GSTR 9 is a type of annual tax return form that needs to be filed by every GST registered taxpayer. This form contains the details of income and expenditure of the financial year. It also integrates the returns filed under GSTR 1, GSTR 2A and GSTR 3 B into one document. In this blog we will discuss what exactly is GSTR 9 and take a look at the process for filing the same. Let’s start!

What is GSTR 9 Annual Return?

The form GSTR 9 is an yearly return to be filed by all GST registered businesses. In this form, you have to mention financial details like outward supply, inward supply, GST applicable, and ITC for the previous financial year. The annual GSTR 9 return filing consists of three types of return forms. The businesses have to file these forms on the basis of annual turnover and GST registration type. The three types of return forms are as follows:

- GSTR 9: This form is needed to be filled by casual taxpayers who also file GSTR 1 and GSTR 3B

- GSTR 9A: This form needs to be filed by taxpayers registered under GST composition scheme

- GSTR 9C: This form is needed to be filed by taxpayers who have an annual turnover of more than ₹ 2 crores. All such accounts are also subject to an audit. Taxpayers are also required to submit a copy of audited accounts, statement of tax reconciliation, and details of tax payable

Who Needs to File GSTR 9?

In accordance with GST law, every GST registered taxpayer is required to file GSTR 9 annually. Suppliers involved in the intra-state movement of goods, and service sector businesses with an annual turnover of over ₹ 20 lakhs are required to file this form. Further, businesses in the goods sector, having a turnover of more than ₹ 40 lakhs are required to file GSTR 9. Some of the taxpayers who do not need to file GSTR 9 are as follows:

- Regular taxable person

- Taxpayers registered under the GST composition scheme

- Input service distributors

- Non-resident registered taxpayers

- Taxpayers paying TDS as stated under Section 51 of the GST act

When is the GSTR 9 Due Date?

The due date for filming a GSTR 9 form is on or before December 31 of the next calendar year. This means that you will file GSTR 9 for the financial year FY 20-21 on or before 31 December 2021. That being said, the due date to file this form can be changed at the Government’s discretion.

What are the Late Fees for GSTR 9?

In order to ensure compliance with the rules and regulations laid down under the GST act, a list of penalties have been declared for not filing GST returns on time. If a registered taxpayer misses the deadline for filing GSTR 9, they have to incur a penalty. The charges are ₹ 100/day under CGST and ₹ 100 under SGST, which brings the total to ₹ 200/day. The maximum late fee liable to be charged is capped at ₹ 5,000. Apart from the late fee charges, the taxpayer is also liable to pay an interest of 18% on the amount.

What are the Details to be Mentioned in GSTR 9?

The GSTR 9 consists of 6 forms that are divided into over 19 sections. The details required in each of the sections are as follows:

- Part 1: This part of the form is for basic details like trade names, legal names, GSTIN number, and details of the taxable goods and services

- Part 2: This part is for the details regarding the declared inwards and outwards supplies during the financial year

- Part 3: Here you need to enter the details of Input Tax Credit filed during the financial year. This information can be found in GSTR 2A

- Part 4: Here you need to mention the details about the taxes paid in return for the financial year

- Part 5: Here you need to provide the details of transactions of the previous financial year that were declared in returns of the current year

- Part 6: This part of the form is for the other details like GST demands, refunds, late fees, and HSN summary

What are the Prerequisites for Filing GSTR 9?

The following are some of the prerequisites for filing GSTR 9 under the GST law:

- The taxpayer has to be a registered casual taxpayer under the GST law for at least one day in the financial year

- The taxpayer is required to have already filed GSTR 1 and GSTR 3B for the financial year

- Table number 6A will be auto-populated on the basis of GSTR 3 B filed by the taxpayer

- Likewise, table number 8A will be auto-populated based on the details mentioned in GSTR 2A

- Details of tax paid in returns filed during the financial year will be auto-populated on the basis of form GSTR 3B for the financial year.

