A PAN card is one of the most important documents for all the citizens of India. Not only does it act as a potent identity proof, but it also helps initiate transactions and file ITRs online. However, due to the rise of duplicate or fake PAN cards, the government of India started to deactivate any suspicious ones. The Income Tax Department has deactivated over 11 lakh fake PAN cards by now. If your authentic PAN has been mistakenly deactivated by the ITD, it’s important that you notify them immediately to reactivate your card and regain the PAN card active status.

This article runs you through the entire process of attaining a PAN card active status after it has been deactivated.

Table of contents

How to Check PAN Card Active or Inactive Status?

Checking the PAN card’s active or inactive status is an easy task. The following are the steps to be followed for the active and inactive status of the PAN card:-

- Visit the official website of the Income Tax Department for e-filing.

- The next step is to verify your PAN card details before proceeding further.

- Now, enter all the required information and click on ‘Continue’ to move forward.

- After completing all the steps, the active status of the Pan card will appear on the screen.

Why Should PAN Cards be Deactivated?

According to the Income Tax Department, cases of fake PAN cards and multiple PAN cards have risen considerably in recent times. The government made it a mandatory requirement to link a PAN card with Aadhaar. People often avoid taking the necessary steps in case of the misplacement of a PAN card. Most people apply for a new PAN card instead of reprinting the existing one. Deactivation of multiple PAN cards is crucial to ensuring the coverage of financial information under a single PAN card. Sometimes the PAN card of a deceased person can be misused to evade taxes. Deactivating the PAN Card prevents this kind of misuse and promotes the applicable taxes for the government.

What to Do When Your Active PAN Card is Deactivated?

In case your PAN card has been deactivated, you should immediately request PAN reactivation via a letter to the Income Tax Department, addressing their jurisdiction AO. Take a look at the detailed process of reactivating your PAN below.

How to Activate Pan Card?

A deactivated PAN card not only deters you from making any transactions over Rs. 50,000 but also prevents filing ITR using the official Income Tax e-filing portal. Being one of the crucial identity proofs for any citizen or organization in India, one should be vigilant to reactivate their PAN card if it has been deactivated by the IT department.

So if you are wondering about how to activate a PAN card, follow the steps mentioned below.

- Write a letter addressed to the AO (Assessing Officer) for the reactivation of your blocked PAN card.

- Attach the self-attested copy of the blocked PAN card.

- Fill the Indemnity Bond, favouring the Income Tax Department.

- Submit the Income Tax Returns that you previously filed in the last three years using the blocked PAN card.

- Visit or send the enclosed documents and the letter to the regional office of the Income Tax Department.

- It takes around fifteen days from the date of application to reissue or reactivate your PAN Card by the Income Tax Department.

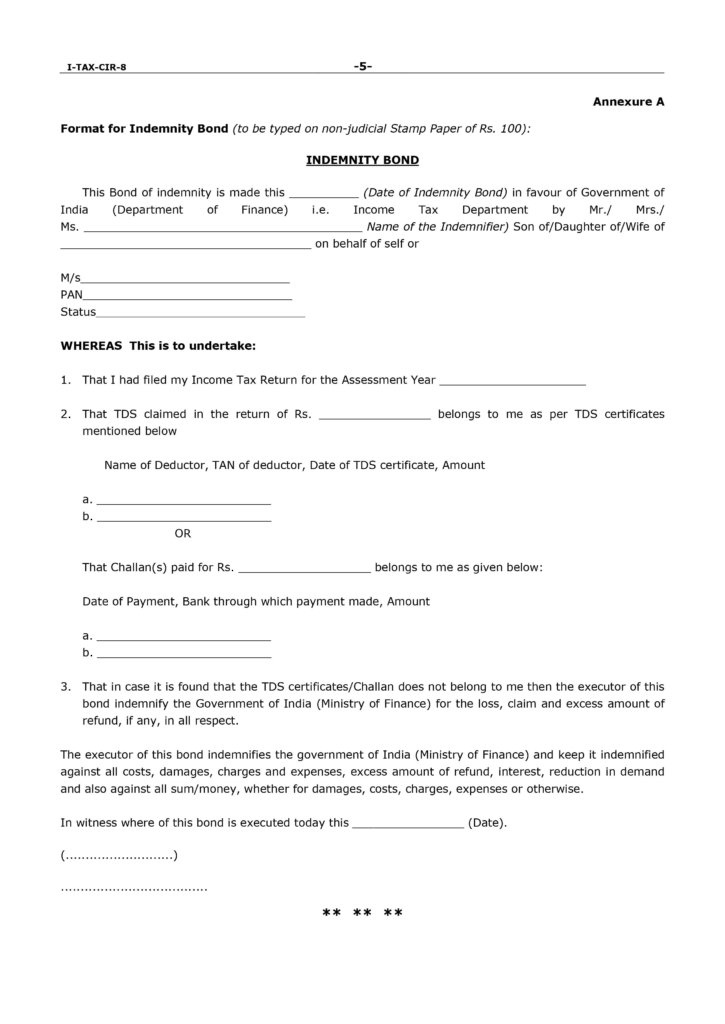

PAN Reactivation – Format of Indemnity Bond

The format of the Indemnity bond for PAN reactivation is given in the image below. You can also click here to download the “Indemnity Bond for PDF” activation.

