Wondering how you can make a PAN Card correction online?

PAN (Permanent Account Number) is a powerful document in India. Apart from playing an integral role in filing taxes to the Indian Income Tax Department, it also acts as one of the most prominent identity proofs and documents for any financial transaction. Any mistake in Permanent Account Number can jeopardize your banking, taxing and investment capacities.

So, if you want to update your name and address on the PAN card, we have got you covered in this comprehensive guide. We will also walk you through how you can apply for PAN card correction online and offline and check your PAN correction status.

Steps for PAN Card Correction Online

You have to follow the step-by-step procedure for PAN card correction online as mentioned below:

Step 1: Open the TIN-NSDL.

Step 2: Click on ‘PAN’ in the ‘Services’ tab.

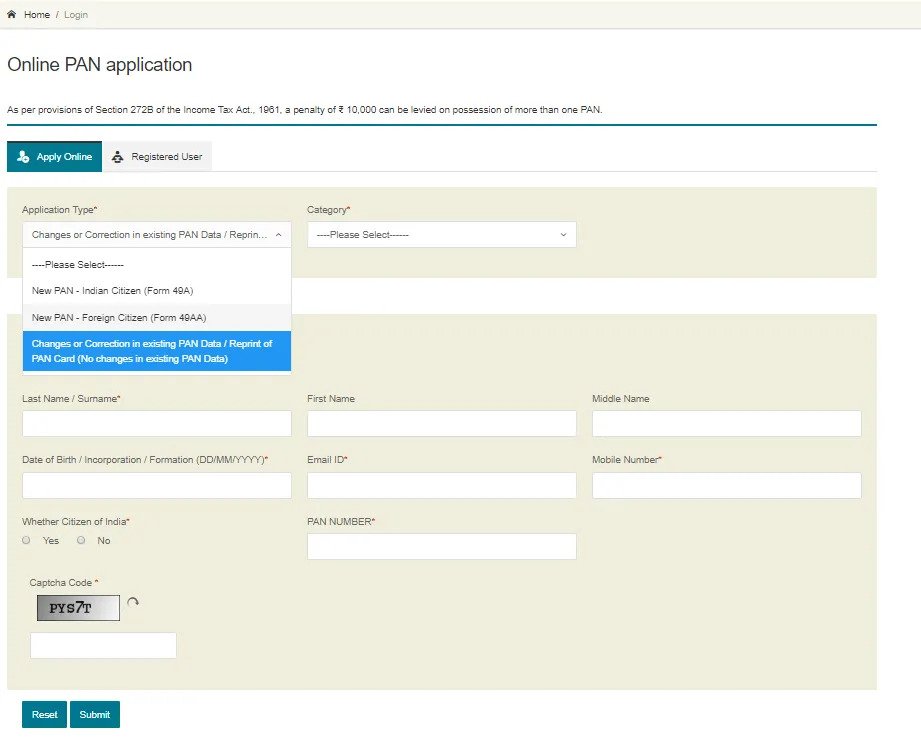

Step 3: Once you are redirected to the ‘Apply Online’ page, scroll down to ‘Change/Correction in PAN Data’ and click on ‘Apply’. The Online PAN Application form will open on a new tab.

Step 4: In the ‘Application Type’ section, select ‘Changes or Correction in existing PAN Data’ from the dropdown.

Step 5: Select the viable option from the dropdown under ‘Category’.

Step 6: Fill in all the required information in the ‘PAN Change Request Form’ online, like your name, contact details, date of birth, and PAN number.

Step 7: Tick Yes or No under the question on citizenship.

Step 8: Enter the Captcha and click ‘Submit’.

Step 9: After your request for PAN changes are confirmed, you will receive a Token Number in the email address you mentioned in the form. Press the ‘Proceed’ button on the email body to continue with the application.

Step 10: On being redirected to the form, you will see three options to upload your documents. Select Submit ‘Scanned Images through eSign on NSDL e-gov’.

Step 11: In the form, enter your parents’ name, Aadhaar number, etc. and press Next.

Step 12: Once redirected to another new page, upload all necessary proofs of identity, address, age, and PAN.

Step 13: e-Sign the declaration. Once you click Submit, you will be taken to the payment page, wherein you can make the payment via demand draft, net banking, and credit or debit card.

