PAN Card and Aadhaar Card are crucial documents issued by the Income Tax Department and UIDAI, respectively. These documents work as identity and income tax proof for an Indian citizen. As per the new announcement by the Income Tax Department, linking both of the documents has been made compulsory. The PAN Card and Aadhaar Card link status will decide whether the document will stay activated or deactivated by the department. If both of them are not linked by March 31st, 2023, they will be deactivated.

In this write-up, you will know how to check PAN and Aadhaar link status, importance, and correction facilities provided by the UIDAI and ITD.

Table of contents

- How to Check The PAN and Aadhaar Link Status?

- How Can I Make Corrections to My Aadhaar Card for PAN-Aadhaar Linking?

- What Will Happen to PAN Cards Not Linked with Aadhar?

- New Rules That You Need to Know – PAN and Aadhaar Linking

- Situations Where PAN Aadhaar Link Is Not Required

- Why Is It Important to Link PAN and Aadhaar Card?

- Frequently Asked Questions (FAQs)

How to Check The PAN and Aadhaar Link Status?

There are two ways of checking the PAN card and Aadhar Card link status. These two ways are through:

- An SMS

- Through E-filing Website

The detailed steps to check the linking status of both documents are mentioned in the sections below:

Steps to Check PAN Aadhaar Status Through SMS

The PAN Aadhaar link status is made easy with the Income Tax Department’s SMS service, through which taxpayers can check it swiftly. To check the status through SMS, send an SMS to 56161 or 567678 followed by a code in the message body.

Send an SMS to the Income Tax Department number 56161 or 567678 in the following format to the registered mobile number:

UIDPAN (12 Digit Aadhaar Card Numbers)(10 Digit PAN Card Number)

If the PAN Aadhaar link status is successful, a message ‘Aadhar is already linked with PAN in ITD Database’ will be sent to the registered number.

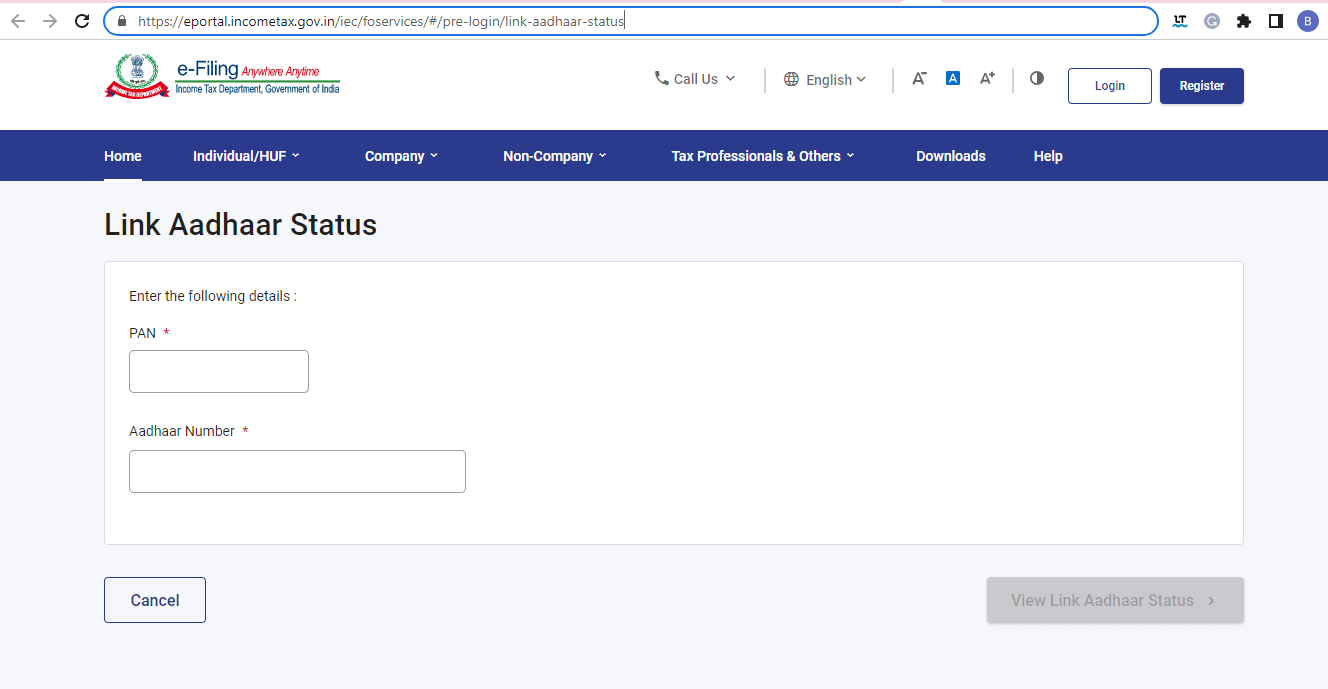

Steps to Check PAN Card and Aadhar Card Link Status Through The E-filing Portal

The steps to check the PAN and Aadhaar link status through the e-filing portal are as follows:

Step 1: Visit the website for e-filing for PAN card and Aadhar card link status, https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status.

