step 2: Select “PAN” from the Services section and “Apply” under the “Change/Correction in PAN Data” section.

- Step 3: Choose ‘Changes or Corrections in Existing PAN Data/Reprint of PAN Card (No Changes in Existing PAN Data)’ from the ‘Application Type’ drop-down menu.

- Step 4: Choose the appropriate category of the assessee from the ‘Category’ dropdown menu. For instance, if your PAN is registered in your name, you would select ‘Individual’ from the available options.

- Step 5: Provide your full name, date of birth, email address, and mobile number. Afterwards, complete the Captcha and select the “Submit” button.

- Step 6: After submitting your request, a token number will be generated and sent to the email address you provided. To proceed, simply click the button below. This will redirect you to the PAN card update form, where you will find three choices for submitting your documents. Opt for the option “Submit scanned images through e-Sign on NSDL e-gov”.

- Step 7:You will be directed to a different webpage where you can change your address. It is important to provide all required documents, including address, age, identity, and PAN proof.

- Step 8: You must sign the declaration and select “Submit.” After this step, you will be directed to the payment page. Various payment methods are available, including demand draft, net banking, and Credit card/Debit card.

- Step 9: A slip will be created as proof of acknowledgement after successful payment. The applicant must print this slip and send it and the necessary physical documents to the NSDL e-government office. Additionally, two photographs should be attached in the designated area, with a signature across them. The envelope should be labelled with ‘Application for PAN Change’ and include the acknowledgement number at the top.

Frequently Asked Questions (FAQ)

What is e-PAN?

e-PAN is a digital PAN card but in an electronic format. It is issued by the Indian ITD using the e-KYC from Aadhaar.

Is a Signature Vital Part of a PAN Card?

Yes, the Signature plays a critical role for a PAN card. Further, a PAN card without a signature is not valid or eligible for any online verification of PAN.

Is e PAN Valid Without a Digital Signature?

e-PAN won’t even exist without a digital signature as it is issued only in an electronic format by the Income Tax department. Thus, you have to offer a valid Aadhaar number to get and sign an e PAN.

Is e PAN Valid for Bank KYC?

Yes, an e PAN will work fine as proof for KYC in a bank. Also, e-PAN contains a QR code that includes all the information about you. You can read the details by scanning the QR code.

How is an e PAN Card Different from a Physical PAN Card?

e-PAN is a card in an electronic format made using Aadhaar e-KYC. In contrast, a physical PAN card can be used interchangeably for all banking and legal purposes.

How to Get a PAN Acknowledgement Number Using SMS Service?

You have to send an SMS to 3030 with word PAN. Give some space and write the application number you get while applying. Here is the format:

SMS to 3030 <PAN 123458760935>

From When New PAN Cards Were Available for Users?

The new PAN cards were available to users after July 7 2018.

How Can I Get a New Colour PAN card online?

You can apply for a new PAN card or request changes in the information through the official website of the National Securities Depository Limited (NSDL) or the UTI Infrastructure Technology and Services Limited (UTIITSL).

Is it Mandatory to Update Your PAN Card?

An updated PAN card is important when filing income tax returns. Therefore, it is imperative to ensure that all the information on the card is up-to-date and correct, reflecting the most recent details.

What is The Expiration Date of the PAN Card?

A PAN card is valid for life time.

On Which Paper is the PAN Card Printed?

A PAN card is made of PVC.