Step 14: After successful payment, take a printout of the generated acknowledgement slip. Send it by post to the NSDL e-gov office along with hard copies of the documents you submitted online. Attach your photo in the designated space in the slip and put your signature over it. On the envelope, mention Application for PAN Change and add the acknowledgement number.

How to Apply for Correction of PAN Card Offline?

You can change the PAN card details offline just by downloading and printing the PAN correction form.

- Make sure to fill the form with all the appropriate and right information.

- Affix two of your passport size photographs on the form.

- Sign the form from your side (at three places) or use a left thumbprint, wherever required.

- Now, you have to send a demand draft in the name of NSDL to the registered address of NSDL.

What are the Documents Requirements for PAN Card Correction?

Here is the list of all the required PAN card correction documents for individuals, HUFs, foreign citizens, companies, etc.

For Indian Citizens and Hindu Undivided Family (HUF)

If you are an individual or a HUF (Hindu Undivided Family) member, check out the comprehensive list of all required documents (copy and original) for PAN Card Correction:

Common Documents: The required copies of documents that work as identity, address and birth date proof for both Individuals and HUFs include:

- Aadhaar card

- Voter ID card

- Driving License

- Passport

Other Documents Required: Given below are the different types of documents under identity, address and birth date proofs an Individual or HUF is required to provide during PAN correction. You can even provide a copy for the same.

Identity Proof:

- Ration card with user’s photo.

- Arm’s license (if acquired).

- Any photo identity card provided by the central or state government or a public sector.

- Pension card with a photo.

- Health Scheme Card with photo.

Address Proof:

- Passbook of Post office along with the address.

- Updated Property Tax Assessment Order.

- Allocation letter of housing as issued by the state or central government (not more than 3 years old).

- Domicile certificate issued by the central government.

- Property registration.

- Utility bills, bank and credit card statements not more than 3 months old.

Birth Date Proof:

- Certificate of birth.

- Photo ID card issued by the state or central government.

- Domicile certificate.

- Health Scheme Card along with your picture.

- Payment order of pension.

- Affidavit claimed by a magistrate.

- Marriage certificate.

Original Documents: Here are the original documents that you have to submit for PAN correction.

- Original identity and address certificates signed by any gazetted officer, MP, MLA or MLC.

- Bank certificate bearing the official bank letterhead and the issuing officer’s name and stamp.

- Employer certificate.

- Affidavit issued by the Karta bearing the original address of all members and names of the HUF member and their father along with application date.

For Foreign Citizens

As foreign citizens, you would have to submit a copy of the following documents for both address and identity proof.

- Passport

- PIO (Person of Indian Origin ) card.

- OCI (Overseas Citizen of India) card.

- CIN (Citizenship Identification Number).

- A tax identification number authenticated by the Apostille, the Indian embassy, the Indian High Commission or the Indian Consulate.

- Certified authorities of banks registered in India with branches spread across the world can also authenticate the tax ID.

Other Documents that Work as ID Proofs:

- Bank Statements (from the resident country).

- NRE bank statement.

- Certificate of being an Indian resident.

- Apostille attested registration certificate issued in the applicant’s home country. Attestations of the same by the Indian Embassy, High Commission or Consulate of the applicant’s country is also accepted in this regard.

- Documents issued by the employer, like visa, original address certificate for their residence in India, and appointment letter of an Indian company.

For Indian Companies

When it comes to PAN card correction for Indian companies, the required documents differ according to the organization type.

Check out the table below demonstrating the documents required based on different organization types.

| Nature of Organization | Copy of Documents |

| Company | Registration Certificate |

| Partnership | Registration Certificate or the deed of partnership |

| Limited Liability Partnership (LLP) | Registration Certificate given by the Registrar of LLPs |

| Trust (People’s Association) | Registration Certificate number as given by Commissioner of Charity and Trust deed |

| AJP (Artificial Juridical Person), BOI (Body of Individuals), AOP (Association of Persons), Local Authority |

|

For Companies with a Registered Office Outside India:

Here is the information about every important document companies have to provide as their address and identity proof, if owns a registered office outside India:

- The tax identification number licensed by the Apostille, Indian Embassy, Indian High Commission. Authorized officials of banks registered in India and overseas can also perform the authorization process.

- Approval or Registration certificate issued by Indian authorities.