Step 2: Enter the PAN Card number and Aadhaar Card number, and click on the ‘View Link Aadhaar Status’ button.

Step 3: In the new window, the PAN and Aadhaar link status will be displayed on the screen.

How Can I Make Corrections to My Aadhaar Card for PAN-Aadhaar Linking?

Follow the steps below to make corrections or updates to your PAN Card.

Step 1: Visit the official website of the National Securities Depository Limited (NSDL). https://www.protean-tinpan.com/

Step 2: Go to ‘Services’ and select ‘PAN’.

Step 3: Select ‘Apply’ on the next page.

Step 4: Fill out the details on the page you’re taken to and click ‘Submit’.

Step 5: Once your request is approved, a generated token ID will be sent to your registered phone number and email ID.

Step 6: Click the ‘Continue with PAN Application Form’ button. Further, three options will pop up on your screen: Online (submit digitally through e-KYC & e-Sign), Submit scanned images through e-Sign and Offline (submit application documents physically); choose your option wisely and fill out the required credentials valid OTP, Name, DOB, etc.

Step 7: Select ‘Yes’ if you want a new hard copy of the updated PAN card, and Nominal fee charges will be applicable.

Step 8: Again, you will be redirected to a new webpage; fill out the corrections or update the required details such as Name, Date of Birth (DOB), email ID, phone number, Surname, Address, etc. Also, upload a copy of the PAN card and an original photocopy of the document you want to correct or update.

Step 9: Fill and Submit the declaration form, upload your signature and photo.

Step 10: After submitting the PAN correction form, make the payment.

Step 11: To complete the PAN card correction, you will also need to complete the KYC process.

What Will Happen to PAN Cards Not Linked with Aadhar?

If your PAN card is not linked with your Aadhar card till the last date, then you will face the following consequences:

- PAN card will be declared invalid.

- The government has the authority to conduct transactions and fulfil several legal obligations.

- Individuals cannot file ITR or claims

- Pending returns and refunds will not be issued

- TCS/TDS shall be deducted at a higher rate under section 206AA

- If, to date, your PAN card is not linked with your Aadhaar card, then there will be a penalty of Rs. 1000.

- The interest rate will not be issued under sub-rule (4) from the starting to the ending date until it becomes functional.

- You cannot open a bank account, transfer money, or purchase any scheme with an unfunctional status.

- Applicant cannot submit 15G/15H declarations.

- In a day, an individual will not be able to deposit funds of more than 50,000/-

New Rules That You Need to Know – PAN and Aadhaar Linking

A PAN card is a vital document for taxpayers, and every Indian citizen should embrace it. A person’s tax-related information is registered under a single PAN number, which acts as the main encryption key for data storage. More than two people or corporations cannot own the same PAN card number.

The government IT department recently issued a circular regarding PAN card holders, urging them to link their PAN card with Aadhaar by June 30, 2023. If not, their PAN card will become inoperative, and they must pay a penalty of Rs 1000.

Situations Where PAN Aadhaar Link Is Not Required

The situation where the government exempts the linking of PAN card and Aadhaar Card are as follows:

- If you are an NRI

- Residents of Meghalaya, Assam, and Jammu & Kashmir

- Foreign People Residing In Indian States

Senior Citizen of India who has attained the age of 80 or over at any time in the financial year

Why Is It Important to Link PAN and Aadhaar Card?

The linking of both the PAN and Aadhaar cards is important for the following reasons:

- If you haven’t linked your PAN and Aadhaar card, it will be deactivated after March 31st, 2023.

- The PAN Card and Aadhar Card link status will help solve the problem of multiple PAN cards issued in the name of the same person.

- The Income Tax Return (ITR) will not be processed if both PAN and Aadhaar are not linked.

- The successful PAN and Aadhaar link status will help the taxpayer to get a summary of the tax levied on them for future reference.

PAN Card Linking Related Articles

Frequently Asked Questions (FAQs)

How do I Check If My PAN Card and Aadhaar Card are linked?

You can check the PAN and Aadhaar link status through the e-filing website or send a message to the Income Tax Department on 56161 or 567678.

Is it possible to link PAN and Aadhaar online?

Yes, it is easy to link the PAN and Aadhaar cards online using the e-filing portal by the Income Tax Department. Both registered and unregistered taxpayers can kink the two documents through the website.

Who needs to link the Aadhaar card and PAN card?

Anyone who has a PAN card is liable to get an Aadhaar number and is required to link both the documents before March 31st, 2023.

How to check if my Aadhaar is linked with my mobile number?

To check that Aadhaar is linked with the mobile number, visit the official website of UIDAI and click on ‘Aadhaar Services’ under My Aadhaar and proceed as the site suggests.

Is it required to submit documentary proof for the success of the PAN and Aadhaar link status?

To link PAN and Aadhaar, one does not require submitting additional documents apart from the PAN number and Aadhaar number.