How to File GSTR 9 on the GST Portal

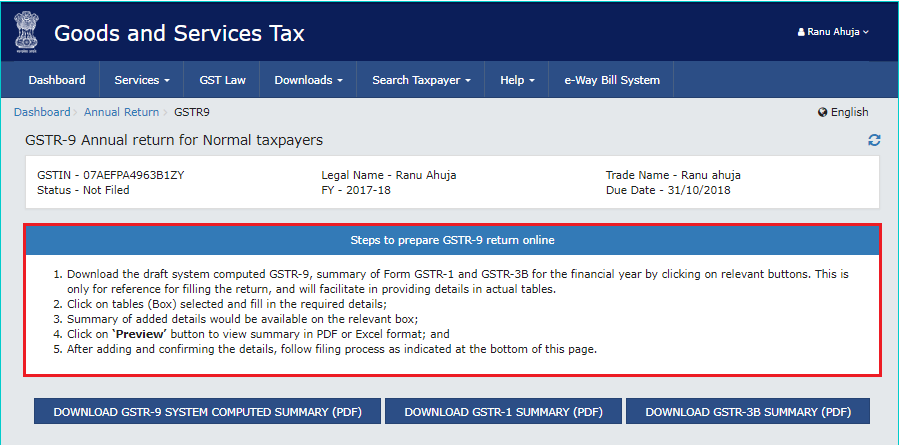

The following is a step-by-step guide on how to file the GSTR 9 form on the GST portal:

Step 1: Login to the official GST portal.

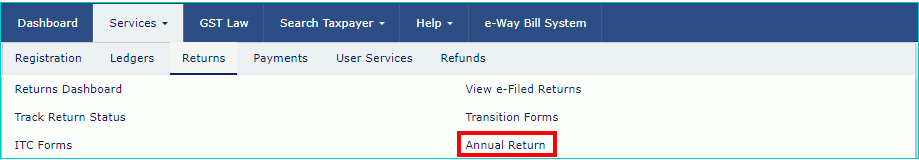

You need to login to the GST Portal and click on ‘Annual Return’ on the ‘Returns Dashboard’

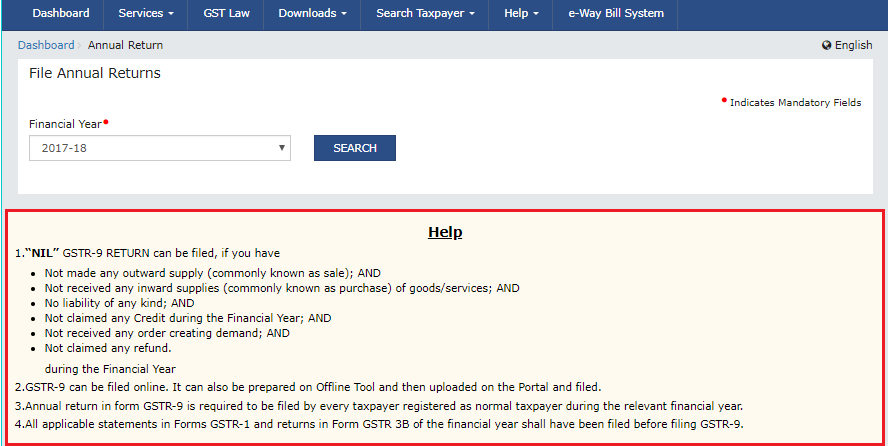

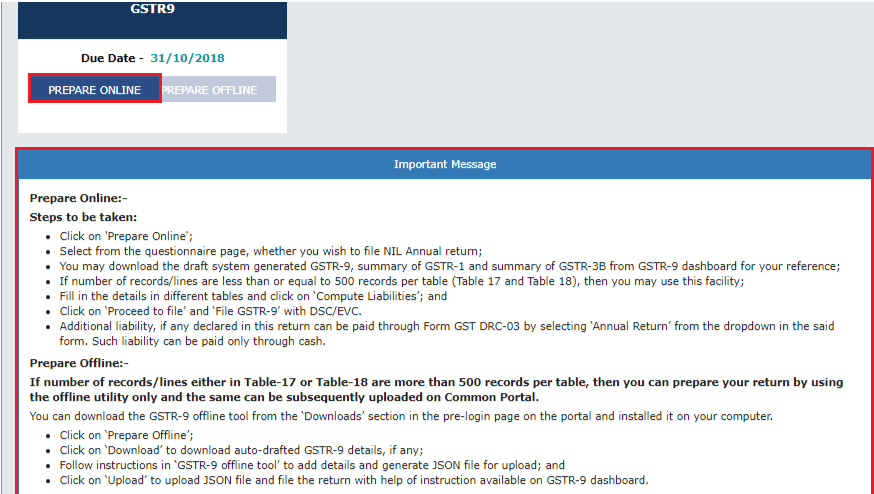

On the ‘File Annual Returns’ page, you need to select the ‘Financial Year’. This will show a pop up documenting the steps to be followed for offline/online GSTR 9 filing. You need to click on ‘Prepare Online’