Documents for Other Individual Categories:

Here are some other supporting documents that would be required for PAN correction if the applicant is a woman (single/married), organization, association or body of people.

| Applicant Type | Document Applicable for Change in Name |

| Married Women (If name changed post marriage) |

|

| Applicants (not married women) |

|

| Organizations or Establishments |

|

| AJP/AOP/BOI/Trust/Local authority/ |

|

What Are the Charges For Pan Correction?

The fee for requesting a new PAN card or making any changes in the existing PAN card is Rs. 96, wherein Rs.85 is charged for application along with a service tax charge of 12.36%. You can pay this fee either using a demand draft, credit card or MasterCard at your convenience.

Steps to Check PAN Correction Status

There are 4 methods to check the PAN card correction status. You can either use the acknowledgement number issued during the application, a coupon number or Aadhaar number.

Additionally, there is also a provision to check the PAN correction status without an acknowledgement number. We have illustrated all the steps of all 4 processes of checking a PAN correction status below.

Using Coupon Number on UTI Website

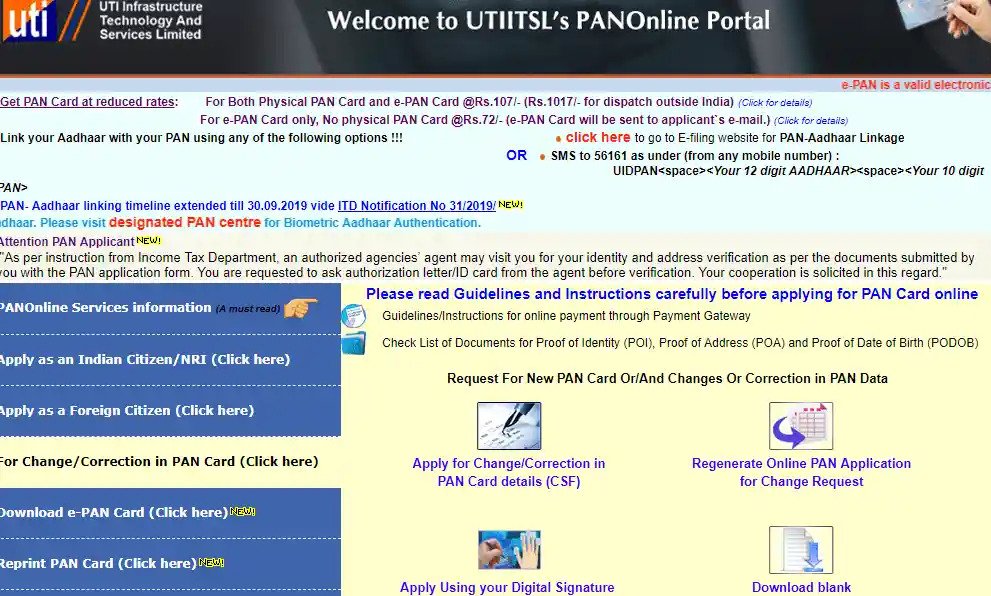

Step 1: Visit the official website of UTIITSL.

Step 2: Enter your coupon number.

Step 3: If you have forgotten your PAN Application Coupon Number, make sure to enter your 10-digit PAN Number.

Step 4: Enter your birth date or incorporation or agreement, etc.

Step 5: Write the captcha code as shown for doing PAN card transaction status.

Step 6: Hit the submit option.

Step 7: Now, you can see your PAN Card transaction on the screen.

Using an Acknowledgement Number

Step 1: Go to the official website of NSDL.

Step 2: Select the “Track PAN Status” option.

Step 3: Choose the “PAN-New/Change Request” from the drop-down menu of the “Application Type” section.

Step 4: Write your unique 15-digit PAN card acknowledgment number in the text field.

Step 5: Enter the captcha code in the given field as shown on the screen.

Step 6: Hit the “Submit” button.

Step 7: The final status of your PAN Card application will display on your screen.

Using No Acknowledgement Number

Step 1: Go to the online portal of TIN-NSDL.

Step 2: Choose the option of “PAN – New/Change Request” available under the Application Type section.

Step 3: Pick the Name section to know the status of your PAN card without using an acknowledgment number.

Step 4: Enter your first, last, and middle name along with your birth date.

Step 5: Hit the “Submit” button to check the PAN card correction status or application status.