Letter Format to the AO

Check out the format of the letter that you need to write to the AO for PAN card active status below:-

To,

The Assessing Officer of Income Tax, Dated: (mention the date)

(Write the Ward no.)

Civic Centre,

New Delhi-110002

Sub: Request for Activation of PAN Card no. (mention your PAN card number) in the Name of Mr./Ms (Your name).

Respected Sir/Madam,

By submitting this application, I bring to your notice that PAN Card No (state your PAN card number) was deactivated. The current PAN status on the Income Tax Department website is also shown as Deactivated. The message “Your PAN card is deactivated by the Department” is being displayed while login. Because of this reason, I am unable to file my ITR for the Assessment Year (mention the financial year for which you intend to submit your ITR).

I request you to please look into the matter and activate my PAN card so that I can file my Income Tax Return for the (mention the financial year for which you intend to submit your ITR).

I have also enclosed the following documents for my PAN card activation,

PAN Card photocopy

Indemnity Bond

Copies of the last 3 years ITR

I request you to please resolve this issue at the earliest and help me in being compliant with the laws.

Details of PAN mentioned in Subject

Name on PAN Card: (write your name as mentioned in the PAN card)

Father’s Name : (mention your father’s name as mentioned in his and your PAN card)

Date of Birth: (in DD/MM/YYYY format)

Residential Address : (write your complete residential address)

Yours faithfully,

(mention your full name)

How to Prevent Your PAN from Deactivation?

Any individual can take precautionary measures to prevent their PAN card from deactivating. There is always a reason for the Income Tax Department to deactivate PAN cards. In some cases, some PAN cards are mistakenly deactivated. Below are some guidelines to help you prevent the deactivation of your PAN card:-

- It is important to file the Income Tax Returns on a yearly basis.

- Don’t forget to link your PAN card with your Aadhaar.

- Regularly log in to the e-Filing website to check the active status of your PAN card.

Reasons for PAN Card Deactivation

The Income Tax Department deactivates PAN cards because of the reasons listed below:-

PAN Card Deactivation for Deceased: The Income Tax Department is eligible to deactivate the PAN of a deceased citizen when their nominees or heirs file a formal application for PAN deactivation. To proceed with this, the death certificate of the deceased must be attached to the PAN card surrender application as proof.

PAN Card Deactivation for Foreigners: People outside India who do not wish to conduct or continue any financial transactions in India often submit their PAN cards to the Income Tax Department to prevent any misuse by others.

Multiple/Duplicate PAN Cards: There can be scenarios where an individual is assigned more than one PAN Card. In a situation like this, the Income Tax Department deactivates the additional PAN Cards that were assigned to the candidate.

Fake PAN Cards: If a PAN Card has been registered with fake documents, there is a possibility that the Income Tax Department will deactivate them. Such cards might contain fake photographs, the name and the signature of the cardholder.

PAN Card Linking Related Articles

FAQ’s:-

Q1. How to Prevent your PAN from Deactivation?

Ans: To prevent your PAN card deactivation, you should fill in your income tax returns every year and link your PAN card with your Aadhaar. Log in to the respective website to ensure that your card is active.

Q2. How Much Time will it Take To Reactivate a Pan Card?

Ans: It takes around 10-15 business days to reactivate a PAN card.

Q3. Where can I check my Deactivated Pan Card?

Ans: You can log into the official government website of income tax filing and check the PAN card active status of your PAN card there.

Q4. How Do I Know my Pan Card is Deactivated?

Ans: You can check the PAN Card active status by logging in to the official Income Tax e-filing portal. After logging in, go to my profile, then PAN details, Jurisdiction Details and then click on Status. It is also important to note that if your PAN card has been blocked or deactivated, you can contact the Jurisdiction AO (Assessing Officer) for the same.

Q5. Will I Receive a Letter or Notification from the Income Tax Department When My PAN Card is Deactivated?

Ans: Yes, the Income Tax Department does send out a notification telling you that the PAN card has been deactivated.

Q6. What happens if the PAN card is deactivated?

Ans: When the PAN card gets deactivated, the e-filing login of the taxpayer also gets blocked.

Q7. What is the fee for reactivating a PAN card?

Ans: Generally, the applicable fee for PAN card reactivation is Rs 1,000.

Q8. What is the life of a PAN card?

Ans: A PAN card offers lifetime validity to taxpayers.

Q9. How can I check if my PAN is active or not?

Ans: You can log in to the Income Tax Department e-Filing website to check the active status of your PAN card.

Q10. How much time does it take to reactivate the PAN card?

Ans: After submitting all the necessary documents, it generally takes 15 days for the PAN card to be reactivated.