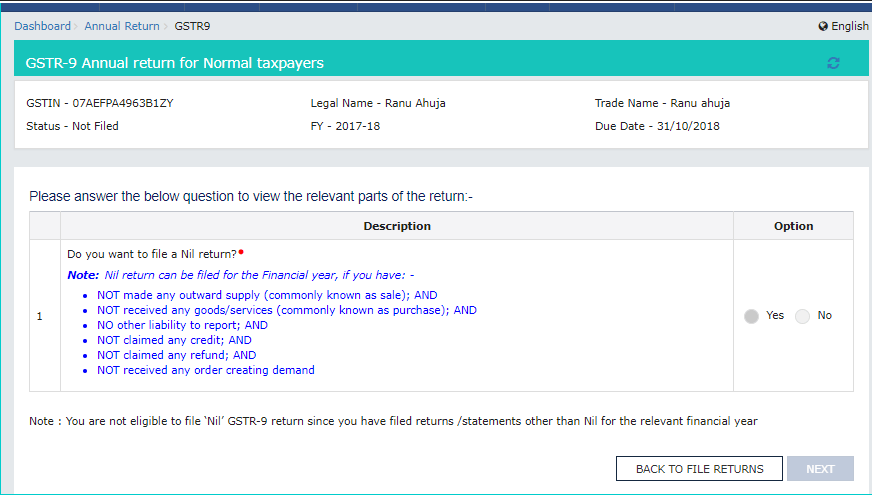

Step 2: Answer the questionnaire to choose between NIL return or annual return.

Here you need to select the return type – whether you want to file a Nil return for the financial year. Click ‘Yes’ if you meet the following criteria:

- No outgoing supply

- No inward supply

- No existing liabilities

- Haven’t claimed any tax credits

- No refund claims

- No demand orders

- Late fees is not required

If you have clicked ‘Yes’, then you need to click on ‘Next’ to compute liabilities and then file the GSTR 9.

If you have clicked on ‘No’. Then clicking on ‘Next’ will bring you to the page ‘GSTR 9 Annual Return for Normal Taxpayers’. It will have various tiles where you need to fill all the details.

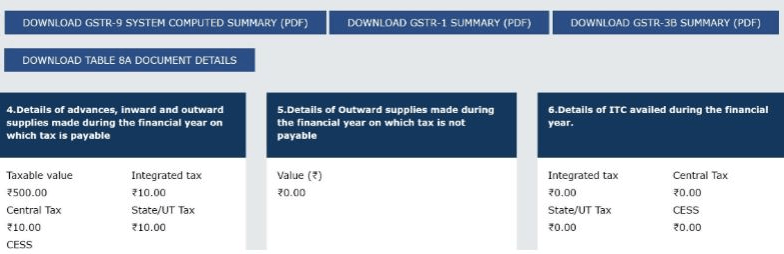

Note: Click on all three tabs to download GSTR 9 System Computed Summary, GSTR 1 Summary, and GSTR 3B Summary. This will help you with all the details you have to enter in the various tiles.

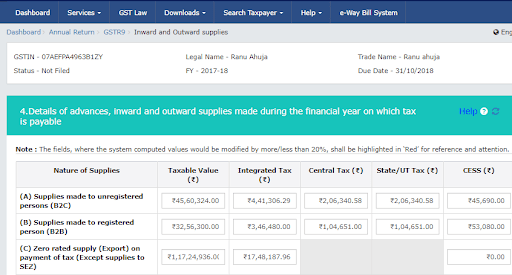

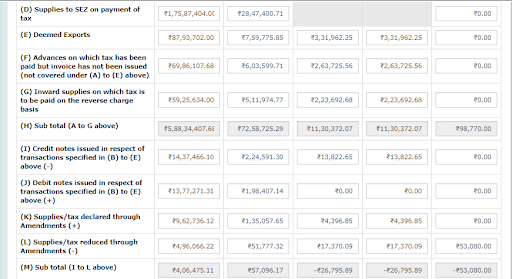

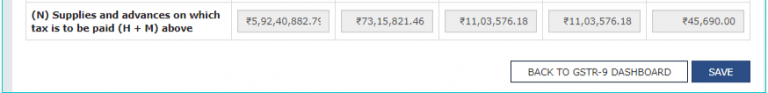

Step 3: Enter the required information for the financial year.