Using Aadhaar Number

Step 1: Go to the website of the Income Tax Department.

Step 2: Enter your Aadhar Number (12-digit number).

Step 3: Enter the captcha code, as displayed on the screen.

Step 4: Hit the ‘Submit’ button.

Step 5: You can successfully see the status of your PAN Card.

Note: Make sure your mobile number is linked with your Aadhar card.

What are the Documents Required to Change Name in PAN Card?

Here are 5 important documents you have to submit for changing your name on the PAN card:

- Your Aadhar card.

- Your Voter Id card.

- Updated Driving License.

- Your Passport.

- Husband’s passport (if the woman applicant has changed her surname after marriage).

How to Change Name in a PAN Card?

You can follow the steps mentioned below for changing your name on a PAN card.

Step 1: Go to the official website of UTIITSL.

Step 2: Select the option ‘For change/correction in PAN card click here’.

Step 3: Now, select ‘Apply for Change/Correction in PAN Card details.

Step 4: You will be redirected to a new page where you have to enter all the details you want to change.

Step 5: Select the documents and upload them as per the requirement of the form.

Step 6: Hit the Submit button.

In a few days, you will be able to see all the latest changes you made.

How to Update/Change Address in PAN Card?

Your PAN card may not have your address, but it plays a crucial role in sending the hard copy of the PAN card. Thus, the address has to be present in the PAN card application form. And, if you want to update the postal address, you have to fill Form 49A offline.

But, if you use an Aadhaar card as address proof, the address is unchangeable (Aadhaar data address is selected by default).

However, here are a few ideas to update or change the communication address.

For Updating Existing Address

Here is how you can update your existing address.

- Fill in the Request for New PAN Or/and Correction in PAN Data Form.

- Make sure to fill in all the fields and tick all the boxes in the checklist on the left side of the communication address (it is selected by default in most cases).

- Mention whether the address is Residential or Official.

- If you are not an individual or a member of HUF, mention the office address.

- However, if you want to update another address, fill in the information of the same, but a new sheet. The sheet will further be attested with the form. You may have to tick the boxes on the left-hand side of the PAN application form.

- Provide the address proof of your new residence.

For Changing Wrong Address

You can try one of the two methods below to correct any mistakes in the address on your PAN card.

- Online Application: When applying online, print the PAN Acknowledgement Form generated post application submission. Put your signature, affix two of your photographs, and send them with the receipt of the supporting documents to the Income Tax Pan Services Unit.

- Offline Application: For an offline application, download Form 49A from the TIN-NSDL website, fill it with correct details and submit it to the NSDL collection centre near you. Send the acknowledgement slip you will receive upon submitting the form to the NSDL office within 15 days of the PAN correction application.

Key Factors to Remember for PAN Card Corrections Online

Keep in mind these four points when applying for a PAN card correction online.

- Avoid using abbreviations when writing your first, last or middle name. In other words, write your complete name as it is.

- In case there is no place in the first row, continue writing your name in the second row.

- Don’t use any abbreviation while mentioning your company’s name.

- For individuals, if your PAN card has any wrongly filled details, unclear photograph or opaque signature, you might have to submit your original PAN while submitting the acknowledgement.

Frequently Asked Questions (FAQ)

When should I apply for changes or corrections in PAN data in the form?

You can apply for changes or corrections in PAN data when you want to make some corrections to the existing information of PAN, legally change your name, rectify the spelling of your name, or change in surname after marriage.

How to make any corrections to PAN information submitted by me?

You have to fill all the columns of the form and tick the boxes on the left-hand side of the text fields you want to make changes in.

Is it necessary to attach two passport-size photographs for Changes or Correction in PAN?

Yes, you must attach two passport-sized photographs on the form when applying for the changes or corrections in your PAN data. Also, make sure that the photos are not stapled, clipped, or blurred. The quality of photographs is of utter importance in the PAN form, especially while making changes or corrections to PAN.

While applying for correction in PAN, should a member of HUF submit an affidavit?

As a member of HUF, you have to submit an affidavit along with other prescribed (PODB, POI, and POA) documents if you want to make changes or corrections in name or/and date of formation by the HUF applicant.

Is it necessary to submit documentary proof for any change in the “Gender” field?

No, it is not necessary to submit any document to support any change in the “Gender” field during PAN card correction.