Details of inwards supplies, outwards supplies, and advances done during the financial year- Table 4N

- Click the tile. The information on this tile will be auto-filled on the basis of the information provided by you in GSTR 3B and GSTR 1

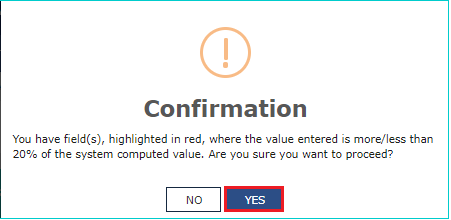

- Enter the information in the tiles. If the details entered by you vary by 20% from the auto-filled details, then the boxes will be highlighted and you will be required to confirm whether you wish to proceed with the new data entered by you

Click ‘Yes’ to accept the changes.

- A pop up confirming the changes will appear ‘Save request is accepted successfully’

- Navigate back to the GSTR 9 dashboard. You will see that the tile 4N has been updated. You need to repeat the same action for rest of the tables mentioned below:

- Table 5M: this table is for the details of tax liable outwards supply made during a financial year

- Table 6(O): Details of the ITC availed during the financial year

- Table 7(1): Details of any reversed ITC and ineligible ITC

- Table 8(A): Details of other ITC related information

- Table 9: Details of the tax paid during the financial year as declared in returns

- Table 10, 11, 12 and 13: Details of all the transaction of the previous financial year, reported in the next financial year

- Table 10 &11: Differential tax paid for declaration

- Table 15: Details regarding demands and refunds

- Table 16: Details of inwards supplies received from taxpayers registered under the composition scheme

- Table 17: Outwards Supply’s HSN wise summary

- Table 18: Inwards Supply’s HSN wise summary

Step 4: Preview draft of GSTR 9 in excel or PDF format.

If you wish to view the draft in PDF format:

- On the dashboard, click on ‘Preview GSTR 9 (PDF)’

A PDF draft of the GSTR 9 form will then be downloaded. If you feel the need to make any changes to the application, you can do so by making the changes online and regenerating the draft.

If you wish to view the draft in Excel format:

- On the GSTR 9 dashboard, click on ‘Preview GSTR 9(Excel)’

- A draft of the filing will be downloaded, and a link for the same will appear on the screen

- Click on the link to download a zip file of the summary. You will need to extract the excel file from the same

- Review all the details. If any changes are to be made, the same can be done online and the summary can be regenerated

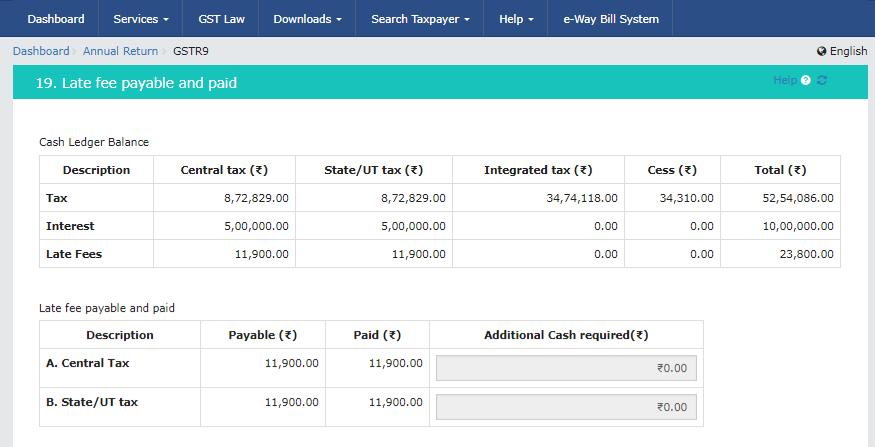

Step 5: Compute late fee and charges.

When you click on ‘Compute Liabilities’, the portal will automatically process all the information entered by you in the tables. It also factors in any late fee charges, if applicable. After the portal has completed the process, a confirmation message will appear for you to continue the filing process. The payment for the same can be made from the available funds in the electronic ledger. In case the ledger does not have enough balance, you can alway top-up the balance in your account. You can make this payment through Netbanking, over the counter, or bank transfer.

Note: It is important to note that the GSTR 9 filing cannot be completed unless all the late fees applicable have been paid off.

Step 6: File GSTR 9.

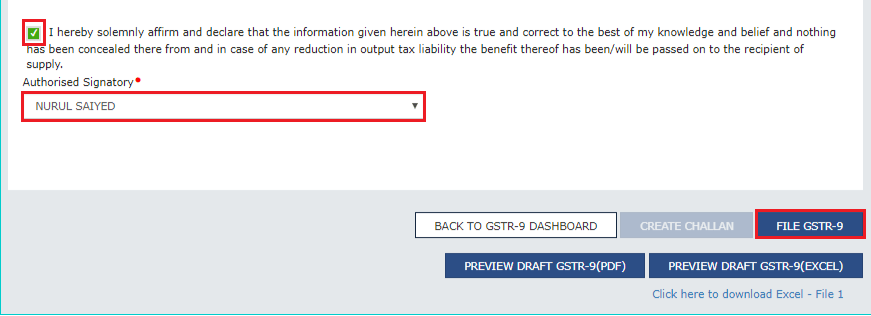

- Click on the declaration box and then click on ‘Authorised Signatory’

- Click on ‘File GSTR-9’

- This will bring you to a page for submitting the application, along with two ways of filing

- File with DSC: Browse and select the certificate. Duly sign and successfully submit the application

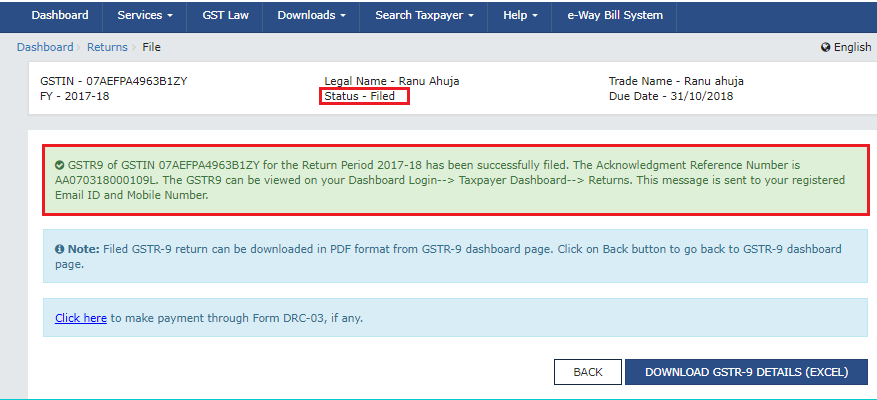

- File with EVC: You will receive an OTP on your registered phone number and email ID. Verify the OTP. Once the OTP has been validated, the status of the return should reflect ‘Filed’

Notes:

- If there is an error in the processing of details, the taxpayer will get a warning prompt about the same. This can be fixed by revisiting the form and making the relevant corrections

- Any additional payment can be made through form DRC-03. The link for the same will be displayed post the successful filing of GSTR-9

- Once the return has been filed, it cannot be revised. There is no way of correcting any errors made in annual return filing.

YOU MAY ALSO LIKE

Frequently Asked Questions (FAQ’s)

What is the penalty for missing the GSTR 9 deadline?

A per day fine of ₹ 200 is applicable on missing the deadline for GSTR 9 filing. The maximum applicable fine is ₹5,000. Further, the taxpayer also has to pay an interest of 18% on the total amount.

Is it necessary to audit GSTR 9 returns?

Yes, it is important to have your GSTR 9 filings audited. The same can be done by approaching a chartered accountant or cost accountant.

Should you match your input GST with 2A before filing GSTR 9?

Yes, you should match GSTR-2A for the financial year with the input tax credit as mentioned in your accounts.